Concept explainers

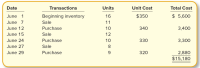

Jimmie’s Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June:

Required:

1. Calculate ending inventory and cost of goods sold at June 30, using the specific identification method. The June 7 sale consists of fishing reels from beginning inventory, the June 15 sale consists of three fishing reels from beginning inventory and nine fishing reels from the June 12 purchase, and the June 27 sale consists of one fishing reel from beginning inventory and seven fishing reels from the June 24 purchase.

2. Using FIFO, calculate ending inventory and cost of goods sold at June 30.

3. Using LIFO, calculate ending inventory and cost of goods sold at June 30.

4. Using weighted-average cost, calculate ending inventory and cost of goods sold at June 30.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 11 images

- give me the ending inventory for sept 30 and cost of goods sold for sept 30 ( FIFO, LIFO, AVERAGE COST)arrow_forwardPlease help mearrow_forwardTop Purse Company applies the periodic inventory system using the specific identification method. The company had the following transactions related to its best selling purse. Date Transaction Units Unit Cost Total Cost November 1 Beginning inventory 5 300 1,500 November 3 Sale 2 November 8 Purchase 9 320 2,880 November 10 Sale 4 November 17 Purchase 3 340 1,020 Compute the cost of goods sold for the best selling purse based on the following: The November 3rd sale consists of purses from beginning inventory. The November 10th sale consists of 1 purse from beginning inventory and 3 purses from the November 8th purchase.arrow_forward

- Eddy's Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June. Eddy's Fishing Hole uses a periodic inventory system. Date June 1 June 7 June 12 June 15 June 24 June 27 June 29 Transactions Beginning inventory Sale Purchase Sale Purchase Sale Purchase Ending inventory Cost of goods sold Units 16 11 10 12 10 8 9 Unit Cost $260 250 240 230 2. Using FIFO, calculate ending inventory and cost of goods sold at June 30. Total Cost $4,160 2,500 2,400 2,070 $11,130arrow_forwardIn its first month of operations, Bramble Corp. made three purchases of merchandise in the following sequence: (1) 240 units at $4, (2) 340 units at $6, and (3) 440 units at $7. Assuming there are 140 units on hand at the end of the period, compute the cost of the ending inventory under (a) the FIFO method and (b) the LIFO method. Bramble Corp. uses a periodic inventory system. FIFO LIFO The Ending Inventory $Enter a dollar amount $Enter a dollar amountarrow_forwardEddy's Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June. Eddy's Fishing Hole uses a periodic inventory system. Date June 1 June 7 June 12 June 15 June 24 June 27 June 29 Transactions Beginning inventory Sale Purchase Sale Purchase Sale Purchase Ending inventory Cost of goods sold Units 16 11 10 12 10 8 9 Unit Cost $260 250 240 230 Total Cost $4,160 2,500 2,400 2,070 $11,130 4. Using weighted-average cost, calculate ending inventory and cost of goods sold at June 30. (Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.)arrow_forward

- The Company uses a periodic inventory system. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.)arrow_forwardPoole Company purchased two identical inventory items. One of the items, purchased in January, cost $40. The other, purchased in February, cost $52. One of the items was sold in March at a selling price of $140. Poole uses LIFO. Which of the following statements is true? Multiple Choice The balance in ending inventory would be $52. The amount of ending inventory would be $46. The amount of cost of goods sold would be $40. The amount of gross margin would be $88.arrow_forwardSant Summa is a retailer that purchases merchandise inventory from Lee Co. Sant Summa record inventory purchases using the gross method and the perpetual inventory system. Sant Summa started the month of July with $2,000 in inventory. Required: Record the journal entries for the following transactions Calculate Sant Summa's Cost of Goods Available for Sale based on the above information. Calculate Sant Summa's Ending Inventory based on the above information. 2-Jul Purchased $5,200 of merchandise inventory from Lee Co. with credit terms 2/15, n60 and FOB shipping point. (Inventory cost Lee $4,000) 3-Jul Paid $350 for shipping charges for the May 2 purchase. 4-Jul Sant Summa returned $200 of damaged merchandise inventory to Lee Co. (inventory cost to Lee of $170) 13-Jul Paid the appropriate amount for the Lee Co. purchases of July 2, taking all discounts. (Lee…arrow_forward

- Required:Determine the costs assigned to the December 31 ending inventory based on the FIFO method.arrow_forwardCrosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021: Beginning inventory. Net purchases Net markups Net markdowns Net sales Beginning inventory Net purchases Net markups Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period (Round ratio calculation to 2 decimal places (i.e.. 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost $180,000 630,000 Net markdowns Goods available for sale (excluding beg. inventory) Goods available for sale (including beg inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) sales Estimated ending…arrow_forwardTop Purse Company applies the periodic inventory system using the specific identification method. The company had the following transactions related to its best selling purse. Date Transaction Units Unit Cost Total Cost November 1 Beginning inventory 5 300 1,500 November 3 Sale 2 November 8 Purchase 9 320 2,880 November 10 Sale 4 November 17 Purchase 3 340 1,020 Compute the cost of ending inventory for the best selling purse based on the following: The November 3rd sale consists of purses from beginning inventory. The November 10th sale consists of 1 purse from beginning inventory and 3 purses from the November 8th purchase.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education