FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

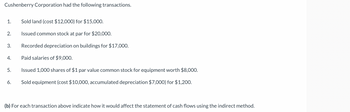

Transcribed Image Text:Cushenberry Corporation had the following transactions.

Sold land (cost $12,000) for $15,000.

Issued common stock at par for $20,000.

Recorded depreciation on buildings for $17,000.

Paid salaries of $9,000.

Issued 1,000 shares of $1 par value common stock for equipment worth $8,000.

6. Sold equipment (cost $10,000, accumulated depreciation $7,000) for $1,200.

1.

2.

3.

4.

5.

(b) For each transaction above indicate how it would affect the statement of cash flows using the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Starlight Co. provided the following information on selected transactions during 20X1: Purchase of land $600,000 Proceeds from issuing bonds 2,000,000 Purchase of inventory 1,800,000 Purchase of treasury stock 400,000 Dividends paid to shareholders 300,000 Proceeds from issuing preferred stock 500,000 Proceeds from sale of equipment 400,000 The net cash provided (used) by investing activities during 20X1 is Question 10 options: $(200,000). $1,300,000. $(700,000). $0.arrow_forwardiarrow_forwardQuan Corp. manufactures construction equipment. Feb. 2 Purchased for cash 5,000 shares of Celeste Inc.’s common stock for $20 per share plus a $100 brokerage commission. Celeste Inc. has 87,000 shares of common stock outstanding. Mar. 6 Received dividends of $0.45 per share on Celeste Inc. stock. June 7 Purchased 2,000 shares of Celeste Inc. stock for $27 per share plus a $130 brokerage commission. July 26 Sold 5,900 shares of Celeste Inc. stock for $35 per share less a $110 brokerage commission. Quan assumes that the first investments purchased are the first investments sold. Sept. 25 Received dividends of $0.45 per share on Celeste Inc. stock. Dec. 31 At the end of the accounting period, the fair value of the remaining 1,100 shares of Celeste Inc. stock was $31,677. Required: Journalize the entries to record the above selected equity investment transactions completed by Quan during a recent year using the fair value…arrow_forward

- Assume the following: Lomo Engineering Company had the following transactions: Jan-01 Issued capital stock for $965,000. Jan-01 Purchased a Packaging Equipment for $20,000. Jan-01 Purchased an Insurance Policy (1 year) for $30,000. Jan-03 Purchased a Machine, paying $15,000 in cash and issuing a note of $20,000. Jan-05 Purchased $28,000 of inventory on account. Jan-07 Sold inventory costing $6,000 for $50,000 on account. Jan-11 Paid $2,000 for inventory purchased on account (from Jan-05). Jan-15 Collect $12,550 of accounts receivable from customers (from Jan-07). Jan-17 Paid utility bills totaling $1,500. Jan-23 Paid wages for $13,000. Jan-25 Collect $8,000 in bank interest. Jan-30 Paid $12,590 due to income taxes. Required: Record the above transactions in General Journal (Journal Entries). Record the transactions in General Ledger format (T-Accounts). Prepare a…arrow_forwardZaire Company had a $26,000 net loss from operations. Depreciation expense for the year was $9,600, and a dividend of $2,000 was declared and paid. The balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End Beginning Cash $3,500 $7,000 Accounts receivable 16,000 27,000 Inventory 51,000 53,000 Prepaid expenses 5,000 9,000 Accounts payable 12,000 8,000 Accrued liabilities 6,000 7,600 Did Zaire Company’s operating activities provide or use cash? Use the indirect method to determine your answer. Use negative signs with cash outflow answers and to indicate operating activities used cash, if applicable.arrow_forward14. How much is the correct balance of the Accumulated retained earnings unappropriated account?arrow_forward

- 3arrow_forwardam. 76.arrow_forwardPowder Company spent $240,000 to acquire all of Sawmill Corporation's stock on January 1, 20X2. The balance sheets of the two companies on December 31, 20X3, showed the following amounts: Cash Accounts Receivable Land Buildings and Equipment Less: Accumulated Depreciation Investment in Sawmill Corporation Accounts Payable Taxes Payable Notes Payable Common Stock Retained Earnings Powder Company $ 30,000 100,000 60,000 500,000 (230,000) 252,000 $ 712,000 $ 80,000 40,000 100,000 200,000 292,000 $ 712,000 Sawmill Corporation $ 20,000 40,000 50,000 350,000 (75,000) $385,000 $ 10,000 70,000 85,000 100,000 120,000 $385,000 Sawmill reported retained earnings of $100,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of 10 years from the date of acquisition. Assume Sawmill's accumulated depreciation on the acquisition date was $25,000. Required: Prepare a consolidated…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education