FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

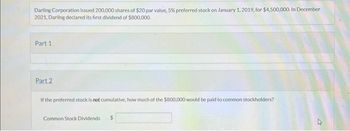

Transcribed Image Text:Darling Corporation issued 200,000 shares of $20 par value, 5% preferred stock on January 1, 2019, for $4,500,000. In December

2021, Darling declared its first dividend of $800,000.

Part 1

Part 2

If the preferred stock is not cumulative, how much of the $800,000 would be paid to common stockholders?

Common Stock Dividends $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- CH Sunland Corporation had the following information in its financial statements for the years ended 2025 and 2026: Cash dividends for the year 2026 $4700 Net income for the year 2026 97700 Market price of stock, 12/31/25 10 Market price of stock, 12/31/26 12 12 Common stockholders' equity, 12/31/25 1008000 Common stockholders' equity, 12/31/26 1192000 Outstanding shares, 12/31/26 100400 Preferred dividends for the year 2026 14000 What is the rate of return on common stock equity for Sunland Corporation for the year ended 12/31/2026? 7.6% O 6.6% 8.9% 07.0% eTextbook and Media W X SPM DELL 78°F Sunnyarrow_forwardInformation concerning the capital structure of Catan Corporation follows Dec. 31, 2019 Dec. 31, 2020 100,000 shares 100,000 shares 10,000 shares $ 2,000,000 Common shares outstanding Convertible preferred shares outstanding 9% convertible bonds 10,000 shares Select one: a. $ 3.65 b. $ 4.75 c. $ 3.33 d. $ 5.00 $ 2,000,000 During 2020, Catan paid dividends of $ 1.00 per common share and $2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 isarrow_forwardAssume the preferred stock is cumulative and Sterling passed the preferred dividend in 2022 and 2023. In 2024, the company declares cash dividends of $35,000. How much of the dividend goes to preferred stockholders and how much goes to common stockholders? Total Dividend Dividend to Preferred stockholders Dividend in arrears Current year dividend Total Dividend to preferred stockholders Dividend to common stockholdersarrow_forward

- Pharoah corporation issued $117000 shares of $19 par value cumulative, 7% preferred stock on January 1,2021 for $2530000 in December 2023 pharoah declared its first dividend of $840000 if the preferred stock is not cumulative how much of the $840000 would be paid to common stockholders? Common stock dividendsarrow_forwardDogarrow_forwardplease answer question 2arrow_forward

- The following information is available for Sheffield Corp.: January 1, 2021 Shares outstanding4060000 April 1, 2021 Shares issued643000July 1, 2021 Treasury shares purchased223000 October 1, 2021 Shares issued in a 100% stock dividend4480000 The number of shares to be used in computing earnings per common share for 2021 is A. 8901500.B. 5601500.C. 9183100.D. 8861500.arrow_forwardM The Clothing Cove has two classes of stock authorized: 7%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issues 100,000 shares of common stock for $15 per share.. February 6 Issues 1,000 shares of 74 preferred stock for $13 per share.. September 10 Purchases 12,000 shares of its own common stock for $20 per share. December 15 Resells 6,000 shares of treasury stock at $25 per share. In its first year of operations, The Clothing Cove has net income of $140,000 and pays dividends at the end of the year of $94,000 ($1 per share) on all common shares outstanding and $700 on all preferred shares outstanding. Required: Prepare the stockholders' equity section of the balance sheet for The Clothing Cove as of December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) THE CLOTHING COVE Balance Sheet (Stockholders' Equity Section) December 31, 2024 Stockholders'…arrow_forwarddont uplode any images in answerarrow_forward

- Problem 1 Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2023 to 2025. At December 31, 2022, the corporation's accounts included (in thousands): Ordinary share capital, P1 par Share premium 105,000 630,000 Retained earnings 970,000 a. On November 1, 2023, the board of directors declared a cash dividend of PO 80 per share on its ordinary shares, payable to shareholders of record on November 15, to be paid on December 1. b. On March 1, 2024, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Ricki was holding as an investment. The bonds had a fair value of P1.6 million, but were purchased two years previously for P1.3 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record on March 13, to be distributed on April 5. The fair value of the…arrow_forwardESPAÑOL INGLÉS FRANCÉS On June 30, 2021, when ABC Co. stock was selling for $65 each, the equity accounts had the following balances: Common Stock ($50 par value, 50,000 issued) $2,500,000 Capital Contributed in Excess of Par Value-Common Shares 600,000 Retained Earnings 4,200,000 How much will the Common Stock account balance be after declaring and distributing a 100% stock dividend? to. $7,300,000. b. $5,000,000. C. $2,500,000. MacBook Air DII DD F7arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education