Kansas City Castings (KCC) is attempting to obtain the maximum loan possible using

-

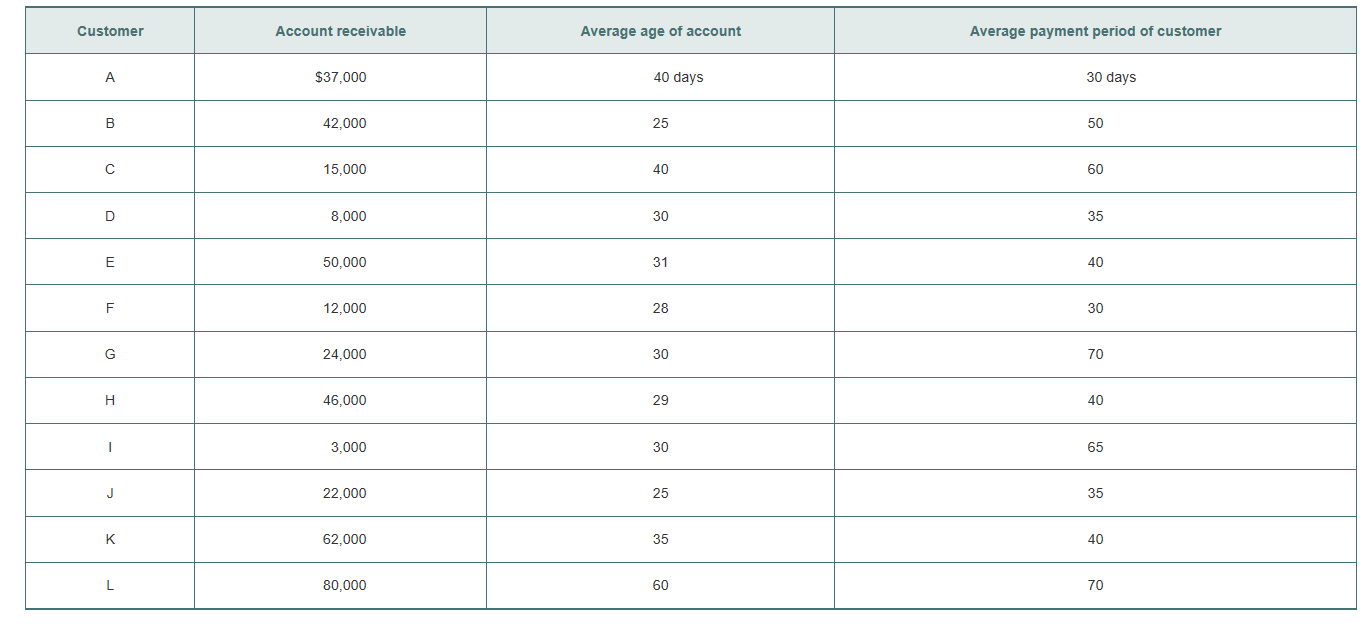

If the bank will accept all accounts that can be collected in 45 days or less as long as the customer has a history of paying within 45 days, which accounts will be acceptable? What is the total dollar amount of accounts receivable collateral? (Note: Accounts receivable that have an average age greater than the customer’s average payment period are also excluded.)

-

In addition to the conditions in part a, the bank recognizes that 5% of credit sales will be lost to returns and allowances. Also, the bank will lend only 80% of the acceptable collateral (after adjusting for returns and allowances). What level of funds would be made available through this lending source?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- A store offers its salespeople a table with coefficients to be applied to the cash sale value of its products if the customer needs to finance the purchase of the products. Assuming the store charges a compound interest rate of 6% p.m. in sales made on credit, calculate the value of these coefficients in the following situations:a) 12 monthly installments, the first being paid after thirty days; (0.119277)b) 24 monthly installments, the first of which is paid upon purchase; (0.075169) c) 36 monthly installments, the first being paid after six months. (0.091528)arrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answer to the nearest cent.) $400 balance, 17%, $350 payment; average daily balance methodarrow_forwardJack Abrams borrowed $8,000 for nine months at an interest rate of 7% (simple interest). The bank also charges a $100 processing fee. What is the actual interest rate for this loan?arrow_forward

- ABC Corporation receives checks from its customers. The total check value averages 700,000 each day. It takes an average of 5 days from deposits for these to clear the bank. If the bank offers to accelerate the 5-day clearing process to 3 days for a monthly fee of 600. If ABC can earn 4% investment income from excess cash, how much is the net annual benefits/cost of this bank offer?arrow_forwardYoo, Incorporated, has arranged a line of credit that allows it to borrow up to $51 million at any time. The interest rate is 627 percent per month. Additionally, the company must deposit 5 percent of the amount borrowed in a noninterest-bearing account. The bank uses compound interest on its line-of-credit loans. If the company needs $27 million for 8 months, how much will it pay in interest? Multiple Choice $1.307,50417 $1,457,29019 $1619,200.22 $1.230.592.16) $1,384,41618arrow_forwardA bank offers your firm a revolving credit arrangement for up to $86 million at an interest rate of 2.15 percent per quarter. The bank also requires you to maintain a compensating balance of 2 percent against the unused portion of the credit line, to be deposited in a non-interest-bearing account. Assume you have a short-term investment account at the bank that pays 1.50 percent per quarter, and assume that the bank uses compound interest on its revolving credit loans. a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use it during the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Effective annual interest rate % b. What is your effective annual interest rate on the lending arrangement if you borrow $50 million immediately and repay it in one year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2…arrow_forward

- Banca Monte dei Paschi di Siena has 300 depositors. Each depositor deposits $150 into the bank at time t=0. The bank promises each depositor 8% interest rate. Each depositor can either withdraw their money at t=1 or t=2. The bank uses the deposits to issue 2-year simple loans. If the bank faces a demand for withdrawal at t=1, it is able to sell its 2-year simple loans at the original loan value. If 200 depositors withdraw at t=1, what is the amount of payment (in $) each depositor who withdraws at t=2 receives? Round your answer to at least 2 decimal places.arrow_forwardPlease answer all subparts with explanation. I will really upvote. Thanksarrow_forwardYou have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.) Payment Period Nominal Rate (%) Loan Term of Present Value Payment Loan (years) (Amount of Loan) every month 6 $40,000 4 %24arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education