Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

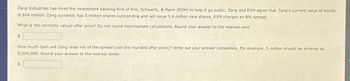

Transcribed Image Text:Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity

is $64 million. Zang currently has 5 million shares outstanding and will issue 1.4 million new shares. ESM charges an 8% spread.

What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent.

$

How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as

5,000,000. Round your answer to the nearest dollar.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Meadows Corporation needs to raise $70 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. If the offer price is $30 per share and the company’s underwriters charge a spread of 8 percent, how many shares need to be sold? (Do not round intermediate calculations and enter your answer in shares, not millions, rounded to the nearest whole number, e.g., 1,234,567.)arrow_forwardThe management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offeris used. The company has determined that the ex-rights price would be $53. The current price is $58per share, and there are 10 million shares outstanding. The rights offer would raise a total of $45million. What is the subscription price? can you handwrite it pleasearrow_forwarddon't provide handwritten solution.arrow_forward

- The Sullivan Co. needs to raise $78 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. If the offer price is $31 per share and the company's underwriters charge a spread of 7 percent, how many shares need to be sold? In the previous problem, if the SEC filing fee and associated administrative expenses of the offering are $1,425,000, how many shares need to be sold now?arrow_forwardZang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $57 million. Zang currently has 4 million shares outstanding and will issue 1.2 million new shares. ESM charges a 6% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $arrow_forwardZang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $55 million. Zang currently has 3 million shares outstanding and will issue 2 million new shares. ESM charges a 5% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $55 million. Zang currently has 3 million shares outstanding and will issue 2 million new shares. ESM charges a 5% spread. How much cash will Zang raise net of the spread Write out your answer completely.arrow_forwardPlease Provide correct answer with optionarrow_forwardPlease answer with explanation. I will really upvotearrow_forward

- Ansarrow_forwardFlemington Farms is evaluating an extra dividend versus a share repurchase. In either case, $15,000 would be spent. Current earnings are $2.80 per share, and the stock currently sells for $75 per share. There are 2,800 shares outstanding. Ignore taxes and other imperfections. The PE ratio will be ____ if the firm issues the dividend as compared to ____ if the firm does the share repurchase.arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education