Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

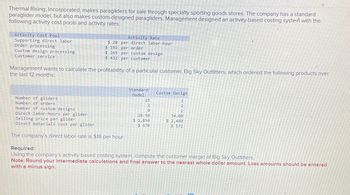

Transcribed Image Text:Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard

paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the

following activity cost pools and activity rates:

Activity Cost Pool

Supporting direct labor

Order processing

Custom design processing

Customer service

Activity Rate

$20 per direct labor-hour

$ 192 per order

$ 265 per custom design

$ 432 per customer

Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over

the last 12 months:

Standard

Model

Custom Design

Number of gliders

Number of orders

Number of custom designs

Direct labor-hours per glider

Selling price per glider

Direct materials cost per glider

The company's direct labor rate is $18 per hour.

Required:

15

200

28.50

$ 1,850

$ 470

2220

34.00

$ 2,480

$ 572

Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters.

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered

with a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Electan Company produces two types of printers. The company uses ABC, and all activity drivers are duration drivers. Electan Company is considering using DBC and has gathered the following data to help with its decision. A. Activities with duration drivers: B. Activities with consumption ratios and costs: C. Products with cycle time and practical capacity: Required: 1. Using cycle time and practical capacity for each product, calculate the total time for all primary activities. Comment on the relationship to ABC. 2. Calculate the overhead rate that DBC uses to assign costs. Comment on the relationship to a unit-based plantwide overhead rate. 3. Use the overhead rate calculated in Requirement 2 to calculate (a) the overhead cost per unit for each product, and (b) the total overhead assigned to each product. How does this compare to the ABC assignments shown in Part B of the Information set? 4. What if the units actually produced were 10,000 for Printer A and 18,000 for Printer B. Using DBC, calculate the cost of unused capacity.arrow_forwardMedical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardBumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forward

- Fisico Company produces exercise bikes. One of its plants produces two versions: a standard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of electronic gadgets to help the exerciser monitor heartbeat, calories burned, distance traveled, etc. At the beginning of the year, the following data were prepared for this plant: Additionally, the following overhead activity costs are reported: Required: 1. Calculate the cost per unit for each product using direct labor hours to assign all overhead costs. 2. Calculate activity rates and determine the overhead cost per unit. Compare these costs with those calculated using the unit-based method. Which cost is the most accurate? Explain.arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardHandy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stencilled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: The direct labor estimated for each production department was as follows: Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: a. Determine the two production department factory overhead rates. b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product.arrow_forward

- Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed on activity-based costing system with the following activity cost pools and activity rates: ActIvity Cost Pool Supporting direct lebor Order processing Custon desion processing Customer service Activity Rate $416 per direct labor-hour $ 182 per order $ 261 per custon design $426 per custoner Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months Stenderd Model Custos Desion 2 2 Number of gilders Number of orders Number of custon des igns Direct iabor-hours per gtider Selling price per glider Direct naterlals cost per ollder 14 30.50 $1,875 $ 444 33.00 $2.450 $ 500 The company's direct labor rate is $22 per hour Required: Using the company's activity-based costing…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 18 per direct labor-hour $ 192 per order $266 per custom design $ 428 per customer Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $16 per hour. Customer margin Standard Model 16 1 0 26.50 $1,900 $ 458 Custom Design 2 2 34.00 $ 2,480 $ 568 Required: Using the company's…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 18 per direct labor-hour $ 192 per order $ 269 per custom design $ 422 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Standard Custom Model Design 13 2 1 2 0 2 33.00 Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $18 per hour. Required: 30.50 $ 1,875 $ 444 $ 2,400 $ 576 Using the company's activity-based costing system,…arrow_forward

- Munabhaiarrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 22 per direct labor-hour $ 182 per order $ 261 per custom design $ 422 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider Standard Model Custom Design 16 2 1 2 0 2 30.50 32.00 $ 1,900 $ 450 $ 2,420 $ 580 The company's direct labor rate is $16 per hour. Required: Using the company's activity-based costing system,…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $20 per direct labor-hour $184 per order $ 254 per custom design $430 per customer Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs i Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $20 per hour. Customer margin Standard Model 15 1 0 28.50 $ 1,925 $ 476 Custom Design 3 3 3 33.00 $ 2,460 $ 570 Required: Using the company's…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning