Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

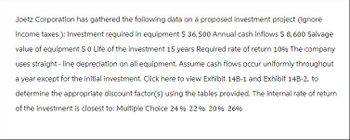

Transcribed Image Text:Joetz Corporation has gathered the following data on a proposed investment project (Ignore

income taxes.): Investment required in equipment $ 36,500 Annual cash inflows $ 8,600 Salvage

value of equipment $ 0 Life of the investment 15 years Required rate of return 10% The company

uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout

a year except for the initial investment. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to

determine the appropriate discount factor(s) using the tables provided. The internal rate of return

of the investment is closest to: Multiple Choice 24 % 22 % 20% 26%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Windsor Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $202,003 $41,080 6 years $0 B $306,910 $49,130 9 years $0 Windsor Company uses the straight-line method to depreciate its assets. Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the facto provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.)arrow_forwardDraw a 5-year cash flow diagram representing the following cash flows to build springs: (Chapter 2) Initial investment in plant and equipment $50K Answer: Annual maintenance: $3K after year 1 and increasing $1K per year after that Answer: Annual production costs – $10K/year Answer: Annual revenue - $25K/year Answer:arrow_forwardGive me step by step solution and explanationarrow_forward

- Garcìa Co. can invest in one of two alternative projects. Project Y requires a $360,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $360,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following annual results. Cash flows occur evenly within each year. Required 1. Compute each project's annual net cash flows. 2. Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will it choose? 3. Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return, which project will it choose? 4. Compute each project's net present value using 8% as the discount rate. If the company bases investment decisions solely on net present value, which project will it choose?arrow_forwardBridgeport Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $260,084 $46,590 Project A 7 years $0 Project B Click here to view the factor table. Bridgeport Company uses the straight-line method to depreciate its assets. B $278,237 Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.) $44,540 9 years $0 Internal rate of return % %arrow_forwardGiven the following, calculate the project's cash flows, NPV, and IRR. Initial investment $325,000 Expected life is 5 years First Year Revenues: 145,000 First-Year Expenses: $65,000 • Growth for revenue and expenses: 4.5 percent per year Straight Line Depreciation over 5 years Salvage Value: $50,000 One-time net working capital investment of $10,000 is required at the start of the project and will be recovered at project end The tax rate is 34 percent The risk-free rate is 4 percent Beta is 1.1 • The expected market return is 8 percent Answer the following: ● ● ● ● ● ● ● ● ● What are the cash flows for each year? What is the NPV? What is the IRR?arrow_forward

- Can you please check my workarrow_forwardIn your first job with TBL Inc. your task is to consider a new project whose data are shown below. What is the project's Year 1 cash flow? The annual operating cash flows of the project can be calculated as follows: OCF = {[Sales - Operating Costs]*(1-Tax Rate)} + (Depreciation * Tax Rate) Sales revenues $225,250 Depreciation $72,602 Other operating costs $92,000 Tax rate 28%arrow_forwardWildhorse Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year 0 1 2 3 4 5 Cash Flow -$3,485,400 871,710 896,700 1,104,400 1,340,360 1,450,600 What is the NPV of this project? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to O decimal places, e.g. 1,525.) The NPV is $arrow_forward

- Required information A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $. Equipment replacement cost in year 2, $ Annual operating cost, $/year Salvage value, $ Life, years -870,000 -300,000 -920,000 250,000 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $-1arrow_forward2. Marigold Corp. is considering the purchase of a piece of equipment and has complied the information…arrow_forwardJoetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment $ 33,500 Annual cash inflows $ 7,400 Salvage value of equipment $ 0 Life of the investment 15 years Required rate of return 10% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The simple rate of return for the investment (rounded to the nearest tenth of a percent) is: Brewer 9e Rechecks 2021-11-26 Multiple Choice 24.7% 15.4% 21.6% 11.2%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education