Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

| Date | DJIA | S&P 500 |

| January 6 | 11,998 | 1,278 |

| January 13 | 12,022 | 1,289 |

| January 20 | 12,330 | 1,315 |

| January 27 | 12,440 | 1,316 |

| February 3 | 12,762 | 1,345 |

| February 10 | 12,801 | 1,343 |

| February 17 | 12,950 | 1,362 |

| February 24 | 12,983 | 1,366 |

| March 2 | 12,978 | 1,370 |

| March 9 | 12,922 | 1,371 |

| March 16 | 13,233 | 1,404 |

| March 23 | 13,081 | 1,397 |

| March 30 | 12,900 | 1,408 |

| April 5 | 13,060 | 1,398 |

| April 13 | 12,850 | 1,370 |

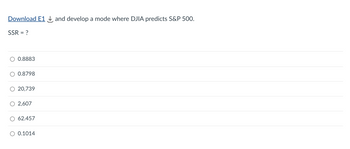

Transcribed Image Text:Download E1 and develop a mode where DJIA predicts S&P 500.

SSR = ?

0.8883

0.8798

20,739

2,607

62.457

0.1014

Expert Solution

arrow_forward

Given,

| Date | DJIA | S&P 500 |

| Jan-06 | 11,998.00 | 1,278.00 |

| Jan-13 | 12,022.00 | 1,289.00 |

| Jan-20 | 12,330.00 | 1,315.00 |

| Jan-27 | 12,440.00 | 1,316.00 |

| Feb-03 | 12,762.00 | 1,345.00 |

| Feb-10 | 12,801.00 | 1,343.00 |

| Feb-17 | 12,950.00 | 1,362.00 |

| Feb-24 | 12,983.00 | 1,366.00 |

| Mar-02 | 12,978.00 | 1,370.00 |

| Mar-09 | 12,922.00 | 1,371.00 |

| Mar-16 | 13,233.00 | 1,404.00 |

| Mar-23 | 13,081.00 | 1,397.00 |

| Mar-30 | 12,900.00 | 1,408.00 |

| Apr-05 | 13,060.00 | 1,398.00 |

| Apr-13 | 12,850.00 | 1,370.00 |

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- TB MC Qu. 14-50 (Algo) Natcher Corporation's accounts receivable at the end... Natcher Corporation's accounts receivable at the end of Year 2 was $150,000 and its accounts receivable at the end of Year 1 was $157,000. The company's inventory at the end of Year 2 was $153,000 and its inventory at the end of Year 1 was $145,000. Sales, all on account, amounted to $1,406,000 in Year 2. Cost of goods sold amounted to $824,000 in Year 2. The company's operating cycle for Year 2 is closest to: (Round your intermediate calculations to 1 decimal place.) Multiple Choice 75.6 days 106.1 days 48.9 days 71.9 daysarrow_forwardSaved to my Mac Design Layout References Mailings Review View Q Tell me | 11 A^ A Aa v AaBbCcDdE ab X2 x A v Av 三三三=| 三。 Normal 3. Given the following financial data below prepare the appropriate closing journal entries Owner's Capital Ending Inventory $ 50,000 18,000 Owner's Withdrawals 23,000 Sales Revenue 500,000 Purchases 110,000 20,000 కంకిలో Sales Returns and Allowances Freight Hn 5,400 Sales Discounts 7,500 Purchase returns and Allowances Beginning inventory Freight-Out Advertising Expense Interest Expense 4,000 17,000 2,300 15,000 19,200 53,000 Salaries and Wages Expense Utilities Expense 18,000 9,000 Depreciation Expense Interest Revenue 18,000 Required: Prepare the closing entriesarrow_forwardAvery Collins Kinsley McDonnough Ross Shannon 2012 Total Sales by Agent January - June January February March April $ 3,671 $ 2,973 $ 4,017 $ 5,040 $ $ 1,549 $ 992 $ $2,267 $ 3,201 $ 2,996 $ 6,948 $ 4,205 $ 5,523 $ 2,003 $ 4,190 $ 3,496 $ $ 4,038 $ 2,064 $ 7,015 $ $ 1,172 $ 866 $2,109 $ $ Task 5 Create Line sparklines in column H in the Summary sheet to display six- month trends for each agent. Show the high point in each sparkline. Task 7 Create a footer with your full name on the left side, the file name in the center, and the Date on the right side of each sheet (Part_1 and Part_2). May June 4,963 $ 5,497 4,008 $ 3,798 6,597 $ 5,147 1,975 $ 2,936 $ 3,498 6,832 $ 5,971 $ 5,497 3,385 $ 4,078 $ 3,598 Trends Bonus $ Bonus Task 6 Insert an IF function in column I that displays a $600 bonus if an agent's average sales are greater than the average of all sales for the six months. Use two nested AVERAGE functions in the logical_test argument of the IF function to make the comparison. Use…arrow_forward

- What the answer for 27 The first answer I had was 61,800 The second answer was 25,200 Both was wrongarrow_forwardPlease do not give solution in image format thankuarrow_forward9:44 P D M (7 all 83% The income statement for Forklift Electrical Ltd for two years are shown below: Forklift Electrical Ltd Income Statement Comparison Current year Prior Year (amounts in thousands) $ 33,750 21,938 $ 11,812 $ 24,750 16,830 $ 7,920 Sales Cost of goods sold Gross profit Wages $ 8,775 $ 6,188 Utilities 675 250 Repairs Selling Total expenses 169 325 506 200 $ 10,125 $ 6,963 Total assets (investment base) $ 4,500 $ 1,500 Required: a) Determine the operating income (loss) (dollars) for each year. b) The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the amounts of the total assets as the investment base, calculate the return on investment. c) Was the decision to invest additional assets in the company successful? Explain. d) Assuming an 8% cost of capital, calculate the residual income for each year. e) Would the management of Forklift Electrical Ltd have been more likely to accept the investment…arrow_forward

- Carleton University > BUSI > BUSI 1004 At January 1, 20 * 2, Jamin Co. had a c... Question Ask a new Question 8. At January 1, 20x2, Jamin Co. had a credit balance of $260,000 in its allowance for uncollectible accounts. Based on past experience, 2% of Jamin's credit sales have been uncollectible. During 20x2, Jamin wrote off $325,000 of uncollectible accounts. Credit sales for 20x2 were $9 million. In its December.31, 20x2 balance sheet, what amount should Jamin report as allowance for uncollectible accounts? a. $440,000 b. $115,00 $245,000 d. $180,000 C. Uploaded by: viviannguyen3 Report Subject: Businessarrow_forwardperform horizontal analysisarrow_forwardDinesh bhaiarrow_forward

- 1arrow_forwardAnalyze Apple Inc. by segment Segment disclosure by Apple Inc. (AAPL) provides sales information for its major product lines for three recent years as follows (in millions): Segment Year 3 Year 2 Year 1 iPhone $136,700 $155,041 $101,991 iPad 20,628 23,227 30,283 Mac 22,831 25,471 24,079 Services 24,348 19,909 18,063 Other Products 11,132 10,067 8,379 Total sales $215,639 $233,715 $182,795 The Services segment includes sales from iTunes Store, App Store, Mac App Store, TV App Store, iBooks Store, Apple Music, AppleCare, and Apple Pay. The Other Products segment includes sales from Apple TV, Apple Watch, Beats products, iPod, and Apple-branded accessories. a. Prepare a vertical analysis of Year 3 sales. (Round percentages to nearest whole percent.)arrow_forwardExercise 9-15 During its first year of operations, Mack’s Plumbing Supply Co. had sales of $3,250,000, wrote off $27,800 of accounts as uncollectible using the direct write-off method, and reported net income of $487,500. Determine what the net income would have been if the allowance method had been used and the company estimated that 1% of sales would be uncollectible. --------------------------------------------------------------------- Using the data in Exercise 9-15, assume that during the second year of operations, Mack’s Plumbing Supply Co. had sales of $4,100,000, wrote off $34,000 of accounts as uncollectible using the direct write-off method, and reported net income of $600,000.a. Determine what net income would have been in the second year if the allowance method (using 1% of sales) had been used in both the first and second years.b. Determine what the balance of the allowance for doubtful accounts would have been at the end of the second year if the allowance method had been…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education