FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

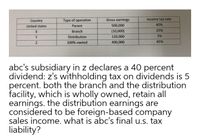

Transcribed Image Text:Country

Type of operation

Gross earnings

Income tax rate

United states

Parent

500,000

40%

X.

Branch

(10,000)

25%

Y

Distribution

120,000

5%

100%-owned

400,000

45%

abc's subsidiary in z declares a 40 percent

dividend: z's withholding tax on dividends is 5

percent. both the branch and the distribution

facility, which is wholly owned, retain all

earnings. the distribution earnings are

considered to be foreign-based company

sales income. what is abc's final u.s. tax

liability?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of capital GB timbers GMBh, based in germany,supplier timber products to construstion and manufacturing industries.The company reported after -tax earnings available to common stock of $3,200,000.from these earning ,the management decided to pay dividednd of $0.80 on each of its 4,000,000 common shared out standing.The capital structure of company includeds 30% debt ,40% common stock and 30% preferred stock.The tax rate applicable to GB timber is30%. a) if the markt price of common stock is $3.60 and dividens are expected to growat a rate of 8% per year for the foreseable future,what is the requeired returned on the company's common stock? b) if underpricing and flotation costs on new shares of common stock amount to $0.40 per share ,what is the company's cost of new common stock financing? c)The company can issue a $1.00 dividend preferred stock for a market price of $10.00 per share.Flotation costs would amount to $0.60 per share. What is the cost of preferred stock financing?…arrow_forwardParent Corporation is located in a country with an income tax rate of 40%. Subsidiary Company located in a country with an income tax rate of 25%. The best tax strategy for the enterprise would be to set the transfer prices on sales of goods from the subsidiary to the parent at a price that is a. higher than the price that would be in effect for unrelated parties in an arms length transaction. b. lower than the price that would be in effect for unrelated parties in an arms length transaction. c. equal to the price that would be in effect for unrelated parties in an arms length transaction. d. transfer prices do not affect overall tax paid.arrow_forwardA US corporation A buys a share of preferred stock of another US firm B (non-affiliated) at $40 and sells it at year-end at $40. The firm A receives a $4 year-end dividend. The firm A is in the 21% tax bracket. What is their after-tax return for this investment during this period? Answer in percentage. Group of answer choices 0.63% 3.00% 5.00% 8.95% 9.37%arrow_forward

- Investco Ltd., a private corporation, received dividend income from taxable Canadian corporations during its year ended December 31, 2023, as follows. Investco Ltd. owns 50% of the issued shares of Subsidiary. Subsidiary's dividend refund for its year ended December 31, 2023 was $4,500. Portfolio dividends from public corporations $ 50,000 Dividends from Subsidiary 65,000 $115,000 Required: Calculate the Part IV tax payable by Investco Ltd. for its year ended December 31, 2023. (Use 0.3833 when multiplying by 38.33% and round your answers to the nearest whole number. Enter all numbers as positive amounts. If an amount should be zero, enter "O".) Part IV tax on dividends received from public corporations Part IV tax on dividends received from Subsidiary Total Part IV tax 0arrow_forwardChristina Company (a U.S.-based company) has a subsidiary in Canada that began operations at the start of 2020 with assets of 142,000 Canadian dollars (CAD) and liabilities of CAD 74,000. During this initial year of operation, the subsidiary reported a profit of CAD 36,000. It distributed two dividends, each for CAD 6,000 with one dividend declared on March 1 and the other on October 1. Applicable U.S. dollar ($) exchange rates for 1 Canadian dollar follow: January 1, 2020 (start of business) $0.79 March 1, 2020 0.77 Weighted average rate for 2020 0.76 October 1, 2020 0.75 December 31, 2020 0.74 Compute the net translation adjustment the company will report in accumulated other comprehensive income for the year 2020 under this second set of circumstances. Assume that the Canadian dollar is this subsidiary’s functional currency. What translation adjustment would the company report for the year 2020?arrow_forwardHw.10.arrow_forward

- Nexus Tech's Earnings and the Fall of the Dollar. Nexus Tech is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Nexus Tech is traded on the NASDAQ. Nexus Tech currently has 652,000 shares outstanding. The basic operating characteristics of the various business units is as follows: Nexus Tech must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Nexus Tech's consolidated earnings and consolidated earnings per share in U.S. dollars? The dollar has experienced significant swings in value against most of the world's currencies in recent years. b. What would be the impact on Nexus Tech's consolidated EPS if all foreign currencies were to appreciate 18% against the U.S. dollar? c. What would be the impact on Nexus Tech's consolidated EPS if all foreign currencies were to depreciate 18% against the…arrow_forwardAustralian Tax Law - Specific Deductions ABC Pty Ltd is in the business of manufacturing furniture and has an annual turnover of $200 million. In this income year, it intends to pay $60 million to acquire a competitor, comprising of the following items: Production equipment: $10 million; Registered design: $20 million; and Goodwill: $30 million. You are required to advise the company of its income tax implications of the above proposed transaction. You are NOT required to compute the amount of capital allowance.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education