FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

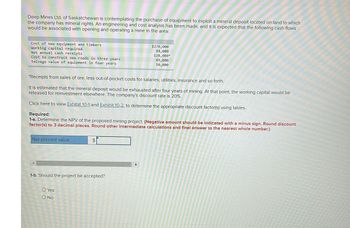

Transcribed Image Text:Deep Mines Ltd. of Saskatchewan is contemplating the purchase of equipment to exploit a mineral deposit located on land to which

the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows

would be associated with opening and operating a mine in the area:

Cost of new equipment and timbers

Working capital required

Net annual cash receipts

Cost to construct new roads in three years

Salvage value of equipment in four years

*Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance and so forth.

It is estimated that the mineral deposit would be exhausted after four years of mining. At that point, the working capital would be

released for reinvestment elsewhere. The company's discount rate is 20%.

Click here to view Exhibit 10-1 and Exhibit 10-2, to determine the appropriate discount factor(s) using tables.

Required:

1-a. Determine the NPV of the proposed mining project. (Negative amount should be indicated with a minus sign. Round discount

factor(s) to 3 decimal places. Round other intermediate calculations and final answer to the nearest whole number.)

Net present value

$276,000

94,000

128,000*

49,000

50,000

$

1-b. Should the project be accepted?

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Most Company has an opportunity to invest in one of two new projects. Project Y requires a $325,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $325,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project Y Project Z Sales $ 370,000 $ 296,000 Expenses Direct materials 51,800 37,000 Direct labor 74,000 44,400 Overhead including depreciation 133,200 133,200 Selling and administrative expenses 26,000 26,000 Total expenses 285,000 240,600 Pretax income 85,000 55,400 Income taxes (38%) 32,300 21,052 Net income $ 52,700 $…arrow_forwardWindhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineraldeposit on land to which the company has mineral rights. An engineering and cost analysis has been made,and it is expected that the following cash flows would be associated with opening and operating a mine inthe area:Cost of new equipment and timbers .............................................. R275,000Working capital required ................................................................ R100,000Annual net cash receipts ............................................................... R120,000*Cost to construct new roads in three years ................................... R40,000Salvage value of equipment in four years ..................................... R65,000*Receipts from sales of ore, less out-of-pocket costs for salaries, utilities,insurance, and so forth.The currency in Namibia is the rand, denoted here by R.The mineral deposit would be exhausted after four years of mining. At…arrow_forwardHHHarrow_forward

- A company must decide between scrapping or reworking units that do not pass inspection. The company has 19,000 defective units that have already cost $132,000 to manufacture. The units can be sold as scrap for $57,000 or reworked for $87,400 and then sold for $165,300. (a) Prepare a scrap or rework analysis of income effects. (b) Should the company sell the units as scrap or rework them? (a) Scrap or Rework Analysis Revenue from scrapped/reworked units Cost of reworked units Income Incremental income (b) The company should: Scrap Reworkarrow_forwardRoosevelt Communication is trying to estimate the Year 1 operating cash flow for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information: Sales revenues $13.3 million Operating Costs 8.4 million Interest Expense 1.3 million Roosevelt has also determined that this project would cannabalize one of its other projecrs by $1.6 million of cash flow (before taxes) per year. The firm has a 25 percent tax rate, and its WACC is 8 percent. Calculate the project's operating cash flow for Year 1. Answers: a. $ -25,000 b. $2,475,000 c. $1,500,000 d. $2,700,000 e. $3,675,000arrow_forwardA new diamond deposit has been found in northern Alberta. Your researchers have determined that it will cost $2.5 million to purchase the land and prepare it for mining. At the beginning of both the second and third years, another $1 million investment will be required to establish the mining operations. Starting at the end of the second year, the deposit is expected to earn net profits of $3 million, which will be sustained for three years before the deposit is depleted. If the cost of capital is 16%, should your company pursue this venture? Provide calculations to support your decision.arrow_forward

- Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment $ 36,500 Annual cash inflows $ 8,600 Salvage value of equipment $ 0 Life of the investment 15 years Required rate of return 10% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The internal rate of return of the investment is closest to: Multiple Choice 24 % 22 % 20% 26%arrow_forwardWindhoek Mines, Limited, of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows would be associated with opening and operating a mine in the area: Cost of new equipment and timbers Working capital required Annual net cash receipts Cost to construct new roads in three years Salvage value of equipment in four years $ 430,000 $ 215,000 $ 150,000* $ 63,000 $ 88,000 "Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance, and so forth. The mineral deposit would be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere. The company's required rate of return is 18%. Required: a. What is the net present value of the proposed mining project? b. Should the project be accepted? Answer is complete but not entirely correct. Complete…arrow_forwardGrey Mining Company has purchased a tract of mineral land for $1,200,000. It is estimated that this tract will yield 80,000 tons of ore with sufficient mineral content to make mining and processing profitable. It is further estimated that 4,000 tons of ore will be mined the first and last year and 8,000 tons every year in between. (Assume 11 years of mining operations.) The land will have a residual value of $80,000. The company builds necessary structures and sheds on the site at a cost of $134,000. It is estimated that these structures can serve 16 years but, because they must be dismantled if they are to be moved, they have no salvage value. The company does not intend to use the buildings elsewhere. Mining machinery installed at the mine was purchased at a cost of $150,000. Grey Mining estimates that about half of this machinery will still be useful when the present mineral resources have been exhausted but that dismantling and removal costs will just about offset its value at…arrow_forward

- Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cash flows would be associated with opening and operating a mine in the area: Cost of new equipment and timbers $ 310,000 Working capital required $ 190,000 Annual net cash receipts $ 125,000 * Cost to construct new roads in year three $ 58,000 Salvage value of equipment in four years $ 83,000 *Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance, and so forth. The mineral deposit would be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere. The company’s required rate of return is 18%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.…arrow_forwardTipton Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment Annual cash inflows Salvage value of equipment Life of the investment Required rate of return O 5 years O 15 years O2 years O 7.143 years $ 30,000 $ 6,000 $0 Chapter 8 15 10 The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the investment is: years %arrow_forwardBunker Hill Mining Company has two competing proposals: a processing mill and an electric shovel. Both pieces of equipment have an initial investment of $552,151. The net cash flows estimated for the two proposals are as follows: Net Cash Flow Year Processing Mill Electric Shovel 1 $176,000 $220,000 2 157,000 204,000 3 157,000 188,000 4 125,000 194,000 5 95,000 6 79,000 7 69,000 8 69,000 The estimated residual value of the processing mill at the end of Year 4 is $220,000. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Determine which equipment should…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education