FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

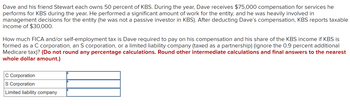

Transcribed Image Text:Dave and his friend Stewart each owns 50 percent of KBS. During the year, Dave receives $75,000 compensation for services he

performs for KBS during the year. He performed a significant amount of work for the entity, and he was heavily involved in

management decisions for the entity (he was not a passive investor in KBS). After deducting Dave's compensation, KBS reports taxable

income of $30,000.

How much FICA and/or self-employment tax is Dave required to pay on his compensation and his share of the KBS income if KBS is

formed as a C corporation, an S corporation, or a limited liability company (taxed as a partnership) (ignore the 0.9 percent additional

Medicare tax)? (Do not round any percentage calculations. Round other intermediate calculations and final answers to the nearest

whole dollar amount.)

C Corporation

S Corporation

Limited liability company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $180, 000 salary working full time for Angels Corporation. Angels Corporation reported $400,000 of taxable business income for the year (2023). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $180,000 (all salary from Angels Corporation). Mason claims $50,000 in itemized deductions. Answer the following questions for Mason. Assuming the business income allocated to Mason is income from a specified service trade or business, what is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardJackson, an individual, is a shareholder in Cadduceus Corp., a C corporation with $40,000 in accumulated earnings and profits. Cadduceus Corp. redeems some of its stock from Jackson for $200,000 as part of a qualifying partial liquidation. Jackson's adjusted basis in the stock at the time of redemption was $50,000. For tax purposes, how will Jackson report the effects of this redemption of stock? As a $40,000 dividend only. As a $150,000 capital gain. As a $40,000 dividend and $110,000 capital gain. As a $10,000 capital loss.arrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $191,500 salary working full time for Angels Corporation. Angels Corporation reported $196,000 of taxable business income for the year (2023). Before considering his business income allocation form Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $191,500 (all salary from Angels Corporation). Mason claims $73,000 in itemized deductions. Assuming the business income allocated to Mason is income from a specified service trade or business, what is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forward

- John, a limited partner of Candy Apple, LP, is allocated $32,000 of ordinary business loss from the partnership. Before the loss allocation, his tax basis is $22,000 and his at-risk amount is $12,000. John also has ordinary business income of $22,000 from Sweet Pea, LP, as a general partner and ordinary business income of $8,200 from Red Tomato as a limited partner. How much of the $32,000 loss from Candy Apple can John deduct currently? Multiple Choice $8,200 $12,000 $23,800 $32,000arrow_forwardFarell is a member of Sierra Vista LLC. Although Sierra Vista is involved in a number of different business ventures, it is not currently involved in real estate either as an investor or as a developer. On January 1, year 1, Farell has a $199,000 tax basis in his LLC interest that includes his $179,000 share of Sierra Vista's general liabilities. By the end of the year, Farell's share of Sierra Vista's general liabilities have increased to $199,000. Because of the time he spends in other endeavors, Farell does not materially participate in Sierra Vista. His share of the Sierra Vista losses for year 1 is $238,000. As a partner in the Riverwoods Partnership, he also has year 1, Schedule K-1 passive income of $18,000. Farell is single and has no other sources of business income or loss. a-1. Determine how much of the Sierra Vista loss Farell will currently be able to deduct on his tax return for year 1. a-2. List the losses suspended due to tax-basis, at-risk, and passive activity…arrow_forwardFarell is a member of Sierra Vista LLC. Although Sierra Vista is involved in a number of different business ventures, it is not currently involved in real estate either as an investor or as a developer. On January 1, year 1, Farell has a $126,000 tax basis in his LLC interest that includes his $115,000 share of Sierra Vista's general liabilities. By the end of the year, Farell's share of Sierra Vista's general liabilities have increased to $126,000. Because of the time he spends in other endeavors, Farell does not materially participate in Sierra Vista. His share of the Sierra Vista losses for year 1 is $153,000. As a partner in the Riverwoods Partnership, he also has year 1, Schedule K-1 passive income of $7,000. Farell is single and has no other sources of business income or loss. D. Assuming the original facts and that Farell is deemed to be an active participant in Sierra Vista, and he also has a $272,000 loss from a sole proprietorship, determine how much total trade or business…arrow_forward

- T borrows $100,000 from the bank in Year 1, which he agrees to repay in Year 2. Whenthe debt becomes due in Year 2, the bank agrees to release T from liability if hepays $80,000.a. T realizes $100,000 of income in Year 1.b. T realizes $20,000 of income from the cancellation of debt in Year 2.c. T realizes $20,000 of ordinary income as compensation for services in Year 2 ifthe cancellation of debt was intended to satisfy the bank’s obligation to pay Tfor services.d. Both a and b.e. Either b or c, depending on the circumstances. T buys a parcel of real estate for $100,000, which he finances by giving the seller a nonrecoursemortgage for the full purchase price. The debt is due in one balloon payment inYear 5. When the debt becomes due in Year 5, T decides to give the property back to theseller in satisfaction of the debt (the property is worth only $50,000 at that time).a. T will realize $100,000 of income in Year 1 because the debt was non-recourse.b. T will realize no income in Year…arrow_forwardConnie recently provided legal services to the Winterhaven LLC and received a 20 percent interest in the LLC as compensation. Winterhaven currently has $50,000 of accounts payable and no other debt. The current fair market value of Winterhaven’s capital is $200,000. If Connie receives a 20 percent profits interest only, how much income must she report?arrow_forwardPeng owns equipment used in his sole proprietor business with an adjusted basis of $12,000 and a fair market value of $28,000. Depreciation claimed was $6,500. How much could Peng deduct as a charitable contribution if he contributed the equipment to a qualified charity?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education