FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

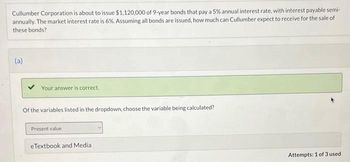

Transcribed Image Text:Cullumber Corporation is about to issue $1.120,000 of 9-year bonds that pay a 5% annual interest rate, with interest payable semi-

annually. The market interest rate is 6%. Assuming all bonds are issued, how much can Cullumber expect to receive for the sale of

these bonds?

(a)

Your answer is correct.

Of the variables listed in the dropdown, choose the variable being calculated?

Present value

eTextbook and Media

Attempts: 1 of 3 used

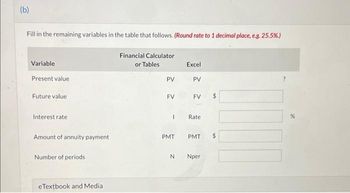

Transcribed Image Text:(b)

Fill in the remaining variables in the table that follows. (Round rate to 1 decimal place, eg. 25.5%)

Financial Calculator

Variable

or Tables

Excel

Present value

PV

PV

Future value

FV

FV

Interest rate

Rate

Amount of annuity payment

PMT

PMT

$

Number of periods

IN.

Nper

eTextbook and Media

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jingle Bells’ bonds are being sold for $980.80, and their coupon rate is 6%, with annual payments. If the maturity of those bonds is in exactly 48 semesters from now, and the face value of each bond is $1,000, calculate the bonds’ YTM. Please don't use the excel Formula "RATE" to calculate YTMarrow_forwardNikita Enterprises has bonds on the market making annual payments, with eleven years to maturity, a par value of $1,000, and selling for $970. At this price, the bonds yield 7 percent. What must the coupon rate be on the bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate I%arrow_forwardFor the next three questions (1-3) assume what follows: Assume that you acquired a previously issued debt instrument. According to its specifications, it promised to pay $1,000 precisely in two years from the day of its original issue. At the time it was issued, investors anticipated 8.00% in interest on instruments with similar characteristics and risk level. *Note, standard rounding rules apply to all calculations! Q1. What price did you have to pay for this security - under assumption that you acquired it in a secondary market precisely three months after its original issuing, and taking into account that at the time of your acquisition investors anticipated to earn 10.00% in interest on securities with similar features and risk characteristics? A). $857.34 B). $846.37 3000K ASarrow_forward

- Cost of debt with fees. Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 11.2% with semiannual payments, and will use an investment bank that charges $30 per bond for its services. What is the cost of debt for Kenny Enterprises at the following market prices? a. $979.18 b. $1,009.76 c. $1,111.03 d. $1,147.97 a. What is the cost of debt for Kenny Enterprises at a market price of $979.18? ☐ % (Round to two decimal places.)arrow_forwardPlease show proper steps thanksarrow_forwardDangerarrow_forward

- Sheridan Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.065 percent and a yield to maturity of 9.3 percent. Assume face value is $1,000. Problem 8.30(a) Your answer is incorrect. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price $ eTextbook and Media Save for Later Attempts: unlimited Submit Answerarrow_forwardPlease solve it in excel with Formulas explanationarrow_forward(Immunization of FI) Consider a financial institution whose asset and liability both consist of coupon bonds only. The asset is a 10-year bond with face value $100 million, coupon rate 9.8% and yield 4%, while the liability is a 15-year bond with face value $100 million, coupon rate 8.2% and yield 4%. Both bonds pay coupon semiannually. Assume parallel yield shift. Required precision: 4 digits after decimal point for duration calculation; 2 digits after decimal point for dollar amount in million, e.g. $12.34 million; 4 digits after decimal point for percentage (coupon) rates, e.g. 1.2345%. (a) What are the market values of asset, liability and equity of this FI? What is its leverage-adjusted modified duration gap? (b) According to the duration model, what would the market value of equity be for a 10 basis points decrease in the yield? (c) To immunize itself from interest rate risk, the FI plans to restructure its asset bond by adjusting its face value and coupon rate, while keeping the…arrow_forward

- Exodus Limousine Company has $1,000 par value bonds outstanding at 10 percent interest. The bonds will mature in 50 years. Compute the current price of the bonds if the percent yield to maturity is a. 5 percent. b. 15 percent. Solution: Present Value of Interest Payments PVA = A × PVIFA (n = 50, i = 5%) Present Value of Interest Payments PVA = A × PVIFA (n = 50, i = 15%)arrow_forwardDesert Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 10%. The firm then enters into an interest rate swap where it pays SOFR and receives a fixed 5% on notional principal of $100 million. What is the firm's effective interest rate on its borrowing? Only typing answer Please answer explaining in detail step by step without table and graph thankyouarrow_forwardYou are considering an investment in 20-year bonds issued by Moore Corporation. The bonds have no special covenants. The Wall Street Journal reports that 1-year T - bills are currently earning 0.50 percent. Your broker has determined the following information about economic activity and Moore Corporation bonds:Real risk-free rateDefault risk premiumLiquidity 0.41% = 1.05 % = 0.90% = 0.75% risk premiumMaturity risk premium = a. What is the inflation premium?b. What is the fair interest rate on Moore Corporation 20-year bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education