FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:5)

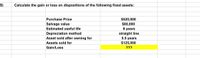

Calculate the gain or loss on dispositions of the following fixed assets:

$520,000

$80,000

8 years

Purchase Price

Salvage value

Estimated useful life

Depreciation method

Asset sold after owning for

straight line

5.5 years

$125,000

Assets sold for

Gain/Loss

???

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An asset that cost $20,000 and has accumulated depreciation of $17,000 is sold for $4,000. This sale will result in a: Group of answer choices loss of $13,000. gain of $4,000. loss of $16,000. gain of $1,000.arrow_forwardBased on the information below, what amount should be recorded for depreciation at the end of Year 2 assuming Straight-Line Depreciation is used? Cost of Equipment $100,000 Salvage Value $5,000 Useful Life 20 years $9,750 $5,000 $4,750 $250arrow_forwardplease answer question 19arrow_forward

- Bruce Company acquired a machinery on April 1, 2020. Cost P 1,200,000 Residual Value P 120,000 Estimated Useful Life 8 years What is the depreciation for 2020 using straight line depreciation? A. P150,000 B. P101,250 C. P112,500 D. P125,000 What is the carrying amount of the machinery on December 31, 2022 using straight line depreciation? A. P750,000 B. P817,500 C. P828,750 D. P780,000arrow_forwardA fixed asset with a cost of $31,304 and accumulated depreciation of $28,173.60 is sold for $5,321.68. What is the amount of the gain or loss on disposal of the fixed asset?arrow_forwardASAP please, direct thumps up :)arrow_forward

- A fixed asset with a cost of $31,365.00 and accumulated depreciation of $28,228.50 is sold for $5,332.05. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $3,136.50 loss $2,195.55 loss $2,195.55 gain $3,136.50 gainarrow_forwardPresented below is information related to equipment owned by Nash Company at December 31, 2025. Cost Accumulated depreciation to date Expected future net cash flows Fair value (a) $6,270,000 Date Assume that Nash will continue to use this asset in the future. As of December 31, 2025, the equipment has a remaining useful life of 4 years and no salvage value. Your answer is partially correct. 750,000 December 4,810,000 3,320,000 Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.) Account Titles and Explanation Debit Credit Earrow_forwardComputing Partial Period Depreciation under Multiple Depreciation Methods Compute depreciation expense for 2021 for each asset #1, #2, #3, and #4. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar. Acquisition Acquisition Useful Salvage 2021 Depreciation Value Asset Date Depreciation Method Cost Life Expense #1 Jan. 1, 2020 Straight-line $4,000 4 years $200 $ 950 v #2 Aug. 30, 2020 Double-declining-balance 5,800 8 years 400 $ 1,125 x #3 Feb. 1, 2021 Sum-of-the-years'-digits 7,200 4 years 320 $ 1,147 x #4 Jul. 31, 2021 Straight-line 13,520 8 years 0 $arrow_forward

- d. The depreciation deduction for year 11 of an asset with a 20-year useful life is $3,600. If the salvage value of the asset was estimated to be zero and straight line depreciation was used to calculate the depreciation deduction for year 11, the initial cost of this asset is most closely equal to which of the following values? (a) $42,000 (b) $67,750 $72,500 (d) $80,000 e. Consider the following data extracted from an After Tax Cash Flow calculation. Before Tax Cash Flow = $22,500 Loan Principal Payment = $7,434 Loan Interest Payment = $892 MACRS Depreciation Deduction = $7,405 Taxes Due = $5,397 Which of the following is closest to the After Tax Cash Flow? (a) $1,372 $8,777 (c) $8,806 (d) $16,211arrow_forwardCalculate the depreciation expense with these methods 1- straight line method 2019 2- double declining method 2020 3- Sum of the years digits for 2020 A house cost $800,000 on April 1,2019 the salvage value is $80,000 and its expected life is 8 years.arrow_forwardAn asset which costs $25,000 and has accumulated depreciation of $6,000 is sold for $11,000. What amount of gain or loss will be recognized when the asset is sold? a. A gain of $14,000 b. A loss of $14,000 c. A gain of $8,000 d. A loss of $8,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education