FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

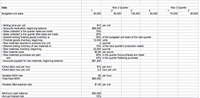

Transcribed Image Text:**Budget Planning Data Overview**

**Budgeted Unit Sales:**

- **Year 2 Quarter 1:** 40,000 units

- **Year 2 Quarter 2:** 60,000 units

- **Year 2 Quarter 3:** 100,000 units

- **Year 2 Quarter 4:** 50,000 units

- **Year 3 Quarter 1:** 70,000 units

- **Year 3 Quarter 2:** 80,000 units

**Financial Assumptions:**

- **Selling Price per Unit:** $12

- **Accounts Receivable (Beginning Balance):** $65,000

**Sales Collection:**

- 75% collected in the quarter sales are made

- 25% collected in the following quarter

**Inventory and Raw Materials:**

- **Finished Goods Inventory (Desired Ending):** 30% of next quarter's sales

- **Finished Goods Inventory (Beginning):** 12,000 units

- **Raw Materials Required per Unit:** 5 pounds

- **Desired Ending Inventory of Raw Materials:** 10% of next quarter's production needs

- **Beginning Raw Materials Inventory:** 23,000 pounds

- **Raw Material Cost:** $0.80 per pound

**Payment Terms for Raw Materials:**

- 60% paid in purchase quarter

- 40% paid in the following quarter

**Accounts Payable for Raw Materials (Beginning Balance):** $81,500

**Labor and Overhead Costs:**

- **Direct Labor Cost per Hour:** $15

- **Direct Labor Hour per Unit:** 0.2 hours

- **Variable Manufacturing Overhead (MOH) Rate:** $2 per hour

- **Total Fixed MOH:** $60,000

- **Variable Selling & Administrative (S&A) Expense Rate:** $1.80 per unit

**Financial Requirements:**

- **Minimum Cash Balance:** $50,000

- **Annual Interest Rate:** 12%

This budget overview reflects the crucial financial metrics and assumptions necessary for planning and forecasting in a manufacturing business, including sales projections, inventory management, cost calculations, and payment terms.

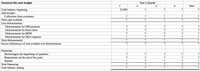

Transcribed Image Text:**Construct the Cash Budget**

| | Year 2 Quarter | | | | Year |

|----------------------------------|-----------------------------|---|---|---|------|

| | 1 | 2 | 3 | 4 | |

| **Cash balance, beginning** | 22,500 | | | | |

| **Add receipts:** | | | | | |

|  Collections from customers | ? | ? | ? | ? | ? |

| **Total cash available** | ? | ? | ? | ? | ? |

| **Less disbursements:** | | | | | |

|  Disbursements for DM purchase | ? | ? | ? | ? | ? |

|  Disbursements for direct labor | ? | ? | ? | ? | ? |

|  Disbursements for MOH | ? | ? | ? | ? | ? |

|  Disbursements for S&A expenses | ? | ? | ? | ? | ? |

| **Total disbursements** | ? | ? | ? | ? | ? |

| **Excess (deficiency) of cash available over disbursements** | ? | ? | ? | ? | ? |

| **Financing:** | | | | | |

|  Borrowing (at the beginning of quarters) | ? | ? | ? | ? | ? |

|  Repayments (at the end of the year) | ? | | | | ? |

|  Interest | ? | | | | ? |

| **Total financing** | ? | ? | ? | ? | ? |

| **Cash balance, ending** | ? | ? | ? | ? | ? |

**Explanation:**

This table is a format for constructing a cash budget over a one-year period divided into four quarters. The cash budget accounts for both incoming and outgoing cash flows during each quarter.

- **Cash balance, beginning:** Starting amount of cash at the beginning of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chapter 7 Problem 1arrow_forwardGive true answerarrow_forwardQuestion 1 QVC Company produces kitchen cabinets at its factory. The following relates to the production of the kitchen cabinets for the period ending December 2020. Production (units) Sales (units) Fixed production cost Fixed Selling overhead Budgeted Actual 75,000 80,000 72,500 77,500 $750,000 $781,250 $562,500 $562,500 The fixed production overhead was absorbed at a pre- determined rate per unit produced. Each kitchen cabinet was sold for $450. Required: At the beginning of January 2020, there was opening stock of 4,375 units valued at $262,500; this includes fixed production overhead of $43,750. c) Prepare the reconciliation statement as at December 31, 2020.arrow_forward

- 3arrow_forwardQUESTION A company manufactures a food product data for which for one week has been analyzed as follows:Standard cost data: KDirect materials: 10 units at K1.50 15Direct wages: 5 hours at K4.00 20Production overhead: 5 hours at K5.00 2560Other overhead may be ignored.Profit margin is 20% of sales Price.Budgeted sales are K30,000 per week.Actual data:Sales K29,880Direct materials K6,435Direct wages K8,162Analysis of variances;Adverse FavourableDirect materials price 585Usage 375Direct labour: rate 318Efficiency 180Production overhead: expenditure 200Volume 375BBAC 212 ASSIGNMENT ONE SEMISTER 2 2021It can be assumed that the production and sales achieved resulted in no changes of stock.REQUIRED;From the data given, to calculate: (i) the actual output; (ii) the actual profit; (iii) the actualn price per unit of material (iv) actual labour rate per hour; (v) the amount of production overhead incurred; (vi) the amount of overhead absorbed; (vii) the amount of production efficiency variance;…arrow_forwardQuestion 5.1 Stark and Company would like to evaluate one of the product lines that they sell to the defense department. Every month the Stark and Company produce an identical number of units, although the sales in units differ from month to month. Selling price Units in beginning inventory $105 110 Units produced 6,400 Units sold 6,100 Units in ending inventory Variable costs per unit: 410 Direct materials $62 Direct labour $48 Variable manufacturing overhead Variable selling and administrative Fixed costs: $3 $7 Fixed manufacturing overhead Fixed selling and administrative $64,000 $35,600 Submission Instructions: 1. Under variable costing, identify the unit product cost for the month. 2. What is the unit product cost for the month under absorption costing? 3. Prepare an income statement for the month using the contribution format and the variable costing method. 4. Prepare an income statement for the month using the absorption costing method.arrow_forward

- Question Two Pass-Well Company Limited produces a product that passes through two processes, Process 1 and Process 2. Details of activities for the month of December, 2020 is as follows; Process 1 @GH₵200.00 200hrs 3,500units GH₵20 per unit Process 2 GH₵25,000.00 600hrs 3,150units GH₵40 per unit a. You are required to prepare the relevant accounts b. You are required to prepare the relevant Accounts With practical example, differentiate between cost assignment and cost apportionment; product cost and period costs; direct Material introduced (4,000 units) Material added Labour Costs (@GH₵400 per hour) Output in units Scrap value of normal loss Note; i. Overhead is absorbed at 80% of labour costs. ii. Normal loss is estimated at 10% for both process. iii. No opening and closing stocks cost and indirect costarrow_forwardAnswer Problem #3 : items 9 & 10arrow_forwardQ49 Arrow, Incorporated, manufactures two products that it sells to the same market. Excerpted below are its budgeted and actual operating results for the year just completed: Budget Actual Unit sales Product X 21,500 40,000 Product Y 89,000 79,000 Unit contribution margin Product X $ 6.00 $ 3.90 Product Y $ 13.00 $ 14.00 Unit selling price Product X $ 13.00 $ 14.00 Product Y $ 30.00 $ 29.00 Industry volume was estimated to be 1,865,000 units at the time the budget was prepared. Actual industry volume for the period was 2,400,000 units. Arrow measures variances using contribution margin. The weighted-average budgeted contribution margin per unit is: Multiple Choice $10.43. $11.64. $12.23. $9.12. $9.17.arrow_forward

- godoarrow_forwardQuestion 4: Dhofar Company manufactures two products M1 and Z1. Its sales department has three divisions: Salalah Ravsut and Mirkat. Initial estimates for the sales budgets for the year ending 31 December 2021 which are based on the assessments of the divisional executives are as follows; Product M1 : Şalalah 45,000 units: Raxsut 110,000 units and Mirkat; 25,000 units Product Z1: Salalah 70,000 units: Raysut 82,000 units and Mirbat:0 Sales Prices: M1: 3 OMR and Z1= 4 OMR in all areas. Arrangements are made for the extensive advertising of product M1 and Z1 and it is estimated that Salalah division sales will increase by 30,000 units. Arrangements are also made to advertise and distribute product z1 in the Mirkat area in the second half of 2021 when sales are expected to be 100,000 units. Since the estimated sales of the Ravsut division represented an unsatisfactory target, it is agreed to increase both the estimates by 15 %. Prepare a sales budget for the year to 31 December 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education