Dakota Company experienced the following events during Year 2:

-

Acquired $30,000 cash from the issue of common stock.

-

Paid $10,000 cash to purchase land.

-

Borrowed $10,000 cash.

-

Provided services for $50,000 cash.

-

Paid $1,500 cash for utilities expense.

-

Paid $35,000 cash for other operating expenses.

-

Paid a $3,250 cash dividend to the stockholders.

-

Determined that the market value of the land purchased in Event 2 is now $12,500.

Required

-

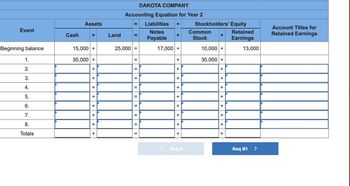

a. The January 1, Year 2, general ledger account balances are shown in the following

accounting equation. Record the eight events in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in theRetained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example. -

b-1. Prepare an income statement for the Year 2 accounting period.

-

b-2. Prepare a statement of changes in equity for the Year 2 accounting period.

-

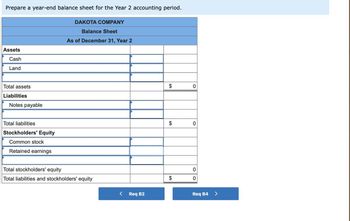

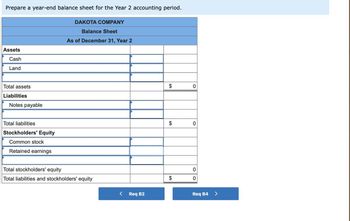

b-3. Prepare a year-end

balance sheet for the Year 2 accounting period. -

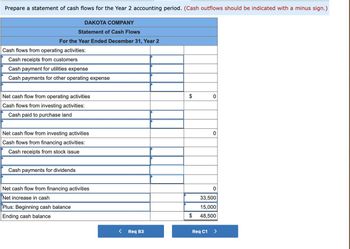

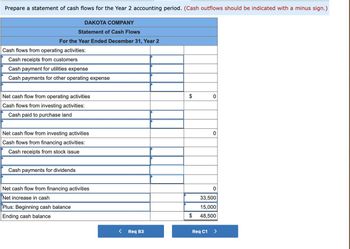

b-4. Prepare a statement of

cash flows for the Year 2 accounting period. -

c-1. Determine the percentage of assets that were provided by retained earnings.

c-2. How much cash is in the Retained Earnings account?

Dakota Company experienced the following events during Year 2:

-

Acquired $30,000 cash from the issue of common stock.

-

Paid $10,000 cash to purchase land.

-

Borrowed $10,000 cash.

-

Provided services for $50,000 cash.

-

Paid $1,500 cash for utilities expense.

-

Paid $35,000 cash for other operating expenses.

-

Paid a $3,250 cash dividend to the stockholders.

-

Determined that the market value of the land purchased in Event 2 is now $12,500.

Required

-

a. The January 1, Year 2, general ledger account balances are shown in the following accounting equation. Record the eight events in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example.

-

b-1. Prepare an income statement for the Year 2 accounting period.

-

b-2. Prepare a statement of changes in equity for the Year 2 accounting period.

-

b-3. Prepare a year-end balance sheet for the Year 2 accounting period.

-

b-4. Prepare a statement of cash flows for the Year 2 accounting period.

-

c-1. Determine the percentage of assets that were provided by retained earnings.

c-2. How much cash is in the Retained Earnings account?

*image is attached, just need answers, thank you*

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

*Images attached of questions needed to be answered, no work needed*

*Images attached of questions needed to be answered, no work needed*

- 12) JAE Corp.'s transactions for the year ended December 31, 20X8 included the following: Purchased real estate for $1,250,000 cash. Sold available-for-sale securities for $1,000,000. Paid dividends of $1,200,000. Issued 500 shares of common stock for $500,000. Purchased machinery and equipment for $250,000 cash. Received a $250,000 cash dividend from an equity investment. Paid $900,000 toward a bank loan. Reduced accounts receivable by $200,000. Increased accounts payable $400,000. JAE Corp's net cash used in INVESTING activities for 20X8 was: a) $250,000. b) $500,000. c) $750,000. d) $1,500,000.arrow_forwardStarlight Co. provided the following information on selected transactions during 20X1: Purchase of land $600,000 Proceeds from issuing bonds 2,000,000 Purchase of inventory 1,800,000 Purchase of treasury stock 400,000 Dividends paid to shareholders 300,000 Proceeds from issuing preferred stock 500,000 Proceeds from sale of equipment 400,000 The net cash provided (used) by investing activities during 20X1 is Question 10 options: $(200,000). $1,300,000. $(700,000). $0.arrow_forwardiarrow_forward

- Assume the following: Lomo Engineering Company had the following transactions: Jan-01 Issued capital stock for $965,000. Jan-01 Purchased a Packaging Equipment for $20,000. Jan-01 Purchased an Insurance Policy (1 year) for $30,000. Jan-03 Purchased a Machine, paying $15,000 in cash and issuing a note of $20,000. Jan-05 Purchased $28,000 of inventory on account. Jan-07 Sold inventory costing $6,000 for $50,000 on account. Jan-11 Paid $2,000 for inventory purchased on account (from Jan-05). Jan-15 Collect $12,550 of accounts receivable from customers (from Jan-07). Jan-17 Paid utility bills totaling $1,500. Jan-23 Paid wages for $13,000. Jan-25 Collect $8,000 in bank interest. Jan-30 Paid $12,590 due to income taxes. Required: Record the above transactions in General Journal (Journal Entries). Record the transactions in General Ledger format (T-Accounts). Prepare a…arrow_forward6. Using the information in #5 above, what are the first two years of depreciation using double declining depreciation? 7. Write the entry if a company issues 50,000 shares of its $1 par value common stock for $45 per share. 8. A company buys 20,000 shares of its own stock for $35 per share. Write the entry to record this transaction. 9. The company in #8 above decides to sell all of the shares it purchased (20,000). They sell the shares for $42 per share. Write the entry to record this transaction. 10. A company declares a 10% stock dividend when its $1 par value common shares are selling for $62 per share. The company has 400 million authorized shares; 1,456,000 issued shares; and 1,200,000 outstanding shares. Write the entry to record the stock dividend. 11. A company issues 10,000 shares of its 5% $20 callable preferred stock for $58 per share. Write the entry to record this transaction.arrow_forward25. Help me selecting the right answer. Thank youarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education