Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

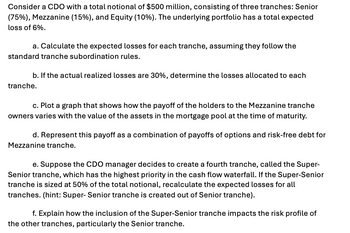

Transcribed Image Text:Consider a CDO with a total notional of $500 million, consisting of three tranches: Senior

(75%), Mezzanine (15%), and Equity (10%). The underlying portfolio has a total expected

loss of 6%.

a. Calculate the expected losses for each tranche, assuming they follow the

standard tranche subordination rules.

b. If the actual realized losses are 30%, determine the losses allocated to each

tranche.

c. Plot a graph that shows how the payoff of the holders to the Mezzanine tranche

owners varies with the value of the assets in the mortgage pool at the time of maturity.

d. Represent this payoff as a combination of payoffs of options and risk-free debt for

Mezzanine tranche.

e. Suppose the CDO manager decides to create a fourth tranche, called the Super-

Senior tranche, which has the highest priority in the cash flow waterfall. If the Super-Senior

tranche is sized at 50% of the total notional, recalculate the expected losses for all

tranches. (hint: Super- Senior tranche is created out of Senior tranche).

f. Explain how the inclusion of the Super-Senior tranche impacts the risk profile of

the other tranches, particularly the Senior tranche.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An investment advisor has recommended a R50,000 portfolio containing assets R, J, and K; R25,000 will be invested in asset R, with an expected annual return of 12 percent; R10,000 will be invested in asset J, with an expected annual return of 18 percent; and R15,000 will be invested in asset K, with an expected annual return of 8 percent. What is the expected annual return of this portfolio? What is the correct answer? A. 12.01% B. 12.00% C. 11.98% D. 12.93%arrow_forwardIn the following exercise, separate the investments according to the type of Keynesian demand they are: Transactions (0% to 5%), Precautionary (6% to 9%), and Speculative demand (greater than 10%). Investment in each category has the same risk. So you want to invest in the highest return for the same risk. Take each demand type and choose the highest return and put that amount into the investment. For example, if Bond fund A has a return of 4% and Fund B has a return of 5%, they have the same risk, so you would put $70 into bond fund B. You have the following investments Opportunities ad returns. Fidelity Bonds 11% Fidelity Magellan 9% Putman Bonds one 4% Putman bonds Two 12% Growth Stock One 15% Growth and Income 8% Income Fund 3% Putman Growth…arrow_forwardWhich of the following investments will experience the largest change in its market value as a result of changes in the level of interest rates (we are talking about the absolute value of the change, up or down)? Suppose interest rates go up or down by 50 basis points (0.5%). Rank the investments from 1 to 4 where a 1 is the most affected (largest absolute change in value) while a 4 is the least affected (smallest absolute change in value). A: $1 million invested in 3-month Treasury bills. 请选择~ B: $1 million invested in STRIPS (zero coupons) maturing in three years. |请选择 C: $1 million invested in a Treasury note maturing in three years. The note pays a 5% annual coupon. |请选择︾ D: $1 million invested in a Treasury note maturing in three years. The note pays a 10.0% annual coupon. |请选择arrow_forward

- Five alternatives (A, B, C, D, and E) are compared. The present worth (Pw) and internal rate of return (IRR) values for these alternatives are ($1,500, 13.42%) for A; ($570, 12.85%) for B; ($1,300, 11.91%) for C; ($2,300, 12.54%) for D; and ($2,950, 12.95%) for E. Alternative A has the lowest capital investment, followed by B, C, D, and then E. If the alternatives are mutually exclusive, which one should be selected when the minimum attractive rate of return (MARR) is 10%? O a. Alternative B O b. Alternative D O C. Alternative c O d. Alternative E O e. Alternative Aarrow_forwardQ6. ) A portfolio is formed by investing 32% in Asset-1; 28% in Asset-2; and 40% in Asset-3. The covariances of the three assets with the market portfolio are 24, 36, and 48. The variance of the market portfolio is 40. If the risk - less rate is 7.5%, and the expected return on the market portfolio is 12.5%, what is the expected return of this portfolio, assuming that the CAPM is valid?arrow_forwardConsider the case of two financial assets and three market conditions (states). The tablebelow gives the respective probability for each market condition and the return of each assetin each one of them. Market Conditions State Recession Normal Expansion Probability of state 30% 40% 30% Return of asset A -30% 20% 55% Return of asset B -10% 70% 0% Consider the portfolio with 50% investment in each of the two assets above. Calculatethe expected return and the standard deviation of the portfolio.arrow_forward

- We have three assets A1, A2, A3 and the following information: E(r1)=15%, σ1=12%,; E(r2)=19% and risk σ2=30%; E(r3)=25% and Risk σ3=35% a) Calculate the effective diversification between A1, A2, A3, and assume ρ12=ρ13=ρ23=0, the expected returns are i.17%, ii.11%arrow_forwardAssume that the rate on a floater is set at LIBOR + 3%, that the floater portion of a class is 75 percent, and that the weighted-average coupon of the floater plus inverse floater should be eight percent. Determine the cap on the formula for the inverse floater that will accomplish this. 23% 26% 20% 28% 36%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education