FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

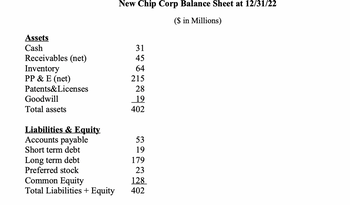

Transcribed Image Text:Assets

Cash

Receivables (net)

Inventory

PP & E (net)

Patents&Licenses

Goodwill

Total assets

Liabilities & Equity

Accounts payable

Short term debt

Long term debt

Preferred stock

Common Equity

Total Liabilities + Equity

New Chip Corp Balance Sheet at 12/31/22

($ in Millions)

31

45

64

215

28

19

402

53

19

179

23

128

402

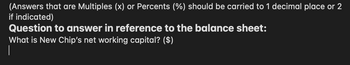

Transcribed Image Text:(Answers that are Multiples (x) or Percents (%) should be carried to 1 decimal place or 2

if indicated)

Question to answer in reference to the balance sheet:

What is New Chip's net working capital? ($)

|

Expert Solution

arrow_forward

Step 1

NET WORKING CAPITAL

Working Capital is the money available to meet your current short-term obligations. Net Working Capital is the Difference between Current Assets & Current Liabilities.

Net Working Capital is Computed :—

= Total Current Assets - Total Current Liabilities

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How to calculate working capital, current assests, current liabilities, quick assets, quick ratio and current ratio.arrow_forwardDo the following: (1) Assign a formula to (1) Tot. current assets, (2) Net fixed assets, (3) Total assets (2) Do the same to other cells if they are calculated. This can vary depending on YOUR financial statements FIN CF and Toves Last Namo vlex (sheet name:arrow_forwardWhich of the below are the correct adjustments we make to a company's EBIT to arrive at its FCFF? Select all that apply. Select All That Apply A B D E F Take out taxes Subtract depreciation and amortization Subtract capital expenditures Add back acquisition expenses Subtract changes in net working capital Add back R&D expenses ?arrow_forward

- Which one of the following will decrease net working capital? Select one: a. A decrease in accounts payable. b. A sale of inventory at a profit. c. A sale of a fixed asset for cash. d. An increase in accounts receivable. e. An increase in accounts payable.arrow_forwardIdentify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Transaction 1. Owner invests $900 cash in business in exchange for stock 2. Receives $700 cash for services provided 3. Pays $500 cash for employee wages 4. Buys $100 of equipment on credit 5. Purchases $200 of…arrow_forward1) Where is the Standard Balance Sheet located in QuickBooks? 2) What is the purpose of a comparative balance sheet? 3) How is a balance sheet modified?arrow_forward

- Required: a. What is the ratio of real assets to total assets? (Hint: for this question, only include those listed under "Real assets") b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? Assets Real assets Equipment and intellectual property Real estate Inventories Total real assets Financial assets Deposits and cash Marketable securities Required A $ Billion $ 8,345 14,423 2,724 $ 25,492 Required B $ 2,333 4,059 4,075 14,005 $ 24,472 $ 49,964 % Total 16.7% 28.9 5.5 51.0% 4.7% 8.1 8.2 28.0 49.0% 100.0% Liabilities and Net Worth Liabilities Debt securities Bank loans & mortgages Other loans Trade debt Other Total liabilities Complete this question by entering your answers in the tabs below. Net worth $ Billion Trade and consumer credit Other Total financial assets TOTAL Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States,…arrow_forwardIf current assets exceed current liabilities, payments of accounts payable willa. decrease the current ratio.b. increase the current ratio.c. decrease working capital.d. increase working capital.arrow_forwardWhat exactly does the word balance mean in the title of the balance sheet ? Why do we balance the two halves ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education