Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

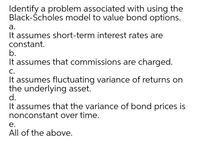

Transcribed Image Text:Identify a problem associated with using the

Black-Ścholes model to value bond options.

а.

It assumes short-term interest rates are

constant.

b.

It assumes that commissions are charged.

С.

It assumes fluctuating variance of returns on

the underlying asset.

d.

It assumes that the variance of bond prices is

nonconstant over time.

е.

All of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Provide some idea of the effect of the sensitivity of security prices to changes in market interest rates?arrow_forwardCheck all that are true with respect to the yield to maturity (YTM) and the expected return for a bond. Group of answer choices The expected return is based on the contractly obligated payments whereas the YTM is based on what the investors expect to receive The YTM is based on the promised payments whereas the expected return is based on the expected cash flows Higher YTMs always mean higher expected returns In the presence of non-zero default risk, the YTM will be higher than the expected return YTM is just another name for the expected returnarrow_forwardMacaulay duration is the optimal holding period to immunize the interest rate risks, namely to make the reinvestment risk and selling price risk offset one another completely. O True O Falsearrow_forward

- Consider the supply and demand equilibrium bond graph of the market. Consider the effects of the following scenarios on bond prices, bond interest rates and equilibrium quantities traded. a. Firms expect a decrease in their future profits. b. Expected rises. inflationarrow_forwardGive typing answer with explanation and conclusion Question 16: Which of the following statements about convexity are true? I. Convexity accounts for the curvilinear function of bond rates II. A bond with a very low coupon and a long maturity will have low convexity III. A bond investor would seek to avoid bonds with high convexity. IV. Convexity is defined as the rate of change of the slope of the price/yield curve V. There is an inverse relationship between maturity and convexity a. I. b. II. III. IV. c. I. IV. d. II. IV. V. e. I. II. IV. V.arrow_forwardThe inverted yield curve predicts that bond prices will fall. Select one: True OR Falsearrow_forward

- With regard to interest rate sensitivity measures and bonds: Group of answer choices C. Convexity attempts to capture the sensitivity of a bond’s duration to changes in interest rates. D. Both B & C B. Duration is related to yield approximation and convexity is related to price. A. Convexity is related to yield approximation and duration is related to pricearrow_forwardWhich of the following is correct with regards to Theories of Term Structure? When the shape of the yield curve depends on investors’ expectations about prospective prevailing interest rates, the Pure Exception Theory is being applied. When the economic outlook is improving, the yield curve inverts as it reflects no changes in inflation premium. The liquidity preference theory suggests that long-term rates are generally higher than short-term rates since investors perceive more liquidity in long-term investments. Under the Market segmentation theory, there is an apparent relationship between the yield curve and the prevailing rate of returns in each market segment.arrow_forwardIf the forward rate is expected to be an unbiased estimate of the future spot rate, and interest rate parity holds, then: a. the international Fisher effect (IFE) is refuted. b. the international Fisher effect (IFE) is supported. c. covered interest arbitrage is feasible. d. the average absolute error from forecasting would equal zero.arrow_forward

- Suppose an investor observes an upward term structure of interest rate. Answer the followingquestions. (a) According to the expectation hypothesis, what will be the investor’s forecast about futurechange of interest rate (increase, decrease or unchanged)? (b) What will the investor say about the future change of interest rate according to liquiditypreference theory? Explain your argument.arrow_forwardDo you agree with the following statement? Explain why.“The information about a bond’s duration and convexity adjustment is sufficient to quantifyinterest rate risk exposure.arrow_forwardWhich one of the following expressions about risk and returns is wrong? A. In general, one reason why a stock is riskier than a bond is that because cash flows from a bond are known and promised, whereas cash flows from a stock are neither known nor promised. B. According to CAPM model, a well-diversified portfolio will have a beta which equals to 0. C. Risk premium is the extra return provided on risky assets to compensate for risk. The difference between risky return and the risk-free return. D. Unexpected return happened because new information came to light which caused our expectations about prices and returns to change.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education