FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Creative Computing sells a tablet computer called the Protab. The $740 sales price of a Protab Package includes the following:

- One Protab computer.

- A 6-month limited warranty. This warranty guarantees that Creative will cover any costs that arise due to repairs or replacements associated with defective products for up to six months.

- A coupon to purchase a Creative Probook e-book reader for $225, a price that represents a 40% discount from the regular Probook price of $375. It is expected that 20% of the discount coupons will be utilized.

- A coupon to purchase a one-year extended warranty for $70. Customers can buy the extended warranty for $100 at other times if they do not use the $70 coupon. Creative estimates that 40% of customers will purchase an extended warranty.

- Creative does not sell the Protab without the limited warranty, option to purchase a Probook, and the option to purchase an extended warranty, but estimates that if it did so, a Protab alone would sell for $720.

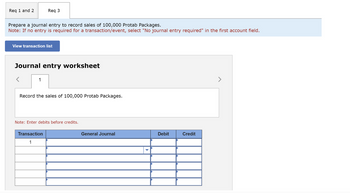

Transcribed Image Text:Req 1 and 2

Prepare a journal entry to record sales of 100,000 Protab Packages.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Req 3

View transaction list

Journal entry worksheet

1

Record the sales of 100,000 Protab Packages.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

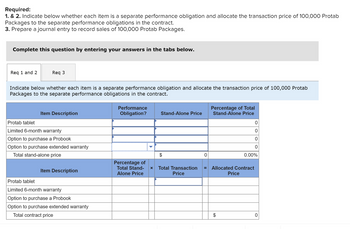

Transcribed Image Text:Required:

1. & 2. Indicate below whether each item is a separate performance obligation and allocate the transaction price of 100,000 Protab

Packages to the separate performance obligations in the contract.

3. Prepare a journal entry to record sales of 100,000 Protab Packages.

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Indicate below whether each item is a separate performance obligation and allocate the transaction price of 100,000 Protab

Packages to the separate performance obligations in the contract.

Item Description

Protab tablet

Limited 6-month warranty

Option to purchase a Probook

Option to purchase extended warranty

Total stand-alone price

Item Description

Protab tablet

Limited 6-month warranty

Option to purchase a Probook

Option to purchase extended warranty

Total contract price

Performance

Obligation?

Percentage of

Total Stand-

Alone Price

Stand-Alone Price

X Total Transaction

Price

0

Percentage of Total

Stand-Alone Price

= Allocated Contract

Price

0

0

0

0

0.00%

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company Acer issues a 10-year notes receivable to customer Red Lasso for $70,000 in exchange for a specialized product. The note states zero interest to the customer but the market rate is 9%. 1) Record JE for the initial sale of the product 2) Record the monthly JE to recognize payment and any associated interest entries Please avoid solutions in an image format thanksarrow_forwardCreative Computing sells a tablet computer called the Protab. The $785 sales price of a Protab Package includes the following: One Protab computer. • A 6-month limited warranty. This warranty guarantees that Creative will cover any costs that arise due to repairs or replacements associated with defective products for up to six months. ● • A coupon to purchase a Creative Probook e-book reader for $425, a price that represents a 50% discount from the regular Probook price of $850. It is expected that 20% of the discount coupons will be utilized. • A coupon to purchase a one-year extended warranty for $55. Customers can buy the extended warranty for $55 at other times as well. Creative estimates that 45% of customers will purchase an extended warranty. Creative does not sell the Protab without the limited warranty, option to purchase a Probook, and the option to purchase an extended warranty, but estimates that if it did so, a Protab alone would sell for $765. All Protah salos r ●arrow_forwardFoxtrot Corporation is purchasing a new Ford Transit delivery van for $24,600. Its lender requires a maximum loan to value ratio of 80% on the purchase price of the vehicle. The term of the loan is 5 years. The interest rate is 5% APR. The loan is a closed end credit loan. There is no trade-in. Sales tax is 7%. Documentation fee is $275. a. What is the total cost of the delivery van including purchase price, sales tax, and documentation fee; and how much is classified as an asset on the balance sheet and how much is classified as an expense on the income statement? b. How much cash must Foxtrot Corporation have to make the down payment? c. How much of the first monthly payment will be interest and how much of the last monthly payment will be interest?arrow_forward

- ! Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $16 and its retail selling price is $80. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 80 razors for $6,400 cash. November 30 December 9 December 16 December 29 December 31 January 5 January 17 January 31 View transaction list Recognized warranty expense related to November sales with an adjusting entry. Replaced 16 razors that were returned under the warranty. Sold 240 razors for $19,200 cash. Replaced 32 razors that were returned under the warranty. Recognized warranty expense related to December sales with an adjusting entry. Sold 160 razors for $12,800 cash.…arrow_forwardComputer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90-day warranty against defects. Based on previous experience, Computer Wholesalers expects warranty costs to be approximately 4% of sales. Sales for the month of December are $400,000. Actual warranty expenditures in January of the following year were $13,000. Required: 1. Does this situation represent a contingent liability? 2. & 3. Record the necessary entries in the Journal Entry Worksheet below. 4. What is the balance in the Warranty Liability account after the entries in Parts 2 and 3?arrow_forwardDengerarrow_forward

- Mammoth Publishing, Incorporated owns a weekly magazine called “Nova Health,” and sells annual subscriptions for $86. Customers prepay their subscription fee and receive 52 issues starting in the following month. The company also offers new subscribers a 30% discount coupon on its other weekly magazine called “Fishing & Camping,” which has a list price of $70 for an annual subscription. Mammoth estimates that approximately 10% of the discount coupons will be redeemed.\\n\\nRequired:\\n(a) How many performance obligations are in a single subscription contract?\\n\\n(b) Prepare the journal entry to account for one new subscription of “Nova Health,” clearly identifying the revenue or deferred revenue associated with each performance obligation.arrow_forwardCreative Computing sells a tablet computer called the Protab. The $890 sales price of a Protab Package includes the following: • One Protab computer. • A 6-month limited warranty. This warranty guarantees that Creative will cover any costs that arise due to repairs or replacements associated with defective products for up to six months. • A coupon to purchase a Creative Probook e-book reader for $270, a price that represents a 40% discount from the regular Probook price of $450. It is expected that 25% of the discount coupons will be utilized. • A coupon to purchase a one-year extended warranty for $65. Customers can buy the extended warranty for $95 at other times if they do not use the $65 coupon. Creative estimates that 30% of customers will purchase an extended warranty. • Creative does not sell the Protab without the limited warranty, option to purchase a Probook, and the option to purchase an extended warranty, but estimates that if it did so, a Protab alone would sell for $870.…arrow_forwardOn October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $16 and its retail selling price is $80. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. November 11 Sold 60 razors for $4,800 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $14,400 cash. December 29 Replaced 24 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 120 razors for $9,600 cash. January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education