FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Current Attempt in Progress

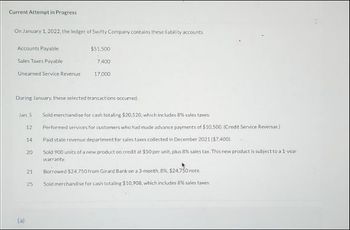

On January 1, 2022, the ledger of Swifty Company contains these ability accounts.

Accounts Payable

Sales Taxes Payable

Unearned Service Revenue

Jan 5

During January, these selected transactions occurred

(a)

12

14

20

21

$51,500

7,400

25

17.000

Sold merchandise for cash totaling $20,520, which includes 8% sales taxes.

Performed services for customers who had made advance payments of $10,500. (Credit Service Revenue)

Paid state revenue department for sales taxes collected in December 2021 ($7,400)

Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year

warranty.

Borrowed $24.750 from Girard Bank on a 3-month, 8 %, $24.750 note..

Sold merchandise for cash totaling $10,908, which includes 8% sales taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer ASAParrow_forwardi need the answer quicklyarrow_forwardExcise and Sales Tax Calculations Barnes Company has just billed a customer for $1,144, an amount that includes a 10% excise tax and a 6% state sales tax. a. What amount of revenue is recorded? b. Prepare a general journal entry to record the transaction on the books of Barnes Company. Round all answers to the nearest dollar. a. Amount of recorded revenue $ 0 b. Date Dec.31 Excise Tax Payable Sales Tax Payable General Journal Description 수 $ + To record sale on account subject to excise tax and sales tax. Debit 0 $ 0 0 0 Credit 0 0 0 0arrow_forward

- The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. Apr. Jun. Jul. Aug. Dec. 1 Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. 31 Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. 30 Paid Kirkwood Co. the amount owed on the note of March 31. 1 Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. 1 Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 15 30 1 22 31 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) Paid Triple Creek Bank the amount due on the note of July 16. Paid Poulin Co. the amount due on the note of July 1. Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes for $28,600 each,…arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forwardOn January 1, 2022, the ledger of Sunland Company contains these liability accounts. Accounts Payable Sales Taxes Payable Unearned Service Revenue 12 During January, these selected transactions occurred. 14 20 Jan. 5 Sold merchandise for cash totaling $20.520, which includes 8% sales taxes. 21 $56,500 • 25 7,900 15.500 Performed services for customers who had made advance payments of $11,000. (Credit Service Revenue.] Paid state revenue department for sales taxes collected in December 2021 ($7,900). Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. Borrowed $24.750 from Girard Bank on a 3-month 8%, $24.750 note Sold merchandise for cash totaling $11,016, which includes 8% sales taxes. 4arrow_forward

- A business has the following balances at the beginning of the year: Accounts receivable: 235000 Allowance for doubtful accounts: -15250The following summary transactions occurred during the year.Sales for the year, 100% on credit: 450000Cash collected on accounts receivable for the year: 445200Write-offs of uncollectable accounts receivable : 28200Received a cheque from a customer whose account was previously written off: 2820The overall rate used to estimate the allowance for doubtful accounts at year end: 8%Using the information above, answer the following questions.What is the balance in the accounts receivable account at year end? 1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?arrow_forwardUse the attachment to answer the following Accounts receivable days outstanding at the end of Year 2 is closest to: a) 30.6 days b) 26.0 days c) 27.0 days d) 6.1 daysarrow_forwardView Policies Current Attempt in Progress Vaughn Bikes Ltd. reports cash sales of $6,600 on October 1. (a) Record the sales assuming they are subject to 13% HST. (b) Record the sales assuming they are subject to 5% GST and 9.975% QST. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) No. Date Account Titles and Explanation Debit Credit (a) Oct. 1 (b) Oct. 1 eTextbook and Media List of Accountsarrow_forward

- Apr. 20 Purchased $38,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $3,000 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. __?__ Paid the amount due on the note to Locust at the maturity date. __?__ Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $30,000 cash from Fargo Bank by signing a 60-day, 6%, $30,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank.arrow_forwardTask 2: Evaluate the company's efficiency in collecting its accounts receivable during the fiscal year ended 31 December 2021. Use the company's information from its annual reports: Receivables as of 31 December 2020 $4,468,392 $4,972,722 $45,349,943 Receivables as of 31 December 2021 Sales revenue for year ended 31 December 2021 1. Calculate the company's number of days of sales outstanding (DSO) for the fiscal year ended 31 December 2021. (Use the average receivables to calculate the ratio). Not Accounting receivable Average Day's sales in receivable = 154; 2. Interpret the calculated ratio. 3. Assume that the industry average DSO ratio is 60 days. Based on this information and the subject company's DSO ratio, critically evaluate the company's credit policy and its implications.arrow_forwardJohn Lee Wholesale provides the following information: Accounts Receivable - 01/07/2020 $150 Accounts Receivable - 30/06/2021 900 Cash received from accounts receivable 8,050 What would be the credit sales for the year? Select one: 8,950 750 8,800 1,050arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education