ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

5...

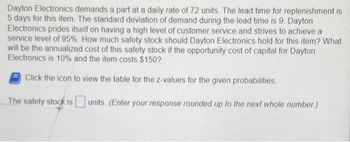

Transcribed Image Text:Dayton Electronics demands a part at a daily rate of 72 units. The lead time for replenishment is

5 days for this item. The standard deviation of demand during the lead time is 9. Dayton

Electronics prides itself on having a high level of customer service and strives to achieve a

service level of 95%. How much safety stock should Dayton Electronics hold for this item? What

will be the annualized cost of this safety stock if the opportunity cost of capital for Dayton

Electronics is 10% and the item costs $150?

Click the icon to view the table for the z-values for the given probabilities

The safety stock is units. (Enter your response rounded up to the next whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6. Determinants of demand The following graph input tool shows the demand for sedans in New York City. For simplicity, assume that all sedans are identical and sell for the same price. Initially, the calculator shows market demand under the following circumstances: average household income is $50,000 per year, the price of a gallon of regular unleaded gas is $3 per gallon, and the price of a subway ride is $1.50. Use the graph input tool to help you answer the questions that follow. (Note: You will not be graded on any adjustment made to the graph used in the tool.) PRICE (Thousands of dollars per sedan) Demand 100 200 300 400 500 600 700 800 900 QUANTITY (Sedans per month) Graph Input Tool Price of a sedan (Thousands of dollars) Quantity of sedans (Sedans per month) Average Income (Thousands of dollars) Price of gasoline (Dollars per gallon) Price of a subway ride Suppose that the price of a sedan decreased from $25,000 to $20,000. This would cause a 25 450 50 $3.00 $1.50 Suppose that…arrow_forwardI cant seem to remeber the formula to use to fill out S2 and D2arrow_forward15. Consider Graphs |-V. (See supplementary graphs.) Which graph represents going from a positive fare to a zero fare? Graph I Graph II Graph II a. b. C.arrow_forward

- 3. Refer to the information provided in Figure below to answer the following questions. Price of pizza +6 0 A B D₁ D₂ Number of pizzas per month D3 a. Under what situation consumer moves from A to B? When they move from C to A? Explain the reasons in both cases. b. Imagine your demand curve for pizza last year was D3. Now the demand is D1. Write down possible reasons for this. Explain this carefully c. Can you expect the demand to increase at the same price? Explain the reasons carefully. d. Can you expect the demand to decrease at the same price? Explain this carefully.arrow_forward10) Figure 1 shows some indifference curves and budget lines for consumer Yusuf. Milk A B Cheese Figure 1 If Yusuf's income increases, his optimal consumption changes from point A to point B. Which of the following statements is true for Yusuf? (a) Cheese and milk are substitutes. (b) Cheese is an inferior good. (c) Milk is an inferior good . (d) Milk is a normal good. (e) None of the above.arrow_forward5. Assume a product's demand is Price = -(3/4) * Quantity + 12 [or P = -(3/4)*Q+12]. Fill in the demand schedule (i.e., pick quantities [0, 4, 8, 12 etc.] and find the associated prices) and plot demand on the graph (also label graph axes with the traditional measures for demand graphs) Page 3 Quantity Price 13 12 11 10 9- 8 7 6 5 4 3 2 1 0 0 2 4 6 8 10 12 14 16 18 20 22arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education