Concept explainers

The comparative

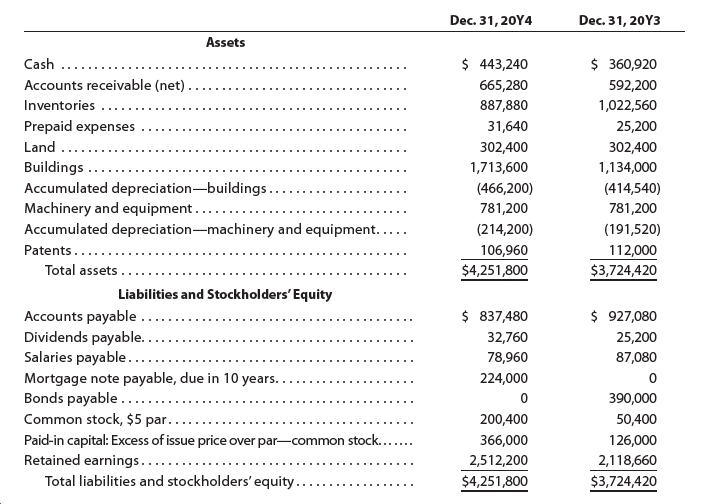

Please see the attachment for details:

An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4:

a. Net income, $524,580.

b.

c. Patent amortization reported on the income statement, $5,040.

d. A building was constructed for $579,600.

e. A mortgage note for $224,000 was issued for cash.

f. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable.

g. Cash dividends declared, $131,040.

Instructions

Prepare a statement of

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Use the following financial statements for Manufacturing Inc. to compute the 1) DSO 2) TIE 3) ROE Manufacturing Inc. Balance Sheets, Income Statements and Additional Information for Year Ending December 31 (Millions of Dollars, Except for Per Share Data) Balance Sheet 2019 Assets Cash and equivalents $4,156.00 Accounts receivable $12,980.00 Inventories $8,920.00 Total current assets $26,056.00 Net property, plant & equipment (PP&E) $13,405.00 Total assets $39,461.00 Liabilities and Equity Accounts payable $7,410.00 Notes payable $5,460.00 Accruals $4,290.00 Total current liabilities $17,160.00 Long-term bonds $7,800.00 Total liabilities $24,960.00 Common stock $6,921.00 Retained earnings $7,580.00 Total common equity $14,501.00 Total liabilities and equity $39,461.00 Income Statement…arrow_forwardThe comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $246,670 $230,250 Accounts receivable (net) 89,360 82,700 Inventories 252,250 244,840 Investments 0 94,860 Land 129,390 0 Equipment 278,320 216,470 Accumulated depreciation—equipment (65,160) (58,370) Total assets $930,830 $810,750 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $168,480 $159,720 Accrued expenses payable (operating expenses) 16,750 21,080 Dividends payable 9,310 7,300 Common stock, $10 par 50,260 39,730 Paid-in capital in excess of par—common stock 188,960 110,260 Retained earnings 497,070 472,660 Total liabilities and stockholders’ equity $930,830 $810,750 Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: Equipment and land were…arrow_forwardThe December 31, Year 4, balance sheet for Finch Corporation is presented here. These are the only accounts on Finch's balance sheet. Amounts indicated by question marks (?) can be calculated using the following additional information: Assets Cash FINCH CORPORATION Balance Sheet As of December 31, Year 4 Accounts receivable (net) Inventory Property, plant, and equipment (net) Liabilities and Stockholders' Equity Accounts payable (trade) Income taxes payable (current) Long-term debt Common stock Retained earnings Additional Information Current ratio (at year end) Total liabilities + Total stockholders' equity Gross margin percentage $35,000 a. Accounts payable b. Retained earnings Inventory C. 292,000 $442,000 $ ? P $ P 35,000 298,000 Inventory turnover (Cost of goods sold + Ending inventory) Gross margin for Year 4 12 1.6 to 1.0 70% 40% 9.6 times Required a. Compute the balance in trade accounts payable as of December 31, Year 4. b. Compute the balance in retained earnings as of…arrow_forward

- An analysis of changes in selected balance sheet accounts of Johnson Corporation shows the following for the current year: Plant and Equipment accounts: Debit entries to asset accounts Credit entries to asset accounts Debit entries to accumulated depreciation accounts (resulting from sale of plant assets) Credit entries to accumulated depreciation accounts (representing depreciation for the current year) $ 154,000 $ 115,000 $ 88,000 Johnson's income statement for the current year includes a $11,000 loss on disposal of plant assets. All payments and proceeds relating to purchase or sale of plant assets were in cash. Select one: $ 104,000 Total cash proceeds received by Johnson from sales of plant assets during the current year amounted to: a. $104,000. b. $208,000. c. $219,000. d. $16,000.arrow_forwardThe draft financial statements of Enjoy Ltd for the year ended 31 December 20X6 are given below. The following additional information is also provided: (i) Plant with an original cost of $800 and accumulated depreciation of $600 was sold for $200. (ii) Interest expense was $350 of which $140 was paid during the period. $130 relating to interest expense of the prior period was also paid during the period. (iii) Investment income included $250 of interest that was received during the period and $250 of interest still to be received. The $250 of interest still to be received is included within other receivables. (iv) Investment income also included $300 of dividend that was received. Statement of Profit and Loss for the year ended 31 December 20X6: Sales 44,870 Cost of sales 31,000 Gross Profit…arrow_forward(a) Calculate the asset tumover ratio, Asset tumover ratio________ 1) eTextbook 2) and Media List of Accountsarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education