FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

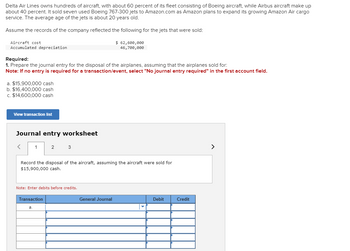

Transcribed Image Text:Delta Air Lines owns hundreds of aircraft, with about 60 percent of its fleet consisting of Boeing aircraft, while Airbus aircraft make up

about 40 percent. It sold seven used Boeing 767-300 jets to Amazon.com as Amazon plans to expand its growing Amazon Air cargo

service. The average age of the jets is about 20 years old.

Assume the records of the company reflected the following for the jets that were sold:

Aircraft cost

Accumulated depreciation

Required:

$ 62,600,000

46,700,000

1. Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for:

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

a. $15,900,000 cash

b. $16,400,000 cash

c. $14,600,000 cash

View transaction list

Journal entry worksheet

1

2

3

Record the disposal of the aircraft, assuming the aircraft were sold for

$15,900,000 cash.

Note: Enter debits before credits.

Transaction

a.

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the total amount that Bryant Inc. should expense during the year (versus the company capitalizing the costs): 1. Purchased the cost of a patent from another company for $165,500. 2. Incurred $278,900 of Research and Development Costs. 3. Internal costs incurred to create a patent for $105,490. 4. Purchased a tradename for $97,300. 5. Goodwill from purchasing another division for $205,800.arrow_forwardRequired information [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express - distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $17,000. Movelt had originally purchased the vehicle and recorded it in the Truck account for $29,000 and had recorded depreciation for three years. Required: Calculate the amount of gain or loss on disposal, assuming that Accumulated Depreciation - Truck was (a) $12,000, (b) $8,000, and (c) $14,000. (Select "None" if there is no Gain or Loss.) Required information [The following information applies to the questions displayed below.] (a) (b) (c) & Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a…arrow_forwardMoveIt Corporation is the world’s leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that MoveIt sold a delivery truck for $11,000. MoveIt had originally purchased the truck for $18,000 and had recorded depreciation for three years. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $7,000, (b) $4,000, and (c) $12,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- MoveIt Corporation is the world’s leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that MoveIt sold a delivery truck for $6,000. MoveIt had originally purchased the vehicle and recorded it in the Truck account for $10,000 and had recorded depreciation for three years. Using the following structure, indicate the effects (accounts, amounts, and + for increase and − for decrease) of the disposal of the truck, assuming Accumulated Depreciation—Truck was (a) $4,000, (b) $3,000, and (c) $5,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.)arrow_forwardDelso Company purchased the following on January 1, 20x1: • Office equipment at a cost of $54,000 with an estimated useful life to the company of three years and a residual value of $16,200. The company uses the double-declining-balance method of depreciation for the equipment. • Factory equipment at an invoice price of $741,000 plus shipping costs of $36,000. The equipment has an estimated useful life of 105,000 hours and no residual value. The company uses the units-of-production method of depreciation for the equipment. • A patent at a cost of $252,000 with an estimated useful life of 12 years. The company uses the straight-line method of amortization for intangible assets with no residual value. The company's year ends on December 31. Required: 1-a. Prepare a partial depreciation schedule of office equipment for 20x1, 20x2, and 20x3. 1-b. Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,600 hours in 20x1, 9,800 hours in 20x2, and…arrow_forwardRequired information [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $38,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,200. During the four-year period, the company expects to drive the van 201,250 miles. Actual miles driven each year were 52,000 miles in year 1 and 58,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) 2. Double-declining-balance. Annual Year Depreciation 1 2arrow_forward

- 6arrow_forwardFast Delivery is the world's largest express transportation company. In addition to the world's largest fleet of all-cargo aircraft, the company has more than 657 aircraft and 62,000 vehicles and trailers that pick up and deliver packages. Assume that Fast Delivery sold a dellvery truck that had been used in the business for three years. The records of the company reflected the following: Delivery truck cost Accumulated depreciation $ 43,000 28,000 Required: 1. Prepare the journal entry for the disposal of the truck, assuming that the truck sold for: (If no entry transaction/event, select "No journal entry required" in the first account field.) required for a a. $15,000 cash b. $17,300 cash c. $13,300 cash View transaction list Journal entry worksheet 2 3 Record the disposal of the truck, assuming the truck was sold for $15,000 cash. Note: Enter debits before credits. General Journal Debit Credit Transaction aarrow_forwardRequired information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $520,000. The ovens originally cost $712,000, had an estimated service life of 10 years, had an estimated residual value of $42,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. 4. Determine the financial statement effects of the sale of the ovens at the end of the second year. Note: Amounts to be deducted should be indicated by a minus sign. Assets Balance Sheet Liabilities Stockholders' Equity Common Retained Stock Earnings Revenues Income Statement Expenses Net Incomearrow_forward

- Sheridan Corp is a publicly traded company that has just purchased a new piece of equipment for its production process. The equipment costs $54000 with a $8800 residual value, an estimated useful life of 8 years and an expected life of 10 years with a $4000 salvage value. Assuming that Sheridan has a December 31 year end and the equipment was purchased on January 1, how much depreciation expense should the company record at the end of year one? The company uses the straight-line method.Questi Multiple CQuestioMultiple Ch $4520 $5085 $5 650 $5400arrow_forwardRequired information [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $38,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,200. During the four-year period, the company expects to drive the van 201,250 miles. Actual miles driven each year were 52,000 miles in year 1 and 58,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) 1. Straight-line. Annual Year Depreciation 1 2arrow_forwardMoveIt Corporation is the world’s leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that MoveIt sold a delivery truck for $11,000. MoveIt had originally purchased the truck for $18,000 and had recorded depreciation for three years. Required: Calculate the amount of gain or loss on disposal, assuming that Accumulated Depreciation was (a) $7,000, (b) $4,000, and (c) $12,000. (Select "None" if there is no Gain or Loss.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education