FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

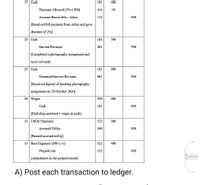

Transcribed Image Text:17 Cash

101

490

Discount Allowed (2% x 500)

414

10

Account Receivable - Asher

112

500

(Received full payment from Asher and gave

discount of 2%)

20 Cash

101

700

Service Revenue

401

700

(Completed a photography assignment and

received cash)

25 Cash

101

500

Unearned Service Revenue

601

500

(Received deposit of booking photography

assignment on 20 October 2020)

30 Wages

520

400

Cash

101

400

(Paid shop assistant's wages in cash)

31 Utility Expenses

522

300

Accrued Utility

540

300

(Record accrued utility)

31 Rent Expenses (800 x %)

521

400

Prepaid rent

313

400

(Adjustment on the prepaid rental)

A) Post each transaction to ledger.

Transcribed Image Text:2.0 General Journal

Date

Account and explanation

Ref | Debit (RM) Credit (RM)

2020

Cash

101

15000

August 1

Саpital

301

15000

(Started business with cash as capital)

1 Prepaid rent

510

800

Cash

101

800

(Paid rent for 2 month's with cash)

2 Supplies

516

1920

Account Payable - Moonlight

201

1920

Enterprise

(Purchased supplies on credit from Moonlight

Enterprise with credit term of 3/10, n/30)

5 Cash

101

150

Service Revenue

401

150

(Finished a few job for customer and

collected cash)

6 Account Payable – Moonlight Enterprise

201

120

Return Outwards

512

120

(Reccived a credit memo from Moonlight

Enterprise for the return of damage supplies)

8 Account Receivable - Asher

112

500

Service Revenue

401

500

(Finished a photography assignment for

Asher on credit with credit terms of 2/10,

n/30)

11 Account Payable – Moonlight Enterprise

201

1800

(1920-120)

Discount Received (1800 x 3%)

514

54

Cash (1800-54)

101

1746

16 Drawings

302

200

Cash

101

200

(The owner withdrew cash for personal use)

17 Cash

101

490

Discount Allowed (2% x 500)

414

10

Account Receivable - Asher

112

500

(Received full payment from Asher and gave

discount of 2%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education