FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

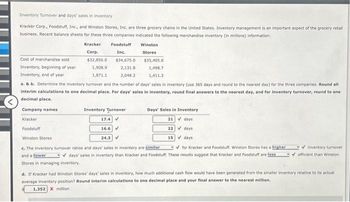

Transcribed Image Text:Inventory Turnover and days' sales in inventory

Kracker Corp., Foodstuff, Inc., and Winston Stores, Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail

business. Recent balance sheets for these three companies indicated the following merchandise inventory (in millions) information:

Cost of merchandise sold

Inventory, beginning of year

Inventory, end of year

Kracker

Corp.

$32,850.0

1,908.9

1,871.1

Foodstuff

Inc.

Stores in managing inventory.

$34,675.0

2,131.8

2,048.2

Winston

Stores

$35,405.0

1,498.7

1,411.3

a. & b. Determine the inventory turnover and the number of days' sales in inventory (use 365 days and round to the nearest day) for the three companies. Round all

interim calculations to one decimal place. For days' sales in inventory, round final answers to the nearest day, and for inventory turnover, round to one

decimal place.

Company names

Inventory Turnover

Kracker

17.4 V

Foodstuff

16.6 ✔

Winston Stores

24.3

c. The inventory turnover ratios and days' sales in inventory are similar

and a lower

Days' Sales in Inventory

21

days

22

days

15

days

✔for Kracker and Foodstuff. Winston Stores has a higher

✓days' sales in inventory than Kracker and Foodstuff. These results suggest that Kracker and Foodstuff are less

✓inventory turnover

✓efficient than Winston

d. If Kracker had Winston Stores' days' sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual

average inventory position? Round interim calculations to one decimal place and your final answer to the nearest million.

1,352 X million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculating inventory turnover A7X corporation has ending inventory of $625,817, the cost of goods sold for the year just ended was $9,758,345. What is the inventory turnover? The days sales in inventory? How long, on average, did a unit of inventory sit on the shelf before it was sold?arrow_forwardCalculate inventory turnover at cost (to nearest hundredth, format as 1.23 that's it, it's a ratio): Ending inventory $25,000 Cost of goods sold $43,000 Beginning inventory $15,000 Net sales $55,800arrow_forwardInventory Analysis The following data were extracted from the income statement of Keever Inc.: Current Year Previous Year Sales $1,168,000 $1,222,000 Beginning inventories 84,800 75,984 Cost of goods sold 584,000 678,900 Ending inventories 76,800 84,800 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. Round interim calculations to the nearest dollar and the final answers to one decimal place. Assume 365 days a year. Current Year Previous Year 1. Inventory turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in inventory fill in the blank 3 days fill in the blank 4 daysarrow_forward

- Inventory Analysis A company reports the following: Cost of goods sold $478,150 Average inventory 95,630 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. a. Inventory turnover b. Number of days' sales in inventory daysarrow_forwardThe following is information for Palmer Co. Year 3 Year 2 Year 1 Cost of goods sold $ 643,825 $ 426,650 $ 391,300 Ending inventory 97,400 87,750 92,500 Use the above information to compute inventory turnover for Year 3 and Year 2, and its days' sales in inventory at December 31, Year 3 and Year 2.arrow_forwardSCC Company reported the following for the current year: Net sales $ 48,000 Cost of goods sold 40,000 Beginning balance in inventory 2,000 Ending balance in inventory 8,000 Compute (a) inventory turnover and (b) days’ sales in inventory. Compute the inventory turnover. Inventory Turnover Numerator: / Denominator: = Inventory Turnover / = Inventory turnover / = 0 times Compute the days’ sales in inventory. Days’ Sales In Inventory Numerator: / Denominator: × Days = Days’ Sales In Inventory / × = Days’ sales in inventory / × = 0 daysarrow_forward

- Inventory Analysis A company reports the following: Cost of merchandise sold $569,400 Average merchandise inventory 87,600 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. a. Inventory turnover fill in the blank 1 b. Number of days' sales in inventory fill in the blank 2 daysarrow_forwardGiven the following data, what is cost of goods sold as determined by the FIFO method? Sales Beginning inventory Purchases OA. $1,750 O B. $2,040 O C. $1,600 OD. $3,200 320 units 290 units at $5 per unit 88 units at $10 per unitarrow_forwardQuestion Content Area Based on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $598,636 Cost of merchandise sold during year 212,753 Accounts receivable, beginning of year 44,419 Accounts receivable, end of year 53,126 Merchandise inventory, beginning of year 32,158 Merchandise inventory, end of year 39,584arrow_forward

- pp. Subject :- Accountingarrow_forwardInventory turnover and number of days’ sales in inventory Financial statement data for years ending December 31 for Tango Company follow: 20Y7 20Y6 Cost of goods sold $3,791,255 $4,079,970 Inventories: Beginning of year 773,800 737,300 End of year 839,500 773,800 Required a. Determine the inventory turnover for 20Y7 and 20Y6. Round to one decimal place. 20Y7 20Y6 Inventory turnover b. Determine the number of days’ sales in inventory for 20Y7 and 20Y6. Use 365 days and round to one decimal place. 20Y7 20Y6 Number of days’ sales in inventory days days c. Are the changes in inventory turnover and the number of days’ sales in inventory from 20Y6 to 20Y7 favorable or unfavorable?arrow_forward21arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education