FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

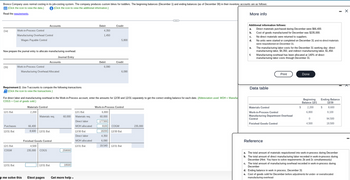

Transcribed Image Text:Bronco Company uses normal costing in its job-costing system. The company produces custom bikes for toddlers. The beginning balances (December 1) and ending balances (as of December 30) in their inventory accounts are as follows:

(Click the icon to view the data.) (Click the icon to view the additional information.)

Read the requirements.

(1a)

(1b)

Now prepare the journal entry to allocate manufacturing overhead.

Journal Entry

12/1 Bal.

Purchases

12/31 Bal.

Work-in-Process Control

Manufacturing Overhead Control

Wages Payable Control

12/1 Bal.

COGM

Work-in-Process Control

Requirement 2. Use T-accounts to compute the following transactions.

(Click the icon to view the transactions.)

12/31 Bal.

Manufacturing Overhead Allocated

Accounts

p me solve this

Materials Control

2,200

66,400

8,600

Accounts

Materials req.

For direct labor and manufacturing overhead in the Work-in-Process account, enter the amounts for 12/30 and 12/31 separately to get the correct ending balance for each date. (Abbreviation used: MOH = Manufac

COGS = Cost of goods sold.)

12/31 Bal.

4,500

235,000 COGS

Finished Goods Control

Etext pages

12/31 Bal.

60,000

259000

19500

Get more help.

12/1 Bal.

Materials req.

Direct labor

MOH allocated

Debit

12/30 Bal.

Direct labor

MOH allocated

12/31 Bal.

4,350

1,450

Debit

6,090

Credit

5,800

Credit

6,090

Work-in-Process Control

6,800

60,000

177300

9100 COGM

18200 12/30 Bal.

4,350

6.090

19,540

12/31 Bal.

C

235,000

More info

Additional information follows:

a.

b.

C.

d.

e.

f.

Direct materials purchased during December were $66,400.

Cost of goods manufactured for December was $235,000.

No direct materials were returned to suppliers.

No units were started or completed on December 31 and no direct materials

were requisitioned on December 31

The manufacturing labor costs for the December 31 working day: direct

manufacturing labor, $4,350, and indirect manufacturing labor, $1,450.

Manufacturing overhead has been allocated at 140% of direct

manufacturing labor costs through December 31.

Data table

Materials Control

Print

Work-in-Process Control

Manufacturing Department Overhead

Control

Finished Goods Control

Reference

$

Done

Beginning

Balance 12/1

2,200

6,800

0

4,500

Ending Balance

12/30

$

8,600

9,100

94,500

19,500

a. The total amount of materials requisitioned into work-in-process during December

b. The total amount of direct manufacturing labor recorded in work-in-process during

December (Hint: You have to solve requirements 2b and 2c simultaneously)

c. The total amount of manufacturing overhead recorded in work-in-process during

December

- X

d. Ending balance in work in process, December 31

e. Cost of goods sold for December before adjustments for under- or overallocated

manufacturing overhead

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Harper Company uses a job order cost system. Journalize the entries for materials and labor, based on the following data:Raw materials issued: Job No. 609, $850; for general use in factory, $600Labor time tickets: Job No. 609, $1,600; $400 for supervision If an amount box does not require an entry, leave it blank. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18arrow_forwardOverview of general ledger relationships. Estevez Company uses normal costing in its job-costing system. The company produces kitchen cabinets. The beginning balances (December 1) and ending balances (as of December 30) in their inventory accounts are as follows:arrow_forwardDon't give solution in image format..arrow_forward

- i need the answer quicklyarrow_forwardConcord, Inc. manufactures ergonomically designed computer furniture. Concord uses a job order costing system. On November 30, the Work in Process Inventory consisted of the following jobs: Job No. CC723 CH291 PS812 Job No. CC723 CH291 PS812 DS444 Job No. CC723 Computer caddy Chair CH291 DS444 Item Printer stand On November 30, Concord's Direct Materials Inventory account totaled $671,000, and its Finished Goods Inventory totaled $3,486,400. Concord applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totaled $4,750,000, and the company planned to use 950,000 machine hours during the year. Through the first eleven months of the year, the company used a total of 840,000 machine hours, total manufacturing overhead amounted to $4,294,500, and Cost of Goods Sold was $8,760,250. For the purposes of this problem, ignore year-end disposition of over / under applied overhead. Concord purchased $638,000 in direct materials in…arrow_forwardSubject:- accountingarrow_forward

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwarda)Calculate the amount of overhead that should be applied to each job and amount of Rullos overapplied or underapplied overhead at the end of the first year b)Calculate Rullos balances for work in process ,finished goods and cost of goods sold at the end of the first yeararrow_forwardI need answer of last three requirement I need answer of last three requirement please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education