FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

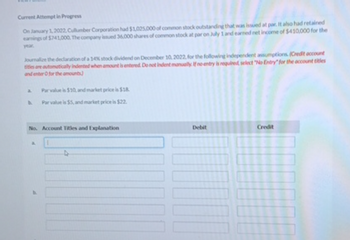

Transcribed Image Text:Current Attempt in Progress

On January 1, 2022, Cullumber Corporation had $1,005,000 of common stock outstanding that was issued at par. It also had retained

earnings of $741,000. The company issued 36,000 shares of common stock at par on July 1 and earned net income of $410,000 for the

year.

Journalize the declaration of a 14% stock dividend on December 10, 2022, for the following independent assumptions. (Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts)

4

Par value is $10, and market price is $18.

Par value is $5, and market price is $22.

No. Account Titles and Explanation

4

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 12 images

Knowledge Booster

Similar questions

- Owearrow_forwardOn January 1, 2022, Skysong, Inc. had $1,190,000 of common stock outstanding that was issued at par and retained earnings of $749,000. The company issued 43,000 shares of common stock at par on July 1 and earned net income of $395,000 for the year. Journalize the declaration of a 15% stock dividend on December 10, 2022, for the following two independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) No. Account Titles and Explanation (a) Par value is $10 and market price is $15. Par value is $5 and market price is $8. (b) Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Debit 277,425 147,960 Credit 184,950 277,425 92,475 332,910arrow_forwardDogarrow_forward

- Do not give answer in imagearrow_forwardPlease provide assistance and explanation for scenario provided in the attached image.arrow_forwardBlue Spruce Limited reported profit of $472,686 for its November 30, 2024, year end. Cash dividends of $63,700 on the common shares and $60,000 on the noncumulative preferred shares were declared and paid during the year. The following information is available regarding Blue Spruce's common shares: Dec. 1, 2023 Feb. 28, 2024 The opening number of common shares was 55,100. Sold 8,800 common shares for $220,000 cash. May 31, 2024 Nov. 1, 2024 Reacquired 4,400 common shares for $101,200 cash. Issued 13,200 common shares in exchange for land with a fair value of $280,000. (a) Question Part Score (b) Calculate the weighted average number of common shares for the year. Weighted average number of shares 2/2arrow_forward

- Don't provide answers in image formatarrow_forwardVikrambhaiarrow_forwardThe stockholders’ equity accounts of Grouper Company have the following balances on December 31, 2020. Common stock, $10 par, 290,000 shares issued and outstanding $ 2,900,000 Paid-in capital in excess of par—common stock 1,120,000 Retained earnings 5,110,000 Shares of Grouper Company stock are currently selling on the Midwest Stock Exchange at $ 36.Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) A stock dividend of 7% is (1) declared and (2) issued. (b) A stock dividend of 100% is (1) declared and (2) issued. (c) A 2-for-1 stock split is (1) declared and (2) issued. No. Account Titles and Explanation Debit Credit (a) (1) enter an account title for case A to record the declaration of stock dividends…arrow_forward

- On January 1, 2020, Windsor Corporation had $2,000,000 of $10 par value common stock outstanding that was issued at par and retained earnings of $1,040,000. The company issued 235,000 shares of common stock at $12 per share on July 1. On December 15, the board of directors declared a 15% stock dividend to stockholders of record on December 31, 2020, payable on January 15, 2021. The market value of Windsor Corporation stock was $15 per share on December 15 and $16 per share on December 31. Net income for 2020 was $535,000. (a1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation July 19 Dec 15 Debitarrow_forwardplease answer this with must explanation , computation for each part and steps answer in text formarrow_forwardOn January 1, 2023, Sunland Ltd. had 498,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Mar. 1 May 1 June 1 Oct. 1 Issued 180,000 shares Issued a 10% stock dividend Acquired 195,000 common shares and retired them Issued a 2-for-1 stock split Issued 74,000 shares The company's year end is December 31. Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to 0 decimal places, e.g. 5,275.) Weighted average number of shares outstanding eTextbook and Media Assume that Sunland earned net income of $3,164,460 during 2023. In addition, it had 110,000 of 8%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education