FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

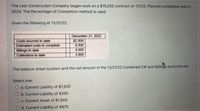

Transcribed Image Text:The Leto Construction Company began work on a $15,000 contract on 1/1/22. Planned completion was in

2024. The Percentage-of Completion method is used.

Given the following at 12/31/22:

Costs incurred to date

Estimated costs to complete

Billings to date

Collections to date

December 31, 2022

$2,500

9,500

4,000

3,800

The balance sheet location and the net amount of the 12/31/22 Combined CIP and Billings accounts are:

Select one:

O a. Current Liability of $1,500

O b. Current Liability of $200

c. Current Asset of $1,500

d. Current Liability of $875

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the NOI of a property based upon the information provided below: Building area: Average base rents: .NNN recoveries: Vacancy rate: Operating expenses . . • Percentage rent . Concessions . Annual debt service 165,720 O 315,720 O 375.720 440,220 O 478.500 O None of these 15,000 sqft $27.50 psf $4.00 psf 5.0% $4.30 psf $6,000 per year 3.0% $210,000 per yeararrow_forwardThe insured has divided the insurance on its building as follows: $200,000 with insurer M and $300,000 with insurer R. The If there is a $100,000 loss, insurer M will pay: OA $40,000 OB. $60,000 C $66,666 $100,000 D.arrow_forwardAssume 4 tranches at the first level of securitization: AAA (78%), A (10%), BBB (10%), and NR (2%) What are the losses to tranches of ABS?arrow_forward

- AmountFinanced Number ofPayments MonthlyPayment FinanceCharge APR $18,300 72 $426.08 $ %arrow_forward5. Which of the following is a characteristic of a current liability? OA current liability must be of a known amount. OA current liability is due within one year or one operating cycle, whichever is longer. A current liability must be of an estimated amount. Current liabilities are subtracted from long-term liabilities on the balance sheet.arrow_forward$100,000 x 4.79079* = Lease Payments $479,079 Right-of-Use Asset *Present value of an annuity due of $1: n = 6,i = 10%arrow_forward

- Current liabilities are a.payable if a possible subsequent event occurs b.due, but not payable for more than one year c.due and receivable within one year d.due and to be paid out of current assets within one yeararrow_forwardFind A and B Principal $8,425 Interst rate: 8.2% Time 60 days Simple Interest: A Total Amount owed: Barrow_forward6. On August 1, 2012, Gabriel Company leased a machine to Baby Company for a six-year period requiring payments of P100,000 at the beginning of each year. The machine cost P480,000, which is the fair value at the lease date, and has a useful life of eight years with no residual value. Gabriel's implicit interest rate is 10% and present value factors are rounded off to three decimal places. Gabriel appropriately recorded the lease as a direct financing lease. /arrow_forward

- A long term note ($400,000 face value) matured. The interest of $40,000 was paid but the principle was not. Here is question 2. Expenditures—Debt Service—Principal................................................. Expenditures—Debt Service—Interest....................................... Cash................................................................................ Defaulted Note Payablearrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education