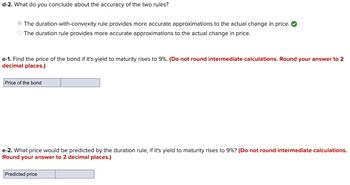

d-2. What do you conclude about the accuracy of the two rules? The duration-with-convexity rule provides more accurate approximations to the actual change in price. The duration rule provides more accurate approximations to the actual change in price. e-1. Find the price of the bond if it's yield to maturity rises to 9%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of the bond e-2. What price would be predicted by the duration rule, if it's yield to maturity rises to 9%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Predicted price

d-2. What do you conclude about the accuracy of the two rules? The duration-with-convexity rule provides more accurate approximations to the actual change in price. The duration rule provides more accurate approximations to the actual change in price. e-1. Find the price of the bond if it's yield to maturity rises to 9%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of the bond e-2. What price would be predicted by the duration rule, if it's yield to maturity rises to 9%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Predicted price

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. The data is missing. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:d-2. What do you conclude about the accuracy of the two rules?

The duration-with-convexity rule provides more accurate approximations to the actual change in price.

The duration rule provides more accurate approximations to the actual change in price.

e-1. Find the price of the bond if it's yield to maturity rises to 9%. (Do not round intermediate calculations. Round your answer to 2

decimal places.)

Price of the bond

e-2. What price would be predicted by the duration rule, if it's yield to maturity rises to 9%? (Do not round intermediate calculations.

Round your answer to 2 decimal places.)

Predicted price

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education