Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

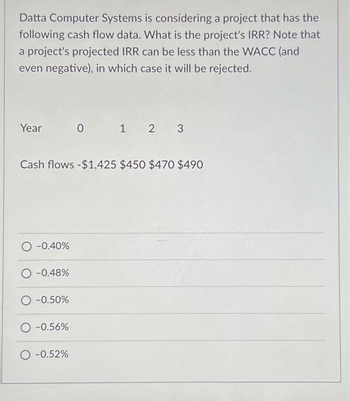

Transcribed Image Text:Datta Computer Systems is considering a project that has the

following cash flow data. What is the project's IRR? Note that

a project's projected IRR can be less than the WACC (and

even negative), in which case it will be rejected.

Year

Cash flows -$1,425 $450 $470 $490

-0.40%

-0.48%

-0.50%

O-0.56%

0 1 2 3

O -0.52%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ZLY calculates that a project with conventional cash flows and a required return of 14% has a negative NPV. What do we then know about the project's internal rate of return? A) equal to 21% B) greater than 14% C) less than 14% D) equal to zeroarrow_forwardBasic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project. Be complete and thorough in your answer.arrow_forwardDatta Computer Systems is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year Cash flows O 7.93% 8.31% 9.46% 9.94% 9.55% -$1,175 $450 $470 دیا $490arrow_forward

- Mf4. 1. Calculate the Payback period 2. Calculate the Net Present Value (NPV) of both projects 3. Calculate the Internal Rate of Return (IRR) of both projects 4. Critically discuss the merits of each investment appraisal method, then discuss the result of the evaluations you have made of the two projects and advise the company which project should be undertakenarrow_forwardsolve these 2 pratice problemsarrow_forwardWarr Company is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. Year 1 4 Cash flows -$1540 $400 $400 $400 $400 O a. 4.13% O b. 0.99% O c. 1.22% O d. 1.547% O e. 3.58%arrow_forward

- Kiley Electronics is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the cost of capital (and even negative), in which case it will be rejected. r: 10.00% Year 0 1 2 3 Cash flows −$1,000 $550 $560 $570arrow_forward3.) XYZ Computer Systems is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. (Answer should be in excel format and show spreadsheet inputs) Year 0 1 2 3 Cash flows ($1,100) $400 $470 $490arrow_forwardZuni Computer Systems is considering a project with the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year 6.67% Cash flows -$1,250 $450 $470 $490 5.99% 5.01% 5.50% 0 6.18% 1 2 3arrow_forward

- Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. O A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC. A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost. O If a project's IRR is smaller than the WACC, then its NPV will be positive. O A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR.arrow_forward1. John approached you with a business proposition to invest in a project. The Annual Cash Flows (CF) are uncertain. However, the following probability distribution provides you with expectations: Probability P(CF) Probable Cash Flow (CF) $80.000 $140,000 $180,000 15 55 30 What is the expected Annual Cash Flow from this project? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). ... BIUS Paragraph Arial 10pt A 10:49 PM a 60F Cloudy 5/16/2022 P Type here to search 5 6. 8Oarrow_forwardEhrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. Training WACC: 12.00% Year 0 1 2 3 Cash flows - $1,000 $540 $540 $540arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education