FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The following information relates to the manufacturing operations of Delicious Co. during the month of January. The company uses

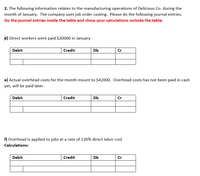

Transcribed Image Text:2. The following information relates to the manufacturing operations of Delicious Co. during the

month of January. The company uses job order costing. Please do the following journal entries.

Do the journal entries inside the table and show your calculations outside the table.

d) Direct workers were paid $20000 in January

Debit

Credit

Db

Cr

e) Actual overhead costs for the month mount to $42000. Overhead costs has not been paid in cash

yet, will be paid later.

Debit

Credit

Db

Cr

f) Overhead is applied to jobs at a rate of 120% direct labor cost

Calculations:

Debit

Credit

Db

Cr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected data were taken from the books of the Owens O-Rings Company. The company uses job costing to account for manufacturing costs. The data relate to April operations. (1) Materials and supplies were requisitioned from the stores clerk as follows: Job 405, material X, $7,100. Job 406, material X. $3,100: material Y, $6,100. Job 407. material X, $7,100; material Y, $3.30o. For general factory use: materials A, B, and C. $2,400. (2) Time tickets for the month were chargeable as follows: $ 11,100 $ 14,100 $ 8,100 $ 3,800 Job 405 3,100 hours Job 406 3,700 hours Job 407 2,000 hours Indirect labor (3) Other information: Factory paychecks for $36,800 were issued during the month. Various factory overhead charges of $19,500 were incurred on account. Depreciation of factory equipment for the month was $5,50o. Factory overhead was applied to jobs at the rate of $3.30 per direct labor hour. Job orders completed during the month: Job 405 and Job 406. Selling and administrative…arrow_forwardHigh Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates: Department Molding Painting Direct labor-hours 31,500 51,600 Machine-hours 88,000 34,000 Fixed manufacturing overhead cost $ 272,800 $ 490,200 Variable manufacturing overhead per machine-hour $ 2.60 - Variable manufacturing overhead per direct labor-hour - $ 4.60 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department Molding Painting Direct labor-hours 85 131 Machine-hours 390 74 Direct materials $ 934 $ 1,220 Direct labor cost $…arrow_forwardZoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. $ b. Determine the cost of goods sold. $17,517 24,466 32,234 15,678 18,439 24,791 22,979arrow_forward

- High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates: Department Molding Painting Direct labor-hours 12,000 60,000 Machine-hours 70,000 8,000 Fixed manufacturing overhead cost $ 497,000 $ 615,000 Variable manufacturing overhead per machine-hour $ 1.50 - Variable manufacturing overhead per direct labor-hour - $ 2.00 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department Molding Painting Direct labor-hours 30…arrow_forwardVishalarrow_forwardVishnuarrow_forward

- Zoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. b. Determine the cost of goods sold. $17,282 29,395 33,789 16,813 18,863 20,514 25,262arrow_forwardOxford Company uses a job order costing system. This month, the system accumulated labor time tickets totaling $24,600 for direct labor and $4,300 for indirect labor. The journal entry to record direct labor consists of a: Multiple Choice Debit Payroll Expense $24,600; credit Cash $24,600. Debit Payroll Expense $24,600; credit Factory Wages Payable $24,600. Debit Work in Process Inventory $24,600; credit Factory Wages Payable $24,600. Debit Work in Process Inventory $28,900; credit Factory Wages Payable $28,900. Debit Work in Process Inventory $4,300; credit Factory Wages Payable $4,300.arrow_forwardKaymer Industries Inc. uses a job order cost system. The following data summarize the operations related to production for January, the first month of operations: a. Materials purchased on account, $28,790. b. Materials requisitioned and factory labor used: Job Materials Factory Labor 301 $2,880 $2,910 302 3,690 3,860 303 2,300 1,780 304 7,820 6,990 305 5,310 5,050 306 3,700 3,280 For general factory use 1,070 4,180 c. Factory overhead costs incurred on account, $5,600. d. Depreciation of factory machinery and equipment, $1,970. e. The factory overhead rate is $53 per machine hour. Machine hours used: Job Machine Hours 301 25 302 34 303 30 304 71 305 42 306 26 Total 228 f. Jobs completed: 301, 302, 303, and 305. g. Jobs were shipped and customers were billed as follows: Job 301, $8,270; Job 302, $11,720; Job 303, $15,730. Required: 1. Journalize the entries to…arrow_forward

- Question: In a job order cost accounting system, which journal entry would be made when raw materials are transferred into production during the month? a. Debit Goods in Process Inventory and Credit Materials Expense. b. Debit Factory Overhead and Credit Raw Materials Inventory. c. Debit Goods in Process Inventory and Credit Raw Materials Inventory. d. Debit Raw Materials Inventory and Credit Goods in Process Inventory. e. Debit Finished Goods Inventory and Credit Goods in Process Inventory.arrow_forwardPrepare the journal entry for (a) materials and (b) labor, based on the following: Raw materials issued: $850 for Job 609 $300 for general use in the factory Labor time tickets: $900 for Job 609 $325 for supervisionarrow_forwardanswer in text form please (without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education