Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

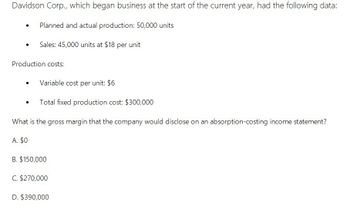

Transcribed Image Text:Davidson Corp., which began business at the start of the current year, had the following data:

.

Planned and actual production: 50,000 units

Sales: 45,000 units at $18 per unit

Production costs:

•

Variable cost per unit: $6

•

Total fixed production cost: $300,000

What is the gross margin that the company would disclose on an absorption-costing income statement?

A. $0

B. $150,000

C. $270,000

D. $390,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- McArthur Corp., which began business at the start of the current year, had the following data: Planned and actual production: 50,000 units • Sales: 45,000 units at $20 per unit • Production Costs: • Variable: $7 per unit • Fixed: $300,000 Selling and Administrative Costs: • Variable: $2 per unit Fixed: $40,000 What is the gross margin that the company would disclose on an absorption-costing income statement? a. $315,000 b. $157,500 c. $225,000 d. $450,000arrow_forwardSmith, which began business at the start of the current year, had the following data: Planned and actual production: 40,000 units Sales: 37,000 units at $15 per unit Production costs: Variable: $4 per unit Fixed: $260,000 Selling and administrative costs: Variable: $1 per unit Fixed: $32,000 The gross margin that the company would disclose on an absorption- costing income statement is: A. $97,500. B. $147,000. C. $166,500. D. $370,000. E. some other amount.arrow_forwardJellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year isas follows:TotalSales $11,700,000Total variable cost 8,190,000Contribution margin $ 3,510,000Total fixed cost 2,254,200Operating income $ 1,255,800Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c) contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 morethan expected.4. For the projected level of sales, compute the margin of safety in units, and then in salesdollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.arrow_forward

- Please need answer this general accounting questionarrow_forwardOslo company prepared the following contrubition format income statement based on a sales volume of 1,000 unites (the relevant range of production is 500 units to 1,500 units). Sales.... $20,000 Variable expenses ... 12,000 Contribution margin .... 8,000 Fixed expenses ... 6,000 Net operating income... $2,000 4) If the sales increase to 1,001 units, what would be the increase in net operating income ? 5) If sales decline to 900 units , what would be the net operating income? 6) If selling price increases by $2 per unit and the sales volume decreases by 100 units , what would be the net operating income ?arrow_forwardPlease provide correct answer this question general accountingarrow_forward

- Which answer is correct?arrow_forwardWhat is the contribution margin per unit of this general accounting question?arrow_forwardPatchi, which began business at the start of the current year, had the following data: Planned and actual production: 40,000 units Sales: 37,000 units at ₱15 per unit Production costs: Variable: ₱4 per unit Fixed: ₱260,000 Selling and administrative costs: Variable: ₱1 per unit Fixed: ₱32,000 The contribution margin that the company would disclose on an absorption-costing income statement is: A. ₱0 B. ₱147,000 c. ₱166,500 D. ₱370,000arrow_forward

- Can you please give me correct solution for this general accounting question?arrow_forwardOslo company prepared the following contrubition format income statement based on a sales volume of 1,000 unites (the relevant range of production is 500 units to 1,500 units). Sales.... $20,000 Variable expenses ... 12,000 Contribution margin .... 8,000 Fixed expenses ... 6,000 Net operating income... $2,000 7) If the variable cost per unit increases by $1, spending on advertising increases by $1,500 , and unit sales increase by 250 units , what would be the net operating income? 8) What is the break-even point in unit sales? 9) What is the break-even point in dollar sales? 10) How many units must be sold to achieve a target profit of $5000?arrow_forward[The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 70,000 Variable expenses 38,500 Contribution margin 31,500 Fixed expenses 23,310 Net operating income $ 8,190 4. If sales increase to 1,001 units, what would be the increase in net operating income? (Round your answer to 2 decimal places.) 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating income? 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,600, and unit sales increase by 220 units, what would be the net operating income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning