FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

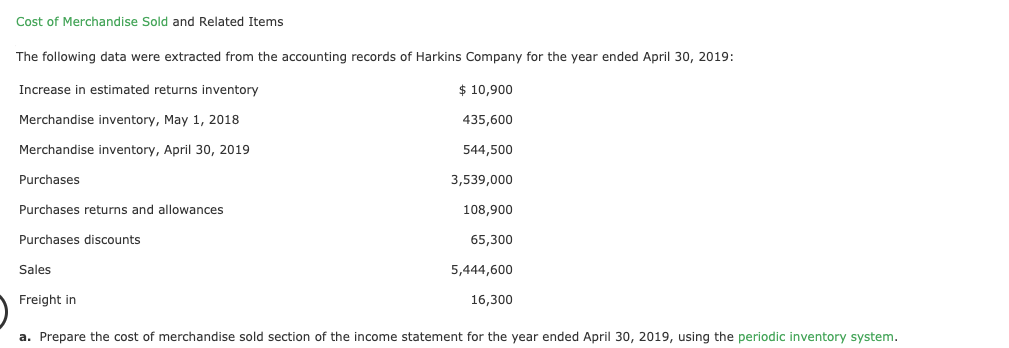

Transcribed Image Text:Cost of Merchandise Sold and Related Items

The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019:

Increase in estimated returns inventory

$ 10,900

Merchandise inventory, May 1, 2018

435,600

Merchandise inventory, April 30, 2019

544,500

Purchases

3,539,000

Purchases returns and allowances

108,900

Purchases discounts

65,300

Sales

5,444,600

Freight in

16,300

a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system.

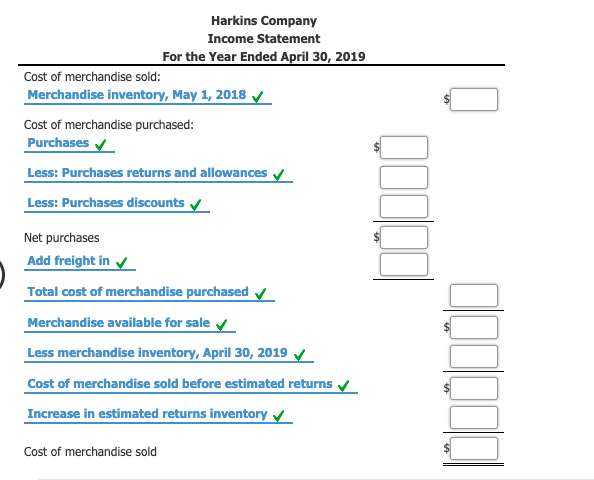

Transcribed Image Text:Harkins Company

Income Statement

For the Year Ended April 30, 2019

Cost of merchandise sold:

Merchandise inventory, May 1, 2018 y

Cost of merchandise purchased:

Purchases

Less: Purchases returns and allowances v

Less: Purchases discounts v

Net purchases

Add freight in /

Total cost of merchandise purchased

Merchandise available for sale v

Less merchandise inventory, April 30, 2019

Cost of merchandise sold before estimated returns v

Increase in estimated returns inventory v

Cost of merchandise sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Question Content Area Based on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $586,967 Cost of merchandise sold during year 176,594 Accounts receivable, beginning of year 46,824 Accounts receivable, end of year 52,382 Merchandise inventory, beginning of year 31,526 Merchandise inventory, end of year 40,442 a.21.2 b.4.9 c.16.3 d.3.9arrow_forwardPerpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for May are as follows: Inventory Purchases May 10 May 1 2,900 units at $37 1,450 units at $39 1,305 units at $41 Sales May 12 14 2,030 units 1,740 units 20 31 870 units a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Prepaid Cell Phones Cost of Merchandise Sold Purchases Purchases Quantity Quantity Unit Cost Inventory Inventory Inventory Quantity Unit Cost Total Cost Unit Cost Total Cost Sold Date Purchased May 1 BE May 10 May 12 May…arrow_forwardFIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale during the year: DATA Beginning inventory Sale First purchase Sale Second purchase Sale Ending inventory Quantity 8,100 5,000 15,400 12,600 15,900 13,100 8,700 REQUIRED: a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? a. FIFO method b. LIFO method Price Inventory Cost Using formulas and cell references from the problem data, perform the required analysis. Formulas entered in the green cells orange cells. Transfer amounts to CNOWv2 for grading. $160 $300 $167 Formulas $300 $172 $300arrow_forward

- Requirements: Complete the Ending Inventory and Cost of Goods Sold schedules for each inventory costing method; FIFO, LIFO, WAVG. Complete the Income Statement and Cash Flow Statement under each inventory costing method. Explain the differences in Net Income under each inventory costing method. Notes: Operating Expenses and taxes were paid in cash. The company's beginning cash balance was $1,200. Cost of Goods Available For Sale Unit Total Units Price Cost Beginning Inventory 150.0 15.0 First Purchase (cash) 100.0 16.0 Second Purchase (cash) 190.0 17.2 Total Cost of Goods Available for Sale Weighted Average Cost Cost of Goods Available For Sale Unit Total Units Price Cost Beginning Inventory 150.0 15.0 First Purchase (cash)…arrow_forwardsssssarrow_forwardLIFO (perpetual) Inventory Cost of Goods Purchased Cost of Goods Sold Cost of Inventory Remaining Numberof units Unit Cost Total Cost Numberof units Unit Cost Total Cost Numberof units Unit Costarrow_forward

- Required information [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Activities Beginning inventory Sales Purchase Sales Purchase Sales Purchase Totals Date January 1 January 10 March 14 March 15 July 30 October 5 October 26 a) Cost of Goods Sold using Specific Identification Available for Sale Date January 1 March 14 July 30 October 26 Less: Equals: Activity Beginning Inventory Purchase Purchase Purchase b) Gross Margin using Specific Identification # of units Units Acquired at Cost 300 units @ $14.00 = @ $19.00 = @ $24.00 = @ $29.00 = 300 520 500 200 1,520 520 units 500 units 200 units 1,520 units Ending inventory consists of 50 units from the March 14 purchase, 80 units from the July 30 purchase, and all 200 units from the October 26 purchase. Using the specific identification method, calculate the following. Cost Per # of units Unit sold MITSTRA 480 units @ $44.00 @…arrow_forwardCurrent Attempt in Progress Assume that Pharoah Company uses a periodic inventory system and has these account balances: Purchases $392,700, Purchase Returns and Allowances $12,300, Purchase Discounts $8,800, and Freight-In $15,300. Determine net purchases and cost of goods purchased. Net purchases Cost of goods purchased $ $ Iarrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item ER27 are as follows: May 1 Inventory 72 units @ $17 9 Sale 58 units 13 Purchase 76 units @ $19 28 Sale 22 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on May 28 and (b) the inventory on May 31. a. Cost of merchandise sold on May 28 b. Inventory on May 31arrow_forward

- Determining the Beginning and Ending Inventory from a Partial Spreadsheet: Periodic Inventory System From the following partial spreadsheet, indicate the dollar amount of beginning and ending merchandise inventory to be used to compute cost of goods sold. ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT Merchandise Inventory Estimated Returns Inventory Supplies Prepaid Insurance Customer Refunds Payable Income Summary 60,000.00 55,000.00 60,000.00 6,000.00 5,500.00 6,000.00 4,700.00 3,300.00 1,600.00 3,800.00 2,200.00 7,200.00 55,000.00 60,000.00 55,000.00 60,000.00 5,500.00 6,000.00 5,500.00 6,000.00 Sales Sales Returns and Allowances 525,140.00 2,200.00 16,700.00 Beginning inventory 55,000 x Ending inventory 60,000 xarrow_forwardd. Weighted average. Goods Purchased Cost of Goods Sold Balance in Inventory Date Units Unit Cost Total $ Units Unit Cost Total $ Units Unit Cost Total $ Jan. 1 200 $2.00 3 400 $3.00 8 400 $5.00 10 15 300 $7.00 20 27 400 $7.00 Northgate Products Corp. sells gadgets and uses the perpetual inventory system. During the month of January 2019, the number of gadgets purchased and sold was as follows: Purchased Sold Balance in inventory Date Units Unit cost Total $ Units Unit cost Total $ Units Unit cost Total $ Jan. 1 200 $2 3 400 $3 8 400 $5 10 700 * 15 300 $7 20 300 ** 27 400 $7…arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education