FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

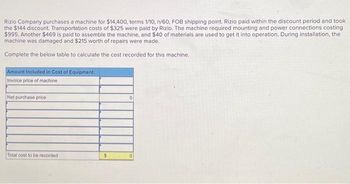

Transcribed Image Text:Rizio Company purchases a machine for $14,400, terms 1/10, n/60, FOB shipping point. Rizio paid within the discount period and took

the $144 discount. Transportation costs of $325 were paid by Rizio. The machine required mounting and power connections costing

$995. Another $469 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the

machine was damaged and $215 worth of repairs were made.

Complete the below table to calculate the cost recorded for this machine.

Amount Included in Cost of Equipment:

Invoice price of machine

Net purchase price

Total cost to be recorded

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rahularrow_forwardQuestions # 24-27 are based on the information below: Chubbyville purchases a delivery van for $23,500. Chubbyville estimates a four-year service life and a residual value of $2,500. During the four-year period, the company expects to drive the van 105,000 miles. Actual miles driven were 24,000 miles in Year 1 and 26,000 miles in Year 2. 24. Using the straight-line method, what is the depreciation expense for year 2? A. $5,250 B. $5,875 C. $10,500 D. $11,750 25. Using the straight-line method, what is the book value at the end of year 3? A. $9,750 B. $10,550 C. $7,750 D. $8,250 26. Using double-declining balance method, what is the depreciation expense for year 1? A. $5,250 B. $5,875 C. $11,250 D. $11,750 27. Using the activity-based method, what is the balance in accumulated depreciation at the end of year 2? A. $10,000 B. $4,800 C. $5,200 D. $13,500arrow_forwardSouthwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $124,960. The seller agreed to allow a 5.00 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost amounted to $2,820. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $870. The loader operator is paid an annual salary of $15,500. The cost of the.company's theft insurance policy increased by $2,320 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $7,600. Required Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. Note: Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign. Costs that are to be capitalized: List price Total costsarrow_forward

- Bilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be either overhauled or replaced with a new truck. The company has assembled the following information: Present Truck New Truck Purchase cost new $ 30,000 $ 39,000 Remaining book value $ 17,000 - Overhaul needed now $ 16,000 - Annual cash operating costs $ 15,500 $ 14,000 Salvage value-now $ 9,000 - Salvage value-five years from now $ 8,000 $ 10,000 If the company keeps and overhauls its present delivery truck, then the truck will be usable for five more years. If a new truck is purchased, it will be used for five years, after which it will be traded in on another truck. The new truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 9% discount rate. Click here to view…arrow_forwardLeonard Co. sells $600,000 (cost $480,000) of vehicles to a local car dealer, Carlson Inc. The vehicles were ready to go when the contract was signed on May 31, 2021 and title passed to Carlson at that date. Carlson was undergoing a significant renovation to its dealership at the time and as a result, Carlson requested that Leonard retain the vehicles at its warehouse until July 15, 2021. Payment was made in full on June 30, 2021. At what date can Leonard Co. recognize the revenue relating to the sale of the vehicles?arrow_forwardVISTA Shop purchased the following used equipment at a special auction sale for $400,000 cash; a drill press, a lathe, and a heavy duty air compressor. The equipment was in excellent condition except for the electric motor on the lathe, which will cost $9,000 to replace with a new motor, Heavy was determined that the selling price for the used items in local outlets are approximately as follows: Drill press- $84,000 Lathe, with a good motor- $240,000 Air Compressor - $105,000. How much is the allocated cost of lathe?arrow_forward

- Southwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $115,370. The seller agreed to allow a 6.25 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Transportation cost amounted to $2,080. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,150. The loader operator is paid an annual salary of $11,910. The cost of the company's theft insurance policy increased by $2,090 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $9,900. Required: Determine the amount to be capitalized in an asset account for the purchase of the front-end loader. Note: Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign. Costs that are to be capitalized: List price Total costsarrow_forwardDorman company purchased a new machine for its production process. The following costs were incurred for the new machine. Training costs for workers who will operate the machine $15,000 Wages paid to workers who operate the machine during production 109,000 Ordinary repairs to the machine before the first production run 1,000 1 Cost of platform used to properly secure the machine 30,000 Costs of tests run which took place before the first production run 8,000 WHICH COSTS SHOULD BE ADDED TO THE COST OF MACHINE?arrow_forwardBilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be either overhauled or replaced with a new truck. The company has assembled the following information: Present Truck New Truck Purchase cost new $ 30,000 $ 39,000 Remaining book value $ 17,000 - Overhaul needed now $ 16,000 - Annual cash operating costs $ 15,500 $ 14,000 Salvage value-now $ 9,000 - Salvage value-five years from now $ 8,000 $ 10,000 If the company keeps and overhauls its present delivery truck, then the truck will be usable for five more years. If a new truck is purchased, it will be used for five years, after which it will be traded in on another truck. The new truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 9% discount rate. Click here to view…arrow_forward

- Sushi Corp. purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $51,300. The equipment has an estimated residual value of $3,300 The equipment is expected to process 267,000 payments over its three- year useful life. Per year, expected payment transactions are 64,080, year 1, 146,850, year 2, and 56,070, year 3. TIP: You cannot depreciation past residual/salvage value in the last year of depreciation. Required: Complete a depreciation schedule for each of the alternative methods. 1. Straight-line. 2. Units-of-production. 3. Double-declining-balance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete a depreciation schedule for Straight-line method. (Do not round intermediate calculations.) Income Statement Year At acquisition 1 2 3 Depreciation Expense $ Cost 51,300 51,300 Balance Sheet wwwwww 51,300 Accumulated Depreciation Required 1 Book Value Required 2 >arrow_forwardCaramel Spa Company sells prefabricated pools that cost $80,000 to customers for $144,000. The sales price includes an installation fee, which is valued at $20,000. The fair value of the pool is $128,000. The installation is considered a seperate performance obligation and is expected to take 3 months to complete. The transaction price allocated to the pool and the installation isarrow_forwardSouthwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $117,890. The seller agreed to allow a 5.00 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Transportation cost amounted to $2,680. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $770. The loader operator is paid an annual salary of $28,360. The cost of the company's theft insurance policy increased by $1,940 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $6,100. Required: Determine the amount to be capitalized in an asset account for the purchase of the front-end loader. Note: Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign. Costs that are to be capitalized: List price Total costs $ 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education