FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

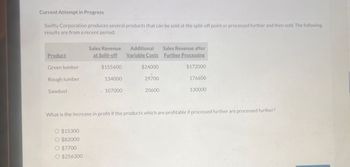

Transcribed Image Text:Current Attempt in Progress

Swifty Corporation produces several products that can be sold at the split-off point or processed further and then sold. The following

results are from a recent period:

Product

Sales Revenue

at Split-off

Additional

Variable Costs

Sales Revenue after

Further Processing

Green lumber

$155600

$24000

$172000

Rough lumber

134000

29700

176600

Sawdust

107000

20600

130000

What is the increase in profit if the products which are profitable if processed further are processed further?

O $15300

O $82000

O $7700

O $256300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Applying Differential Analysis to Alternative Profit Scenarios Epson produces color cartridges for inkjet printers. Suppose cartridges are sold to mail-order distributors for $5.20 each. Total fixed costs per year are $1,881,000. Variable cost per unit are $1.85 for direct materials, $0.10 for direct labor, $0.30 for factory overhead, and $0.05 for distribution. The variable distribution costs are for transportation to mail-order distributors. Also assume the current annual production and sales volume is 990,000 and annual capacity is 1,210,000 units. REQUIRED The company would like to increase profitability in the upcoming year. Estimate the effect of the following separate proposals on annual profits. a. A 15% increase in the unit selling price would likely decrease annual sales by 99,000 units. Note: enter all numbers as positive numbers, do NOT use a negative sign. x . Net estimated profits would increase ✔ by $ 0 b. A 10% decrease in the unit selling price would likely increase…arrow_forwardCurrent Attempt in Progress Marigold Bunyon Lumber Co. produces several products that can be sold at the split-off point or processed further and then sold. The following results are from a recent period: Sales Value Additional at Split-off Variable Costs Further Processing Sales Value after Product $160600 Green lumber $24800 $185400 28300 125000 175000 Rough lumber Sawdust 20100 105000 133200 Which products should be processed further? O All three products. Green lumber and rough lumber O Rough lumber and sawdust. Green lumber and sawdust. )arrow_forward4. Sell at Split-Off or Process Further Decision, Alternatives, Relevant Costs Betram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $76,500, and the result is 5,900 gallons of anderine and 7,900 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $9.00 per gallon and the dofinol for $6.00 per gallon. Alternatively, the anderine can be processed further at a cost of $8.10 per gallon (of anderine) into cermine. It takes 3 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $60. Required: 1. Which alternative is more cost effective and by how much?NOTE: Do NOT round interim calculations and, if required, round your answer to the nearest dollar. by $fill in the blank 2 2. What if the production of anderine into cermine required additional purchasing and quality…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education