FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

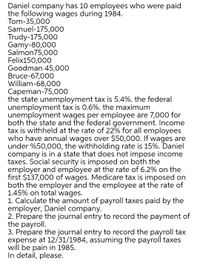

Transcribed Image Text:Daniel company has 10 employees who were paid

the following wages during 1984.

Tom-35,000

Samuel-175,000

Trudy-175,000

Gamy-80,000

Salmon75,00O

Felix150,000

Goodman 45,000

Bruce-67,000

William-68,000

Capeman-75,000

the state unemployment tax is 5.4%. the federal

unemployment tax is 0.6%. the maximum

unemployment wages per employee are 7,000 for

both the state and the federal government. Income

tax is withheld at the rate of 22% for all employees

who have annual wages over $50,000. If wages are

under %50,000, the withholding rate is 15%. Daniel

company is in a state that does not impose income

taxes. Social security is imposed on both the

employer and employee at the rate of 6.2% on the

first $137,000 of wages. Medicare tax is imposed on

both the employer and the employee at the rate of

1.45% on total wages.

1. Calculate the amount of payroll taxes paid by the

employer, Daniel company.

2. Prepare the journal entry to record the payment of

the payroll.

3. Prepare the journal entry to record the payroll tax

expense at 12/31/1984, assuming the payroll taxes

will be pain in 1985.

In detail, please.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sky Company employed Tom Mills in Year 1. Tom earned $5,900 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $870 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employeearrow_forwardTea Tree Therapeutics is an Arizona company with a SUTA tax of 5.2% and a SUTA wage base of $7,000. The employee earnings for the past year are: Theresa, $25,340; Gregori, $7,400; Alain, $20,860; and Katlyn, $5,730. Arizona employers pay a State Unemployment Insurance Tax (SUI) of 2.0% on all wages up to the first $7,000 annually. What is the total of Tea Tree Therapeutic’ employer-share taxes for FUTA, SUTA, SUI, and FICA for the year? (Round your intermediate calculations to 2 decimal places.) Multiple Choice $6,840.79 $6,682.39 $6,623.69 $6,463.31arrow_forwardNielson Corporation has three employees. Each employee is paid overtime at time and one-half after the first 40 hours worked for the week. The current social security and medicare taxes are 6.2% and 1.45% respectively. Social security tax is capped on the first $140,000 of annual wages. The current unemployment tax rates are 3% for state and 1% for federal on the first $8,000 of annual wages. Below is the payroll information for the first week of the new year (therefore, the annual wage caps will not apply). Employee Hourly Rate Hours Worked Federal W/H Rate Roth 401k Deduction Health Insurance United Way Susan W. 27 45 20% 120 150 5 George B. 25.25 50 20% 100 200 5 Maria M. 23 48 15% 75 125 5 a. Prepare a payroll register for the week's payroll (use the form provided to the right).…arrow_forward

- Toren Inc. employs one person to run its solar management company. The employee’s gross income for the month of May is $8,000. Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $440, state income tax of $80, health-care insurance premium of $210, and union dues of $50. The employee is responsible for covering 30% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. May 31 B. Record remittance of the employee's salary with cash on June 1. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. June 1arrow_forwardAn employee earns $5,500 per month working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The employee has $182 in federal income taxes withheld. The employee has voluntary deductions for health insurance of $150 and contributes $75 to a retirement plan each month. What is the amount of net pay for the employee for the month of January? (Round your intermediate calculations to two decimal places.)arrow_forwardLess Nessman, owner of Flying Turkeys Corporation, has three employees who earn $500, $600, and $700, respectively. After 12 weeks how much has Less Nessman contributed for state and federal unemployment? Assume a state rate of 5.6% and a federal rate of .8%.arrow_forward

- [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Exercise 11-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities. Record the employer's September 30 payroll taxes expense and its related liabilities. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Payroll taxes expense FICA—Social security taxes payable FICA—Medicare taxes payable Federal…arrow_forwardAccording to a summary of the payroll of PJW Co., $380,500 in earnings were subject to the 7.7% FICA tax. Also, $62,783 in earnings were subject to state and federal unemployment taxes. Round your answers to the nearest cent. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 4.4%; federal unemployment, 1.1%.arrow_forwardRunner Company incurred the following amounts for their most recent pay period for employee gross wages totaling $10,000. Federal income tax withholding $ 2,400 State income tax withholding $ 1,100 Federal unemployment tax $ 800 State unemployment tax $ 1,200 The FICA tax rate is 7.65% and assume that all wages are subject to the FICA tax. How much was employee net pay total for the payroll period? Group of answer choices $ 3,735arrow_forward

- Zolnick Enterprises has two hourly employees—Kelly and Jon. Both employees earn overtime at the rate of 1.5 times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages, and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kelly and Jon was $270 and $228, respectively, for the first week of January. The following information is for the first week in January Year 1. Employee Hours Worked Wage Rate per Hour Kelly 54 $ 20 Jon 49 $ 25 Requireda. Calculate the gross pay for each employee for the week.b. Calculate the net pay for each employee for the week.c. Prepare the general journal entry to record payment of the wages.arrow_forwardUrban Window Company had gross wages of $310,000 during the week ended July 15. The amount of wages subject to social security tax was $310,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.6% The total amount withheld from employee wages for federal taxes was $47,000. Required: A. Journalize the entry to record the payroll for the week of July 15.* B. Journalize the entry to record the payroll tax expense incurred for the week of July 15.* *Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardWilliam Corp. pays its employees every two weeks. Employee wages earned over a two-week period is $250,000. All wages are subject to social security and Medicare taxes, while $50,000 of wages are subject to federal and state unemployment taxes. Tax rates are the following: • Social security tax 6.0%• Medicare tax 1.5%• State unemployment compensation tax 5.4%• Federal unemployment compensation tax 0.8% Additionally, the total amount withheld from wages for federal income taxes is $75,000 and the total amount withheld for state income taxes is $12,500. ________________________________________ When William Corp. records the journal entry to recognize payroll every two weeks, Employees’ State Income Tax Payable will be: Question 24 options: Debited for $12,500 Credited for $75,000 Debited for $75,000 Neither debited nor credited Credited for $12,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education