FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

dont uplode any image in answer

Prepare the appropriate

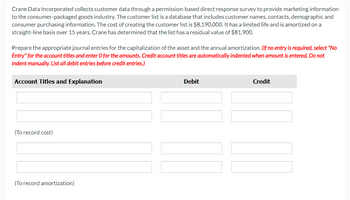

Transcribed Image Text:Crane Data Incorporated collects customer data through a permission-based direct response survey to provide marketing information

to the consumer-packaged goods industry. The customer list is a database that includes customer names, contacts, demographic and

consumer purchasing information. The cost of creating the customer list is $8,190,000. It has a limited life and is amortized on a

straight-line basis over 15 years. Crane has determined that the list has a residual value of $81,900.

Prepare the appropriate journal entries for the capitalization of the asset and the annual amortization. (If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually. List all debit entries before credit entries.)

Account Titles and Explanation

(To record cost)

(To record amortization)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWildhorse Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020. The lease is for an 8-year period and requires equal annual payments of $30,384 at the beginning of each year. The first payment is received on January 1, 2020. Wildhorse had purchased the machine during 2019 for $130,000. Collectibility of lease payments by Wildhorse is probable. Wildhorse set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Wildhorse at the termination of the lease.arrow_forwardit was wrong i need helparrow_forward

- On January 1, 2023 (the first day of its fiscal year) Blossom Ltd. acquired a patent which gave the company the right to use a production process. The process met the six criteria for capitalization as an intangible asset. Below is a listing of the events relating to the patent over the five fiscal years from 2023 through 2027: 2023: on January 1, acquired the patent for the production process for a cash payment of $17,500,000, and determined that the process had an indefinite useful life. on December 31, tested the patent for impairment and determined that its fair value was $18,200,000. 2024: on December 31, tested the patent for impairment and determined that its fair value was $16,400,000. 2025: on December 31, tested the patent for impairment and determined that its fair value was $17,300,000. 2026: on January 1, determined that the useful life of the patent was no longer indefinite, its carrying amount was recoverable, its estimated remaining useful life was 8 years, its…arrow_forwardconverted into preferred stock. Assuming that the book value method was used, what entry would be made? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account title and enter 0 for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardBlue Spruce Corporation purchased $64,800 of 4-year, 7% bonds of Hu Inc. for $60,526 to yield an 9% return. It classified the purchase as an amortized cost method investment. The bonds pay interest semi-annually.arrow_forward

- Nonearrow_forwardPronghorn Group has negotiated the purchase of a new piece of automatic equipment at a price of HK$6,160 plus trade-in, fo.b. factory. Pronghorn paid HK$6,160 cash and traded in used equipment. The used equipment had originally cost HK$54,560; it had a book value of HK$36,960 and a secondhand fair value of HK$40,320, as indicated by recent transactions involving similar equipment. Freight and installation charges for the new equipment required a cash payment of HK$960. (a) Your answer is correct. ress Prepare the general journal entry to record this transaction, assuming that the exchange has commercial substance. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. Include in your journal entry separate account entries for both the new and old equipment. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Equipment Accumulated Depreciation Equipment Equipment Cashi…arrow_forwardPlease don't give image formatarrow_forward

- On January 1, 2022, Sandhill Co. had a balance of $411,000 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $307,650. July 1 Sept. 1 Acquired a 9-year franchise; expiration date July 1, 2,031, $576,000. Research and development costs $178,500.arrow_forwardBlossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardSpring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments: E (Click the icon to view the balances.) The aging of accounts receivable yields the following data: E (Click the icon to view the accounts receivable aging schedule.) Requirements Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. 1. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec. 31 Data Table Accounts Receivable Allowance for Bad Debts 66,000 1,615 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Print Done Data Table Age of Accounts Receivable 0-60 Days Over 60 Days Total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education