FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:!

1

A

1

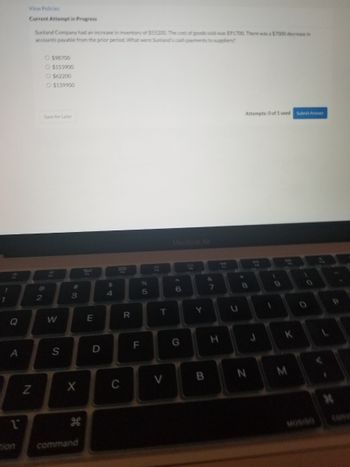

Current Attempt in Progress

Sunland Company had an increase in inventory of $55200 The cost of goods sold was $91700. There was a $7000 decrease in

accounts payable from the prior period. What were Sunland's cash payments to suppliers?

N

2

O$98700

O $153900

O $62200

O $139900

Save for Later

W

S

2000

8

X

command

9.

E

D

$

4

C

R

8

F

5

T

V

MacBook Air

6

G

Y

B

&

7

H

U

Attempts: 0 of 1 used

8

1

9

K

N M

Submit Answer

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide the answerarrow_forwardPlease Do not Give image format and Detail solutionarrow_forward|| Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Aa $ 37,500 (dr) 126,000 (dr) 2,800 (cr) 26,250 (dr) Management has designated $37,500 as the firm's minimum monthly cash balance. Other information about the firm and its operations is as follows: a. Sales revenues of $350,000, $420,000, and $312,500 are expected for October, November, and December, respectively. All goods are sold on account. b. The collection pattern for accounts receivable is 60% in the month of sale, 39% in the month following the month of sale, and 1% uncollectible, which is set up as an allowance. c. Cost of goods sold is 60% of sales revenues. d. Management's target ending balance of merchandise inventory is 10% of the current month's budgeted cost of goods sold. e. All accounts payable for inventory are paid in the month of purchase. f. Other monthly expenses are $49,250, which includes $3,500 of depreciation and $2,000 of bad debt expense. g. In the event of a shortfall, the…arrow_forward

- $127000, $2570000, $243000, $50000, or $643000arrow_forwardSelected transactions for Mason Corporation follow: Aug. 2 13 ate 26 28 Sold $15,000 of merchandise to Vanderbilt Inc., terms n/30. Mason uses a perpetual inventory system and the cost of the goods sold was $9,000. Mason's management expects a return rate of 6%. Merchandise with a selling price of $750 was returned by Vanderbilt because it was the wrong size. A credit was provided to Vanderbilt. The cost of the merchandise returned was $450. The returned goods were in saleable condition and returned to inventory. Received a partial payment of $10,500 from Vanderbilt. Made sales of $7,500 on account to Reisen Ltd., terms n/30. The cost of the goods sold was $4,500. Mason's management expects a return rate of 6%. Record the above transactions on Mason's books, including any cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the…arrow_forwardPlease do not give solution in image formatarrow_forward

- 7arrow_forwardTB MC Qu. 11-161 (Algo) A company purchases its inventory from... A company purchases its inventory from suppliers on account. During the year, its inventory account increased by $18 million and its accounts payable to suppliers decreased by $2 million. If cost of goods sold was $460 million, its cash outflows to inventory suppliers totaled: Multiple Choice $480 million. $440 million. $476 million. $444 million.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education