FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

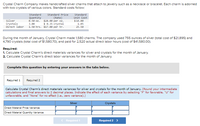

Transcribed Image Text:Crystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or bracelet. Each charm is adorned

with two crystals of various colors. Standard costs follow.

Standard

Standard Price

Standard

Quantity

e.50 oz.

Unit Cost

$14.00

(Rate)

$28.00 per oz.

$ 8.35 crystal

1.50 hrs. $17.00 per hr.

Silver

Crystals

Direct labor

3.00

1.85

25.50

During the month of January. Crystal Charm made 1,580 charms. The company used 755 ounces of silver (total cost of $21,895) and

4.790 crystals (total cost of $1,580.70), and paid for 2,520 actual direct labor hours (cost of $41,580.00).

| cost

Requlred:

1. Calculate Crystal Charm's direct materials variances for silver and crystals for the month of January.

2. Calculate Crystal Charm's direct labor variances for the month of January.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Calculate Crystal Charm's direct materials variances for silver and crystals for the month of January. (Round your intermediate

calculations and final answers to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for

unfavorable, and "None" for no effect (i.e., zero variance).)

Silver

Crystals

Direct Material Price Variance

Direct Material Quantity Variance

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JIngredient A12H is a material used to make Calvin Corporation's major product. The standard cost of Ingredient A12H is $23.00 per ounce and the standard quantity is 3.8 ounces per unit of output. Data concerning the compound for October appear below: a) debit of $3,680. b) credit of $3,680. c) credit of $4,140. d) debit of $4,140.arrow_forwardHelp me with the questions providedarrow_forwardThe direct materials and direct labour standards for one bottle of Clean-All spray cleaner are given below: Standard Quantity or Hours Direct materials Direct labour 7.0 millilitres 0.4 hours Standard Price or Rate $ 0.26 per millilitre $12.00 per hour Standard Cost $1.82 $4.80 During the most recent month, the following activity was recorded: a. 25,000 millilitres of material was purchased at a cost of $0.21 per millilitre. b. All of the material was used to produce 3,000 bottles of Clean-All. c. 750 hours of direct labour time was recorded at a total labour cost of $9,000. Required: 1. Compute the direct materials price and quantity variances for the month. (Indicate the effect of each varlance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (l.e., zero variance).) Materials price variance Materials quantity variance 2. Compute the direct labour rate and efficiency variances for the month. (Indicate the effect of each varlance by selecting "F" for…arrow_forward

- Ava Co. sells custom jewelry for $200. The variable cost per jewel is $160. Ava has fixed operating costs of $4,000. What is Ava's operating breakeven quantity of sales, in units? A. 150 units B. 120 units C. 90 units D. 100 unitsarrow_forwardHow should be the procedure for this questions. Please Scenario: Digital Fingers Glovers bought 378 pairs of gloves at $26 per pair. 220 pairs were sold in the first month, at the regular price of $42 per pair. Another 64 pairs were sold in the second month at a "one-third-off" the regular selling price. The remaining gloves were cleared out in the third month at $16.68. The store's overhead is 17% of cost. 1. What were the total sales? 2. What was the effective rate of markup as a percent of cost? 3. What was the total operating profit or loss on the sale of all of the gloves?arrow_forwardCrystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or bracelet. Each charm is adorned with two crystals of various colors. Standard costs follow: Silver Crystals Direct labor Standard Quantity 0.65 oz. 5.00 Standard (Rate) $25.00 per oz. $ 0.50 per crystal 2.00 hrs. $15.00 per hr. During the month of January, Crystal Charm made 1,500 charms. The company used 935 ounces of silver (total cost of $24,310) and 7,550 crystals (total cost of $3,624.00), and paid for 3,150 actual direct labor hours (cost of $45,675.00). Standard Unit Cost $16.25 2.50 30.00 Required: 1. Calculate Crystal Charm's direct materials variances for silver and crystals for the month of January. (Round your intermediate calculations and final answers to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) Direct Material Price Variance Direct Material Quantity Variance Silver Crystalsarrow_forward

- ok t nces Direct materials: 6 microns per toy at $0.33 per micron Direct labor: 1.2 hours per toy at $7.20 per hour During July, the company produced 5,100 Maze toys. The toy's production data for the month are as follows: Direct materials: 74,000 microns were purchased at a cost of $0.31 per micron. 35,750 of these microns were still in inventory at the end of the month. Direct labor: 6,520 direct labor-hours were worked at a cost of $50,204. Required: 1. Compute the following variances for July: (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount.) a. The materials price and quantity variances. b. The labor rate and efficiency variances. 1a Material price variance 1a. Material quantity variance 1b. Labor rate variance 1b. Labor efficiency variancearrow_forwardH3. Accountarrow_forwardAm. 105.arrow_forward

- Tri star foot ball manufacturer determine the standard production timefor stitching of a football as 80 minutes. Worker engaged in this operationare classified in the pay scale of 600 dollars per day of 8 hours. During a dayoutput of the four worker were given below. You are required to calculatethe wage of the worker if 100 percent premium is paid for time saved. A…………..9 UNITSB…………..7 UNITSC…………..6 UNITSD…………..5 UNITSarrow_forwardThe Walton Toy Company manufactures four dolls and a sewing kit. It provided the following data for next year: Demand Next Selling Price year (units) per Unit 61,000 $ 20.00 53,000 46,000 Direct Materials $ 5.40 $2.20 $ 8.09 $ 3.10 $ 6.50 $33.50 44,400 $14.00 336,000 $ 9.10 $ 4.30 Product Debbie Trish Sarah Mike Sewing kit The following additional information is available: a. The company's plant has a capacity of 113,140 direct labor-hours per year on a single-shift basis. Each employee and piece of equipment are capable of making all five products. b. Next year's direct labor pa rate will be $9 per hour. c. Fixed manufacturing costs total $630,000 per year. Variable overhead costs are $2 per direct labor-hour. d. All of the company's nonmanufacturing costs are fixed. e. The company's finished goods inventory is negligible and can be ignored. Required: 1. How many direct labor-hours are used to manufacture one unit of each of the company's five products? 2. How much variable overhead…arrow_forwardanswer in 20 minutes Imperial Jewelers manufactures and sells a gold bracelet for $407.00. The company’s accounting system says that the unit product cost for this bracelet is $274.00 as shown below: Direct materials $ 148Direct labor 90Manufacturing overhead 36Unit product cost $ 274 The members of a wedding party have approached Imperial Jewelers about buying 26 of these gold bracelets for the discounted price of $367.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $13. Imperial Jewelers would also have to buy a special tool for $456 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education