FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:jannessapala@stx Unit 2 Lab Quiz - AC114 Accou X

4 Unit 2 Lab Quiz

education.wiley.com/was/ui/v2/assessment-player/index.html?launchid=4b1dc98f-a2c8-4982-889e-4213278d9

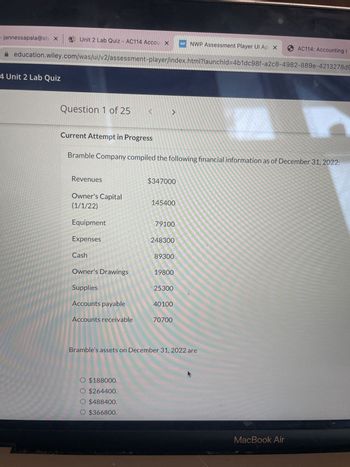

Question 1 of 25

Current Attempt in Progress

Revenues

Owner's Capital

(1/1/22)

Equipment

Expenses

Cash

Bramble Company compiled the following financial information as of December 31, 2022:

Owner's Drawings

Supplies

Accounts payable

<

Accounts receivable

J

O $188000.

O $264400.

O $488400.

O $366800.

$347000

145400

79100

248300

89300

19800

25300

WP NWP Assessment Player Ul Ap X

40100

70700

Bramble's assets on December 31, 2022 are

AC114: Accounting I

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts Receivable Inventory Current Assets Accum.Depreciation Net Fixed Assets Gross Fixed Assets $16,251,665 $20,567,330 Less $7,460,897 $10,117,819 Total Assets O 11.58% O 44.90% O 8.37% $5,268,485 $10,268,485 O 4.35% $2,574,230 $2,314,672 O 6.02% $529,062 $696,685 $8,371,777 $13,279,842 Total Liabilities and Equity What is the common size value for 2022 Notes Payable? $8,790,768 $10,449,511 $17,162,545 $23,729,353 Current Liabilities 2021 Accounts Payable Notes Payable $1,033,110 $1,987,233 2022 $1,673,992 $2,438,271 $2,707,102 $4,425,504 Long Term Debt $9,242,830 $11,468,302 Total Liabilities $11,949,932 $15,893,806 Common Stock ($0.50 par) $1,300,000 $1,600,000 Capital Surplus $1,148,120 $1,800,969 Retained $2,764,493 $4,434,578 Earnings $17,162,545 $23,729,353arrow_forwardCash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Valley Technology Balance Sheet As of March 11, 2020 (amounts in thousands) 9,700 Accounts Payable 4,500 Debt 3,800 Other Liabilities 16,400 Total Liabilities 1,700 Paid-In Capital Retained Earnings Total Equity 36,100 Total Liabilities & Equity 1,500 2,900 800 5,200 7,300 23,600 30,900 36,100 Use T-accounts to record the transactions below, which occur on March 12, 2020, close the T-accounts, and construct a balance sheet to answer the question. 1. Buy $15,000 worth of manufacturing supplies on credit 2. Issue $85,000 in stock 3. Borrow $63,000 from a bank 4. Pay $5,000 owed to a supplier 5. Receive payment of $12,000 owed by a customer What is the final amount in Total Liabilities? Please specify your answer in the same units as the balance sheet.arrow_forwardConsolidated Balance Sheets ($ in thousands) January 31, 2016 January 31, 2015 CURRENT ASSETS Cash $ 37,243 $ 29,129 Accounts receivable (Note 5) 79,373 72,506 Inventories (Note 6) 211,736 204,812 Prepaid expenses 7,229 9,393 335,581 315,840 NON-CURRENT ASSETS Property and equipment (Note 7) 345,881 311,692 Goodwill (Note 8) 37,260 33,653 Intangible assets (Note 8) 32,610 22,485 Deferred tax assets (Note 9) 29,040 28,074 Other assets (Note 10) 13,423 12,555 458,214 408,459 TOTAL ASSETS $ 793,795 $ 724,299 CURRENT LIABILITIES Accounts payable and accrued liabilities $ 152,136 $ 138,834 Current portion of long-term debt (Note 11) — 6,271 Income tax payable 3,365 1,170 155,501 146,275 NON-CURRENT LIABILITIES Long-term debt (Note 11) 225,489 195,125 Defined benefit plan obligation (Note 12) 33,853 36,556 Deferred tax liabilities (Note 9) 2,630 2,392 Other long-term liabilities 18,710 14,668 280,682 248,741 TOTAL…arrow_forward

- The balance sheet data of Blossom Company at the end of 2025 and 2024 are shown below. 2025 2024 Cash $7,500 $9,900 Accounts receivable (net) 80,500 87,700 Merchandise inventory 85,800 79,600 Prepaid expenses 9,000 12,000 Equipment 171,500 145,500 Accumulated depreciation-equipment (45,100) (36,500) Land 30,200 50,100 Total assets $339,400 $348,300 Accounts payable $45,200 $57,600 Accrued expenses 11,100 9,000 Notes payable-bank, short-term -0- 49,100 Bonds payable 19,900 -0- Common stock, $1 par 181,000 161,000 Retained earnings 82,200 71,600 Total liabilities and shareholders' equity $339,400 $348,300 Equipment was purchased for $20,000 in exchange for common stock, par $20,000, during the year; all other equipment purchased was for cash. Land was sold for $31,700. Cash dividends of $7,100 were declared and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g. -12,000 or in parenthesis e.g. (12,000).) (a) Net cash…arrow_forwardThe balance sheets for a company and additional information are provided below. A COMPANY Balance Sheets December 31, 2024 and 2023 2024 2023 Assets Current assets: Cash $160,000 $116,000 Accounts receivable 70,000 88,000 Inventory 91,000 76,000 Investments 3,600 1,600 Long-term assets: Land 440,000 440,000 Equipment 750,000 630,000 Less: Accumulated depreciation (388,000) (228,000) Total assets $1,126,600 $1,123,600 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $95,200 $81,000 Interest payable 5,500 11,600 Income tax payable 7,500 4,600 Long-term liabilities: Notes payable 120,000 240,000 Stockholders' equity: Common stock 660,000 660,000 Retained earnings 238,400 126,400 Total liabilities and stockholders' equity $1,126,600 $1,123,600 Additional information for 2024: Net income is $112,000. Sales on account are $1,382,500. (All sales are credit sales.) Cost of goods…arrow_forwardKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 81,500 $ 54,000 Accounts receivable, net 80,000 61,000 Inventory 73,800 101,500 Prepaid expenses 5,400 7,400 Total current assets 240,700 223,900 Equipment 134,000 125,000 Accumulated depreciation—Equipment (32,000) (14,000) Total assets $ 342,700 $ 334,900 Liabilities and Equity Accounts payable $ 35,000 $ 45,000 Wages payable 7,000 17,000 Income taxes payable 4,400 5,800 Total current liabilities 46,400 67,800 Notes payable (long term) 32,000 70,000 Total liabilities 78,400 137,800 Equity Common stock, $5 par value 240,000 170,000 Retained earnings 24,300 27,100 Total liabilities and equity $ 342,700 $ 334,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 728,000 Cost of goods sold 421,000 Gross profit 307,000 Operating expenses (excluding depreciation) 77,000 Depreciation expense 68,600 161,400…arrow_forward

- Suppose the following items were taken from the December 31, 2025, assets section of the Boeing Company balance sheet. (All dollars are in millions.) Inventory Notes receivable-due after December 31, 2026 Notes receivable-due before December 31, 2026 Accumulated depreciation-buildings eTextbook and Media List of Accounts Save for Later TS V $16,140 > 5,530 345 12,530 Patents Buildings Cash Prepare the assets section of a classified balance sheet. (List the Current Assets in order of liquidity. Enter amounts in millions) Accounts receivable Debt investments (short-term) BOEING COMPANY Partial Balance Sheet (in millions) Assets $13,040 20,700 $ 7.900 5,590 1,590 Assistance Used Attempts: 0 of 3 used Submit Answerarrow_forwardComparative balance sheets at December 31, 2020 and 2021 are show for the company below. 2020 2021 Cash 68,200 131,450 accounts receivable 81,400 86,900 Inventory 129,800 136,400 Prepaid expenses 5,500 6,600 Land 0 70,950 Plant assets 264,400 306,900 Accumulated depreciation (94,600) (88,000) Franchise 35,200 26,400 Total assets $471,900 $677,600 Accounts payable 45,100 58,300 Notes payable 69,300 63,800 Bonds payable 0 141,900 Common stock 275,000 302,500 Additional paid in capital 50,600 61,600 Retained earnings 31,900 49,500 Total liabilities and equity $471,900 $677,600 Additional Information:1. A fully depreciated plant asset, which originally cost $22,000 and had no salvage value, was sold for $1,100. 2. Bonds payable were issued at par value. One-half of the bonds were exchanged for land; the remaining one-half was issued for cash. 3. Common stock was sold for cash. 4. The only entries in the Retained…arrow_forwardUse the following data to determine the total dollar amount of assets to be classified as long-term investments. Ace Supply Company Balance Sheet December 31, 2025 Cash Accounts receivable Inventory Short-term investments Land (held for future use) Land Buildings Less: Accumulated depreciation (60,000) Franchise Total assets O $255,000 O $0 $339,000 O $465,000 O $585.000 $ 126,000 120,000 210,000 90.000 255.000 285,000 210.000 $1.575.000 Accounts payable Salaries and wages payable Note payable (due 2028) Total liabilities Common stock Retained: earnings Total stockholders' equity Total liabilities and stockholders' equity 279,000 $ 165,000 30,000 270.000 465,000 360,000 750,000 1.110.000 $1.575.000arrow_forward

- The following comparative balance sheet is given for Estern Co.: Assets Dec 31, 2021 Dec 31, 2020 Cash $58,500 $351,000 72,000 Notes Receivable 63,000 Supplies & Inventory 81,000 121,500 Prepaid expense 31,500 54,000 Long-term investments 0 81,000 Machines and tools 166,500 144,000 Accumulated depreciation-equipment (63.000) (45,000) Total Assets $639,000 $477.000 Liabilities & Stockholders' Equity Accounts payable $ 76,500 $ 31,500 Bonds payable (long-term) 166,500 211,500 Common Stock 180,000 103,500 Retained Earnings 216.000 130.500 Total Liabilities & Stockholders' Equity $639.000 $477,000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021): 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000,…arrow_forwardAbe Manufacturing Corp. decided to expand further by purchasing the net assets of ERB Manufacturing Corp. ERB's statement of financial position at December 31, 2023 follows. Assets Receivables Inventory Plant assets (net) Total assets ERB MANUFACTURING CORP. Statement of Financial Position December 31, 2023 Cash 450,000 275,000 1,025,000 $1,960,000 $ 210,000 Liabilities and Equities Accounts payable $ 325,000 Common shares 800,000 Retained earnings 835,000 Total liabilities and equities $1,960,000 An appraisal, agreed to by both parties, indicated that the fair value of the inventory was $320,000 and the fair value of the plant assets was $1,225,000. The fair value of the receivables and payables is equal to the amount reported on the balance sheet. The agreed purchase price was $3 million, and this amount was paid in cash to the owners of ERB. Instructions Calculate the amount of goodwill (if any) implied in the purchase price of $3 million. Show calculations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education