FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

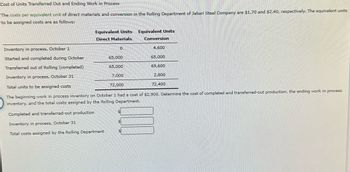

Transcribed Image Text:Cost of Units Transferred Out and Ending Work in Process

The costs per equivalent unit of direct materials and conversion in the Rolling Department of Jabari Steel Company are $1.70 and $2.40, respectively. The equivalent units

to be assigned costs are as follows:

Equivalent Units

Direct Materials

0

Inventory in process, October 1

Started and completed during October

Transferred out of Rolling (completed)

Inventory in process, October 31

Total units to be assigned costs

72,000

The beginning work in process inventory on October 1 had a cost of $2,900. Determine the cost of completed and transferred-out production, the ending work in process

inventory, and the total costs assigned by the Rolling Department.

Completed and transferred-out production

Inventory in process, October 31

Total costs assigned by the Rolling Department

65,000

65,000

7,000

Equivalent Units

Conversion

4,600

65,000

69,600

S

2,800

72,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Rolling Department of Oak Ridge Steel Company are $1.05 and $0.80, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, July 1 0 3,500 Started and completed during July 50,000 50,000 Transferred out of Rolling (completed) 50,000 53,500 Inventory in process, July 31 5,000 2,000 Total units to be assigned costs 55,000 55,500 The beginning work in process inventory on July 1 had a cost of $2,000. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department. Completed and transferred-out production $fill in the blank 1 Inventory in process, ending $fill in the blank 2 Total costs assigned by the Rolling Department $fill in the blank 3arrow_forward*The cost per equivalent units of direct materials and conversion in the Roasting Department of Robusta Coffee Company are $0.60 and $0.25, respectively. The equivalent units to be assigned costs are as follows: Inventory in process, beginning of period Direct Materials Conversion 0 3,000 Started and completed during the period 52,000 52,000 Transferred out of Roasting (completed) 52,000 55,000 Inventory in process, end of period Total units to be assigned costs 3,500 2,100 55,500 57,100 The beginning work in process inventory had a cost of $6,500. Based on the information provided, the total cost of units completed and transferred-out production is equal to: $54,075 $2,625 $51,450 $44,200arrow_forwardEquivalent Units of Conversion Costs The Rolling Department of Jabari Steel Company had 4, 698 tons in beginning work in process inventory (10% complete) on October 1. During October, 52, 200 tons were completed. The ending work in process inventory on October 31 was 3, 132 tons (60% complete). What are the total equivalent units for conversion costs? Round to the nearest whole unit.arrow_forward

- Equivalent Units; Assigning Costs; Cost Reconciliation—Weighted-Average Method Superior Micro Products uses the weighted-average method in its process costing system. During January, the Delta Assembly Department completed its processing of 25,000 units and transferred them to the next department. The cost of beginning work in process inventory and the costs added during January amounted to 5599,780 in total. The ending work in process inventory in January consisted of 3,000 units, which were 80% complete with respect to materials and 60% complete with respect to labor and overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the month. 2. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January. 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and…arrow_forwardMaterials are added at the beginning of the production process. Conversion costs are added uniformly throughout the production process. Assuming a FIFO flow of costs, what is this company's computed total production cost transferred out during the period?arrow_forwardCost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Rolling Department of Kraus Steel Company are $0.55 and $2.55, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, October 1 0 4,100 Started and completed during October 59,000 59,000 Transferred out of Rolling (completed) 59,000 63,100 Inventory in process, October 31 7,000 3,500 Total units to be assigned costs 66,000 66,600 The beginning work in process inventory on October 1 had a cost of $2,500. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department. Completed and transferred-out production Inventory in process, October 31 Total costs assigned by the Rolling Departmentarrow_forward

- Answer to this questionarrow_forwardCost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Rolling Department of Jabari Steel Company are $2.35 and $0.70, respectively. The equivalent units to be assigned costs are as follows: Inventory in process, October 1 Started and completed during October Transferred out of Rolling (completed) Inventory in process, October 31 Equivalent Units Direct Materials 0 Equivalent Units Conversion 3,200 54,000 54,000 54,000 7,000 Total units to be assigned costs 61,000 The beginning work in process inventory on October 1 had a cost of $2,080. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department. Completed and transferred-out production Inventory in process, October 31 Total costs assigned by the Rolling Department 57,200 2,100 59,300arrow_forwardEquivalent Units of Conversion Costs The Rolling Department of Jabari Steel Company had 2,814 tons in beginning work in process inventory (20% complete) on October 1. During October, 40,200 tons were completed. The ending work in process inventory on October 31 was 2,010 tons (10% complete). What are the total equivalent units for conversion costs? Round to the nearest whole unit. unitsarrow_forward

- Cost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Rolling Department of Kraus Steel Company are $2.30 and $1.85, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, October 1 1,500 Started and completed during October 30,000 30,000 Transferred out of Rolling (completed) 30,000 31,500 Inventory in process, October 31 3,000 1,800 Total units to be assigned costs 33,000 33,300 The beginning work in process inventory on October 1 had a cost of $920. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department. Completed and transferred-out production 181,000 x Inventory in process, October 31 Total costs assigned by the Rolling Department Feedback TCheck My Work The assumption would be that units that had been in beginning work in…arrow_forwardHelparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education