Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

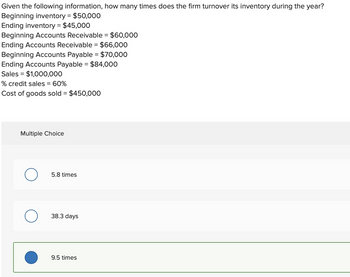

Transcribed Image Text:Given the following information, how many times does the firm turnover its inventory during the year?

Beginning inventory = $50,000

Ending inventory = $45,000

Beginning Accounts Receivable = $60,000

Ending Accounts Receivable = $66,000

Beginning Accounts Payable = $70,000

Ending Accounts Payable = $84,000

Sales = $1,000,000

% credit sales = 60%

Cost of goods sold = $450,000

Multiple Choice

5.8 times

38.3 days

9.5 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Inventory Turnover & GMROI 1) The dress department had the following performance last year. Net sales were $150,000. Average inventory was $28,000 at retail. Cumulative markup was 48%. Gross margin was 42%. A. What is the GMROI? B. Interpret the GMROI figure in words: C. What is the TO? D. Interpret the TO figure in words:arrow_forwardCalculating inventory turnover A7X corporation has ending inventory of $625,817, the cost of goods sold for the year just ended was $9,758,345. What is the inventory turnover? The days sales in inventory? How long, on average, did a unit of inventory sit on the shelf before it was sold?arrow_forwardInventory Analysis A company reports the following: Cost of goods sold $478,150 Average inventory 95,630 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. a. Inventory turnover b. Number of days' sales in inventory daysarrow_forward

- Manshukharrow_forwardLewis Incorporated and Clark Enterprises report the following amounts for the year. Lewis Clark Inventory (beginning) $29,000 $55,000 Inventory (ending) 23,000 65,000 Purchases 339,000 177,000 Purchase returns 20,000 65,000 Required:1. Calculate cost of goods sold for each company.2. Calculate the inventory turnover ratio for each company.3. Calculate the average days in inventory for each company.4. Which company appears to be managing its inventory more efficiently?arrow_forward1 A firm uses an inventory item with the following characteristics. Cost per-item $ 6.00 Annual consumption 1,000 Fixed cost per order placed $30.00 Carrying cost of inventory (as a % of dollar value) 25% How many times should the product be reordered each year and what are the related ordering and carrying costs of inventory?arrow_forward

- You are given the following information: STARTING Inventory $10,576 $5,129 $7,991 A/R A/P Credit Sales COGS $92,136 $60,777 ENDING $10,336 ? $7,395 If you are told that the cash cycle for this firm is 37.520 days, what is the value of the ending accounts receivable for the period? Assume that the company operates 365 days per year. Enter your answer to the nearest dollar. Do not include any commas or dollar signs.arrow_forwardUse the following information relating to Clover Company to calculate (a) the inventory turnover ratio, (b) gross margin, and (c) the number of days' sales in inventory ratio, for years 2022 and 2023. Assume a year has 365 days. Do not round intermediate calculations and round your final answers to 3 decimal places. Year 2021 Year 2022 Year 2023 Year 2022 Year 2023 Sales $260,000 305,000 333,000 Cost of Goods Sold $187,500 241,250 242,250 Inventory Turnover Average Inventory $25,000 30,000 38,000 Gross Margin Days' Sales in Inventoryarrow_forwardInventory Analysis A company reports the following: Cost of goods sold $543,120 Average inventory 67,890 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year.arrow_forward

- Average inventory=1,080,000 Debtors=690,000 Gross Profit ratio=10% Credit sales to total sales=20% Inventory turnover ratio=6 times 1 year is taken as 360 days. With the information given above, find the average collection period.arrow_forwardA company has the following information for the current year's operations: Beginning inventory Purchases Net markups Net markdowns Net sales Multiple Choice O Average cost. Management calculates the cost-to-retail percentage as 57.9%, equal to cost of $440,000 ($40,000+ $400,000) divided by retail of $760,000 ($60,000+ $660,000+ $50,000 $10,000). Which application of the retail inventory method is the company using? O O LIFO. Conventional. Cost $ 40,000 400,000 Dollar-value LIFO. Retail $60,000 660,000 50,000 10,000 580,000arrow_forward"On average, a firm sells $2,500,000 in merchandise a month. Its cost of goods sold equals 80 percent of sales, and it keeps inventory equal to one-half of its monthly cost of goods on hand at all times. If the firm analyzes its accounts using a 360-day year, what is the firm's inventory conversion period?" Group of answer choices a. 360 days b. 180 days c. 30 days d. 15 days e. 10 daysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education