Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

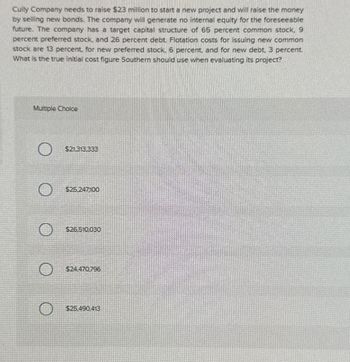

Transcribed Image Text:Cully Company needs to raise $23 million to start a new project and will raise the money

by selling new bonds. The company will generate no internal equity for the foreseeable

future. The company has a target capital structure of 65 percent common stock. 9

percent preferred stock, and 26 percent debt. Flotation costs for issuing new common

stock are 13 percent, for new preferred stock. 6 percent, and for new debt. 3 percent.

What is the true initial cost figure Southern should use when evaluating its project?

Multiple Choice

$21,313,333

$25.247100

$26.510,030

$24.470796

$25.490,413

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Project 1 2 3 4 $2.000 Open spreadsheet Cost Cost of debt 3,000 5,000 2.000 Project 1 Project 2 Project 3 Project 4 Expected Rate of Return 16.00% The company estimates that it can issue debt at a rate of r = 9%, and its tax rate is 30%. It can issue preferred stock that pays a constant dividend of $5 per year at $44 per share. Also, common stock currently sells for $33 per share; the next expected dividend, D₂, is $4.00; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. The data has been collected in the Microsoft Excel Online e below. Open the spreadsheet and perform the required analysis to answer the questions below. % 15.00 a. What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate…arrow_forwardDyrdek Enterprises has equity with a market value of $10.9 million and the market value of debt is $3.60 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.7 percent. The new project will cost $2.22 million today and provide annual cash flows of $581,000 for the next 6 years. The company's cost of equity is 11.11 percent and the pretax cost of debt is 4.89 percent. The tax rate is 21 percent. What is the project's NPV? Multiple Choice $230,173 $375,414 $237,180 $219,241 $512,072arrow_forwardSituational Software Co. (SSC) is trying to establish its optimal capital structure. Its current capital structure consists of 25% debt and 75% equity; however, the CEO believes that the firm should use more debt. The risk-free rate, faF, is 3%; the market risk premium, RPM, is 5%; and the firm's tax rate is 40%. Currently, SSC's cost of equity is 15%, which is determined by the CAPM. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What would be SSC's estimated cost of equity if it changed its capital structure to 50% debt and 50% equity? Round your answer to two decimal places. Do not round intermediate steps. Check My Work Reset Problem @om ईarrow_forward

- The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average risk. Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address. Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity. It has a before-tax cost of debt of 8.2%, and its cost of preferred stock is 9.3%. If Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 12.4%. However, if it is necessary to raise new common equity, it will carry a cost of 14.2%. If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) be if it has to raise additional common equity capital by issuing new common stock instead of raising the funds through…arrow_forwardNCC Corporation is considering building a new facility in Texas. To raise money for the capital projects, the corporation plans the following capital structure: 40% of money will come from issuing bonds, and 60% will come from Retained Earnings or new common stock. The corporation does not currently have preferred stock. NCC Corporation will issue bonds with an interest rate of 9%, up to $30 million dollars in bonds. After issuing $30 million in bonds, the interest cost will rise to 12.5%. The next dividend on common stock is expected to be $2.00 per share. The stock price is $16.00 per share, and is expected to grow at 3% per year. The flotation cost for issuing new common stock is estimated at 12%. NCC Corporation has $66 million in retained earnings that can be used. The tax rate for NCC Corporation is 35%. There are two breakpoints in NCC's capital structure. At what point does the first breakpoint occur? $75 million $100 million $110 million $125…arrow_forwardRETURN ON EQUITY Central City Construction (CCC) needs $1 million of assets to get started, and it expects to have a basic earning power ratio of 20%. CCC will own no securities, so all of its income will be operating income. If it so chooses, CCC can finance up to 50% of its assets with debt, which will have an 8% interest rate. If it chooses to use debt, the firm will finance using only debt and common equity, so no preferred stock willbe used. Assuming a 40% tax rate on all taxable income, what is the difference between CCC’s expected ROE if it finances these assets with 50% debt versus its expected ROE if it finances these assets entirely with common stock?arrow_forward

- Cully Company needs to raise $22 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 70 percent common stock, 10 percent preferred stock, and 20 percent debt. Flotation costs for issuing new common stock are 9 percent, for new preferred stock, 8 percent, and for new debt, 3 percent. What is the true initial cost figure Southern should use when evaluating its project? Multiple Choice $23,694,000 $22,881,907 $20,533,333arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardCully Company needs to raise $23 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 55 percent common stock, 10 percent preferred stock, and 35 percent debt. Flotation costs for issuing new common stock are 8 percent, for new preferred stock, 6 percent, and for new debt, 4 percent. What is the true initial cost figure Southern should use when evaluating its project? $23,589,744 $24,472,000 $24,572,650 $21,620,000 $25,555,556arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education