Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

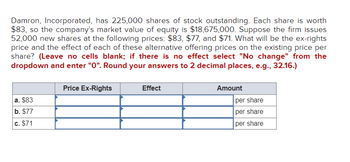

Transcribed Image Text:Damron, Incorporated, has 225,000 shares of stock outstanding. Each share is worth

$83, so the company's market value of equity is $18,675,000. Suppose the firm issues

52,000 new shares at the following prices: $83, $77, and $71. What will be the ex-rights

price and the effect of each of these alternative offering prices on the existing price per

share? (Leave no cells blank; if there is no effect select "No change" from the

dropdown and enter "0". Round your answers to 2 decimal places, e.g., 32.16.)

a. $83

b. $77

c. $71

Price Ex-Rights

Effect

Amount

per share

per share

per share

Expert Solution

arrow_forward

Step 1

A company may raise funds from multiple sources. A collection of all these sources constitutes the entity's capital structure. The major constituents of any company's capital structure are equity and debt. The corporation may issue common stocks to transfer equity to the investors or take debt or issue bonds to get funding.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Firm A has 10 shares. The present value (PV) of the firm is 500, i.e., 50 per share. It has an investment opportunity requiring a costly investment of £X but it must sell new shares to raise this in order to take this opportunity. If it succeeds in issuing and investing, the end period firm PV will be 800 (including the cash raised by any new issue). Explain in two lines why the share price may be lower than the true PV of 50 and why the owners may be able to do little about this.arrow_forwardZang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $55 million. Zang currently has 3 million shares outstanding and will issue 2 million new shares. ESM charges a 5% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardHassinah, Incorporated, is proposing a rights offering. Presently, there are 800,000 shares outstanding at $48 each. There will be 160,000 new shares offered at $40 each. a. What is the new market value of the company? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. How many rights are associated with one of the new shares? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. What is the ex-rights price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the value of a right? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. New market value b. Number of rights needed c. Ex-rights price d. Value of a rightarrow_forward

- LYFT IPO was issued at $72/share. Before the IPO, Lyft had 240 million class A shares outstanding and wanted to issue additional 30 million class A shares. On top of that, Lyft gave its underwriters options to purchase another 5 million shares at $72 each. When Lyft stock price fell below the IPO price of $72, to support the stock price, up to how many shares the underwriters could buy from the open market without losing money? 5 million shares 30 million shares 35 million shares 240 million shares 275 million sharesarrow_forward9. The group company markets two shares for two different companies at a price of $50 per share, one of the two shares is undervalued by $5 and the other is overvalued by $1, but you have no way of knowing which of the two shares is overvalued and which of the two shares is undervalued the Actual. You plan to buy 2,000 shares of each issue. If the issue is priced below the actual price, it would make sense that only half of the required stock would be sold out. If you were able to buy 2,000 shares of each company what would your profit be? And what profit did you actually expect? What is the principle that you Explain itarrow_forwardTransco is considering acquiring Tenco. Tenco's current stock price is $23. What is the maximum price per share that Transco should offer based on the following data for Tenco: PV of future cash flows $200 million, 20 million outstanding shares, no debt, and discount rate of 12%?arrow_forward

- Damron, Incorporated, has 205,000 shares of stock outstanding. Each share is worth $79, so the company’s market value of equity is $16,195,000. Suppose the firm issues 44,000 new shares at the following prices: $79, $73, and $67. What will be the ex-rights price and the effect of each of these alternative offering prices on the existing price per share?arrow_forwardPrahm Corp. wants to raise $4.7 million via a rights offering. The company currently has 530,000 shares of common stock outstanding that sell for $55 per share. Its underwriter has set a subscription price of $30 per share and will charge the company a spread of 6 percent. If you currently own 5,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Sale proceedsarrow_forwardHoobastink Mfg. is considering a rights offer. The company has determined that the ex- rights price will be $61. The current price is $68 per share, and there are 10 million shares outstanding. The rights offer would raise a total of $60 million. What is the subscription price?arrow_forward

- Assume Coleco pays an annual dividend of $1.90 and has a share price of $38.00. It announces that its annual dividend will increase to $2.20. If its dividend yield is to stay the same, what should its new share price be? The new share price should be $ (Round to the nearest cent.)arrow_forwardMyers Inc. currently has 5, 750,000 shares outstanding, and they trade at a price of $23.76. They need to raise $35,000,000 in new funding, and will execute a Rights Offering at a subscription price of $18.00 per share. At the current share price, what will be the price of one Right leading up to the subscription? Group of answer choices $3.04 $1.46 $1.74 $22.30 $2.96arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education