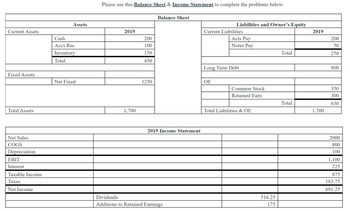

Please use this

) 2019

2) 2019 Quick Ratio: [CA-Inventory/CL] Question Blank 2 of 20

3) Cash Ratio: [Cash/CL] Question Blank 3 of 20

4) Total Debt Ratio: [TA-TE/TA] Question Blank 4 of 20

5) Debt-Equity Ratio: [Total Debt/Total Equity] Question Blank 5 of 20

6) Equity Multiplier: [Total Assets/Total Equity] or [1+Debt-Equity Ratio] Question Blank 6 of 20

7) Times Interest Earned: [EBIT/Interest] Question Blank 7 of 20

8) Cash Coverage Ratio: [(EBIT +

9) Inventory Turnover: [COGS/Inventory] Question Blank 9 of 20

Days’ Sales in Inventory: [365/Inventory Turnover] Question Blank 10 of 20

Receivables Turnover: [Sales/

Days Sales in Receivable: [365/Receivable Turnover] Question Blank 12 of 20

Total Asset Turnover: [Sales/TA] Question Blank 13 of 20

Profit Margin: [Net Income/Sales] Question Blank 14 of 20

Return on Assets (ROA): [Net income/TA] Question Blank 15 of 20

Return on Equity (ROE): [Net Income/TE] Question Blank 16 of 20

Earnings Per Share (EPS): [Net Income/Shares Outstanding] (Shares Outstanding = 33) Question Blank 17 of 20

Price to Earnings (PE): [Price Per Share (PPS) / EPS] (Price Per Share = 88) Question Blank 18 of 20

Price-Sales Ratio: [PPS / Sales Per Share] Question Blank 19 of 20

(Sales Per Share = Total Sales/Shares Outstanding)

Market to Book: [PPS / (TE / Shares)] Question Blank 20 of 20

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- 6d photo, thank you.arrow_forwardLO 10-5 Corporation E10-10 Calculating and Interpreting the Debt-to-Assets Ratio and Times Interest Earned Ratio At May 31, 2019, FedEx Corporation reported the following amounts (in millions) in its financial statements: Total Assets Total Liabilities Interest Expense Income Tax Expense Net Income game Tot 1500 2019 $54,400 36,600 ainuoms 21000056 590 115 540 2018 $52,330 32,900 560 220 4,570arrow_forwardplease help me thankuarrow_forward

- Please do not give solution in image format and show all calculation thankuarrow_forwardCarter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet at year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. Cash Accounts receivable. Inventory Current assets Capital assets Assets Total assets $9 15 10 34 34 $68 Balance Sheet (in $ millions) Liabilities and Shareholders' Equity Accounts payable Accrued vages Accrued taxes Current liabilities. Long-term debt Common stock Retained earnings Total liabilities and shareholders' equity $9 8 7 24 10 15 19 $68 The firm has an aftertax profit margin of 8 percent and a dividend payout ratio of 40 percent. a. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the expansion. (Do not round intermediate calculations. Enter the answer in millions. Round the final…arrow_forwardFinance Questionarrow_forward

- A) Prepare the 2024 combined common-size, common-base year balance sheet. B) Calculate the following financial ratios for each year. Comment on each ratio and interpret the changes from 2023 to 2024. A. Current ratio B. debt to equity ratio C. total asset turnover D. ROE C) Use the DuPont analysis on each year and interpret your results.arrow_forwardHi, coudl you help me fill this up please. The nature of teh account is between either; asset, liability, revenu and expense.arrow_forwardGuys could you please help me: I'm attaching AT&T's Balance Sheet and Income Statement for the analysis.I'd really appreciate help with the following: Perform a vertical financial analysis incorporatingi. Debt ratioii. Debt to equity ratioiii. Return on assetsiv. Return on equityv. Current ratiovi. Quick ratiovii. Inventory turnoverviii. Days in inventoryix. Accounts receivable turnoverx. Accounts receivable cycle in daysxi. Accounts payable turnoverxii. Accounts payable cycle in daysxiii. Earnings per share (EPS)xiv. Price to earnings ratio (P/E)xv. Cash conversion cycle (CCC), andxvi. Working capitalxvii. Explain Dupont identity, apply it to your selected company, interpret thecomponents in Dupont identity.arrow_forward

- Directions: Click the Case Link above and use the information provided in Revolutionary Designs, Inc., Part B, to answer this question: What is the impact on Revolutionary Design's adjusted debt ratio (total liabilities less subordinated debt) to adjusted tangible net worth (tangible net worth plus subordinated debt) if we assume that the owner debt will no longer be subordinated in 20Y3? Adjusted debt to adjusted tangible net worth will increase from approximately 2.7 to approximately 3.8 in 2013. Adjusted debt to adjusted tangible net worth will improve from approximately 3.5 to approximately 2.6 in 20Y3. Adjusted debt to adjusted tangible net worth will increase from approximately 3.5 to approximately 3.8 in 20Y3. Bookmark for reviewarrow_forwardHello Tutor, Can I have assistance with creating the attached commomn statement using income and Balance sheet statements along with the interpreation. I would really appreciate it. using the column of difference on Balance sheet and some transactions on income to determine added or subtracted and transfer to appropriate activity (operating, investing, and financing) with numbers (NO ü). Please insert more column as you need Items 2020 2019 Difference Added Subtracted Operating Investing Financing…arrow_forwardRATIO ANALYSIS. Debt Ratio Activity 6 · Understand the information provided by the debt ratio. · Identify the expected range and whether an increasing or decreasing trend is preferred. Purpose: The debt ratio compares total liabilities to total assets. This ratio measures the proportion of assets financed by debt. It is a measure of long-term solvency. Total liabilities DEBT RATI0 = Total assets JOHNSON & CITIGROUP 12/31/99 HEWLETT- PACKARD 10/3 1/99 JOHNSON 1/03/99 WAL-MART 1/31/99 ($ in 000s) Assets $716,937,000 $35,297,000 $26,211,000 $49,996,000 Liabilities 667,251,000 17,002,000 12,621.000 28,884,000 Stockholders' Equity $ 49,686,000 $18,295,000 $13,590,000 $21,112,000 Source: Disclosure, Inc, Compact D/SEC, 2000. 1. For each-company listed above, compute the debt ratio. Record your results below. Debt ratio: 0.93 2. The debt ratios computed above are primarily in the ranġe (less than 0,40 / 0.40 through 0.70 / over 0.70): 3. % of Wal-Mart's assets are financed by debt. 4.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education