FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

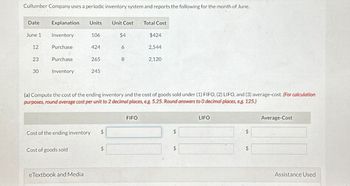

Transcribed Image Text:Cullumber Company uses a periodic inventory system and reports the following for the month of June.

Date

Explanation Units

Unit Cost

Total Cost

June 1

Inventory

106

$4

$424

12

Purchase

424

6

2,544

23

Purchase

265

8

2,120

30

Inventory

245

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average-cost. (For calculation

purposes, round average cost per unit to 2 decimal places, e.g. 5.25. Round answers to O decimal places, e.g. 125.)

Cost of the ending inventory

$

Cost of goods sold

$

eTextbook and Media

FIFO

LIFO

Average-Cost

$

$

$

$

Assistance Used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FLCL Company had the following transactions for the month: Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. first-in, first-out (FIFO) last-in, first-out (LIFO) weighted averagearrow_forwardHamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units Unit Cost Inventory, December 31, prior year 1,930 $ 7 For the current year: Purchase, March 21, 6,080 6 Purchase, August 14, 100 4 Inventory, December 31, current year 2,980 Required: Compute ending inventory and cost of goods sold under FIFO, LIFO, and average cost inventory costing methods.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following are the transactions for the month of July. Unit Selling Units Unit Cost Price $ 10 July 1 July 13 July 25 Beginning Inventory 41 Purchase 205 12 Sold (100) $ 16 July 31 Ending Inventory 146 Required: a. Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. b. Calculate sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. Complete this question by entering your answers in the tabs below. Required A Required B Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. Cost per FIFO (Periodic). Units Total Unit Beginning Inventory Purchases מ 4 . ו. .!arrow_forward

- The following data has been provided by Lee Company regarding its inventory purchases and sales throughout the year. Transaction Units Cost per Unit January 1 Balance 185 $86 March 14 Sale 54 May 23 Purchase 136 90 August 21 Sale 100 November 5 Purchase 171 91 November 18 Sale 100 November 30 Sale 100 December 5 Sale 100 December 10 Purchase 25 95 Required: Compute the cost of goods sold and ending inventory using the perpetual inventory system for the LIFO cost flow assumption. Ending inventory Cost of goods soldarrow_forwardPark Company’s perpetual inventory records indicate the following transactions in the month of June: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods?what do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces…arrow_forwardThe Luann Company uses the periodic inventory system. The following July data are for an item in Luann's inventory: July 1 Beginning inventory 30 units @ 10 Purchased $9 per unit 50 units @ $11 per unit 15 Sold 60 units 26 Purchased 25 units @ $13 per unit Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) the weighted-average cost methods. Note: Round your cost per unit to three decimal places, if needed. Then round your final answers to the nearest dollar. A. First-in, First-out: Ending Inventory Cost of Goods Sold: B. Last-in, first-out: Ending Inventory Cost of Goods Sold: C. Weighted-average cost: Ending Inventory Cost of Goods Soldarrow_forward

- In chronological order, the inventory, purchases, and sales of a single product for a recent month are as follows (see attached). 1.Using the periodic inventory system, compute the cost of ending inventory, cost of goods sold, and gross margin. Use the average-cost, FIFO, and LIFO inventory costing methods. (Round unit costs to cents and totals to dollar.) 2.Explain the differences in gross margin produced by the three methods.arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. Required: 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. Date Activities Units Acquired at Cost Units Cost per unit Total cost Units Units Sold at Retail Selling price per Total Sales January 01 Beginning inventory 205 $13.00 $2,665.00 January 10 January 20 January 25 Sales Purchase Sales 165 $22 $3,630.00 140 $12.00 $1,680.00 145 $22 $3,190.00 January 30 310 $11.50 655 Purchase Totals Notice that cost of goods sold, $3,917.22, plus ending inventory, $3,992.78, equals cost of goods available for sale, $7,910.00. Weighted Average Cost of Goods Sold $3,565.00 $7,910.00 310 $6,820.00 Inventory Balance Units Date Activities Cost per unit Cost of goods sold Units Cost per Total Cost January 01 Beginning inventory 205 unit $13.00 $2,665.00 January 10 Sales 165 $13.000 $2,145.00 40 $13.00 $520.00…arrow_forwardYou have the following information for Coronado Inc. for the month ended June 30, 2022. Coronado uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $23 June 4 Purchase 135 26 June 10 Sale 110 53 June 11 Sale return 15 53 June 18 Purchase 55 29 June 18 Purchase return 10 29 June 25 Sale 65 59 June 28 Purchase 35 33 Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost.arrow_forward

- The accounting records of Sheridan Company show the following data. Beginning inventory 2,710 units at $5 Purchases 7,470 units at $7 Sales 9,376 units at $10 Calculate average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Average unit cost ______ Determine cost of goods sold during the period under a periodic inventory system using the FIFO method, the LIFO method, and the average-cost method. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO Average-cost Cost of goods sold: FIFO, LIFO, Average costarrow_forwardNittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Inventory, December 31, prior year For the current year: Purchase, March 21 Purchase, August 1 Inventory, December 31, current year Ending inventory Cost of goods sold FIFO Units 1,960 LIFO 5,100 2,950 4,030 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. Note: Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount. Unit Cost $5 Average Cost 7 8arrow_forwardTamarisk Company uses a periodic inventory system. For April, when the company sold 550 units, the following information is available. April 1 inventory April 15 purchase April 23 purchase Units Unit Cost $26 Ending inventory 230 360 410 1,000 31 Cost of goods sold $ 34 Total Cost $5,980 11.160 Compute the April 30 inventory and the April cost of goods sold using the LIFO method. 13,940 $31.080arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education