ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a.

C.

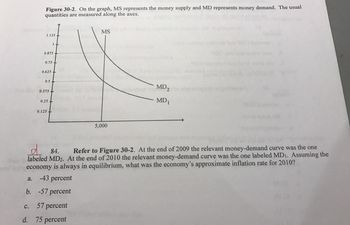

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual

quantities are measured along the axes.

d.

1.125

0.875

it

0.75

0.625

05.

0.375 +

0.25 +

0.125 +

d

84.

Refer to Figure 30-2. At the end of 2009 the relevant money-demand curve was the one

labeled MD2. At the end of 2010 the relevant money-demand curve was the one labeled MD₁. Assuming the

economy is always in equilibrium, what was the economy's approximate inflation rate for 2010?

-43 percent

b. -57 percent

MS

57 percent

75 percent

5,000

MD₂

MD₁

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4) If actual inflation is more than expected inflation, which of the following groups will most certainly benefit? а. Lenders b. Borrowers с. Minorities d. Women е. Men Suppose that the consumer price index of a country was 160 at year-end 2004 and 168 at the 5) end of 2005. What was the country's inflation rate during 2005? 5 percent b. а. 8 percent 60 percent d. с. 68 percent 6) If the consumer price index (CPI) at the end of year one was 100 and was 108 at the end of year two, the inflation rate during year two was zero; the CPI of 100 indicates that prices were stable. b. а. 8 percent. 5 percent. d. c. 108 percent.arrow_forwardsub= 24 helparrow_forward3. Explain any three costs associated with inflation? Also, provide a real-world example of hyperinflation that happened in the past.arrow_forward

- Which of the following is NOT one of the negative effects associated with inflation? O Menu costs, when producers need to constantly update prices to reflect the changing value of the dollar. O The negative impact on borrowers with fixed payments (like mortgage payments). O Shoe leather costs, the cost associated with consumers efforts to ajdust behavior to counter-act inflation. O The lowering of the purchasing power for individuals who hold large amounts of cash. Because of inflation, what happens to the value of the REAL minimum wage during periods of time when congress keeps the minimum wage constant (like it has been since 2009). O Since prices go up, real minimum wage decreases. O The value of the real minimum wage is determined by the level of effort put in by workers. If the congress is keeping the minimum wage constant, the real minimum wage is not changing. O The real minimum wage increases since inflation makes all prices increase.arrow_forwardQuestion 38 FIGURE 1 MS r2 P2 P1 MD2 AD MD, Y2 REFER TO FIGURE 1. What does Y represent on the horizontal axis of the right-hand graph? O nominal output the rate of inflation O the quantity of money O real outputarrow_forward32 There is a new central bank president who wants low inflation much more than the previous president did. According to the Augmented Phillips Curve Model, in this situation, which of the following would be the most help in keep unemployment from rising in the sort run? a.People know the central bank president's true desires and believe he will stay in office for a long time b.Peoples' wage wage contracts are long-lasting. c.People know the central bank president's true desires and believe that he will only be in office for a short time. d.People think that the central bank president's desires are the same as the previous president's and believe that the new president will be in office for a short time. e.People think that the central bank president's desires are the same as the previous president's and believe that the new president will be in office for aarrow_forward

- a. Examine the fundamental causes of a nation’s business cycle fluctuations. Also, examine the relationship between total spending by government and consumers in a nation and the location of the countries’ GDP on the business cycle. b. 1. Suppose you have $200,000 in a bank term account. You earn 5% interest per annum from this account.You anticipate that the inflation rate will be 4% during the year. However, the actual inflation rate for the year is 6%.Calculate the impact of inflation on the bank term deposit you have and examine the effects of inflation in your city of residence with attention to food and accommodation expenses. 2. The Australian Bureau of Statistics (ABS) reported in May 2017 that the civilian population in Australia over 15 years of age was 20.8 million.Of this population of 20.8 million Australians, 13.5 million were employed and 0.7 million were unemployed.Calculate Australia’s labor force and the number of people in the civilian population who were not in…arrow_forwardPRICE LEVEL Point D Point E Point A +H Point B +0 A LRAS +6 +8 ON REAL GOP From point A to E to B to I to C. + From point A to B to C. From point A to D to B to H to C. From point A to D to F to H to C. + SHAS Suppose the economy is self-regulating and is at point A when it experiences a one-shot, demand-induced inflation. If there are no other changes in the economy, at what point will the economy settle? SRAS SRAS, AD₁ AD₂ AD₁ Suppose the economy is at point A when it is faced with two adverse supply shocks. The Fed tries to counter these shocks by increasing aggregate demand. What path will the economy follow?arrow_forwardIf an economy is achieving the goals of full employment and price level stability, then: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a b C the unemployment rate is equal to the natural rate of unemployment and inflation rate is in the range of 2%. both the unemployment rate and the inflation rate must be equal to 0%. all people willing and able to work have a job and nominal incomes are increasing by at least the rate of inflation. Your answer it is likely that the economy is on the brink of a recession because the two goals cannot be met at the same time.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education