FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

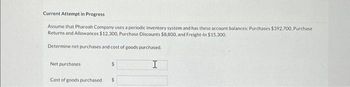

Current Attempt in Progress Assume that Pharoah Company uses a periodic inventory system and has these account balances: Purchases $392,700, Purchase Returns and Allowances $12,300, Purchase Discounts $8,800, and Freight-In $15,300. Determine net purchases and cost of goods purchased. Net purchases Cost of goods purchased $ $ I

Transcribed Image Text:Current Attempt in Progress

Assume that Pharoah Company uses a periodic inventory system and has these account balances: Purchases $392,700, Purchase

Returns and Allowances $12,300, Purchase Discounts $8,800, and Freight-In $15,300.

Determine net purchases and cost of goods purchased.

Net purchases

Cost of goods purchased i

$

$

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DETERMINING THE BEGINNING AND ENDING INVENTORY FROM A PARTI ALSPREADSHEET: PERIODIC INVENTORY SYSTEM From the following partial spreadsheet, indicate the dollar amount of beginning and ending merchandise inventory to be used to compute cost of goods sold.arrow_forwardAssume the perpetual inventory system is used. Sales $642,363 Merchandise Inventory 582,620 Sales Discounts 58,010 Interest Expense 3,777 Sales Returns and Allowances 90,232 Interest Revenue 10,268 Cost of Goods Sold 225,598 Rent Expense 15,090 Depreciation Expense-Office Equipment 3,400 Insurance Expense 2,450 Advertising Expense 12,870 Accounts Receivable 101,440 Office Supplies Expense 1,600 Rent Revenue 23,680 Sales Salaries Expense 30,410 Accounts Payable 138,404 Common Stock 59,419 Marketing Expense 33,000 A. Use the data provided to compute net sales for 2019.arrow_forwardUsing the chart of accounts below. Prepare a journal entries of Quarantino Covidap under periodic inventory system.arrow_forward

- Suppose that Ivanhoe uses a periodic inventory system and has these account balances: Purchases $571,000; Purchase Returns and Allowances $11,800; Purchases Discounts $9,100; and Freight-In $14,300. Determine net purchases and cost of goods purchased. Net purchases tA Cost of goods purchased $arrow_forwardThe following data is given for Co. A., a merchandising company. Assume the company uses the Periodic Inventory system and that the cost of goods sold is $ 300,000, $14.000 40.000 60.000 2 4.000 6.000 Freight-In Merchandise Inventory, January 1, 2020 Merchandise Inventory, January 31, 2020 Purchases Purchase Returns Purchase Discounts Required: a. Calculate the missing amount for "Purchases" b. Calculate the "Cost of Goods Sold"arrow_forwardPlease help me make a perpetual FIFO, perpetual LIFO, Weighted Average, and Specific ID chart. Thank youarrow_forward

- The following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a perpetual inventory system. July 1 Purchased merchandise from Sabol Imports Co., $13,322, terms FOB destination, n/30. 3 Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. 5 Purchased merchandise from Schnee Co., $13,700, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Schnee Co. for merchandise with an invoice amount of $4,850 returned from purchase on July 5. 13 Paid Saxon Co. for invoice of July 3. 14 Paid Schnee Co. for invoice of July 5, less debit memo of July 6. 19 Purchased merchandise from Southmont Co., $29,840, terms FOB shipping point, n/eom. 19 Paid freight of $410 on July 19 purchase from Southmont Co. 20 Purchased merchandise from Stevens Co., $22,200, terms FOB destination, 1/10, n/30. 30 Paid…arrow_forwardThe following data regarding purchases and sales of a commodity were taken from the related inventory account (perpetual inventory system is used): May 1 Balance 25 units at $41 6 Sale 20 units 8 Purchase 20 units at $42 16 Sale 10 units 20 Purchase 20 units at $43 23 Sale 25 units 30 Purchase 15 units at $45 (a) Determine the total cost of the inventory balance at May 31, using the first-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (b) Determine the total cost of the inventory balance at May 31, using the last-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (a) FIFO (b) LIFOarrow_forwardBremmer uses a periodic inventory system and the following information is available: Sales Beginning Inventory Ending Inventory Purchases What is the cost of goods sold? Select one: Oa. $230,400 Ob. $96,800 Oc. $133,600 Od. $132,200 $ 230,400 21,200 19,800 132,200arrow_forward

- Journalize the following transactions for Armour Inc. Oct. 7 Sold merchandise on credit to Rondo Distributors, for $1,200, terms n/30. The cost of the merchandise was $720. Purchased merchandise, $10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of $525 added to the invoice. Journalize the transactions above using the periodic inventory system. If an amount box does not require an entry, leave it blank. Oct. 7 Oct. 8 Journalize the transactions above using the perpetual inventory system. Oct. 7- Sale Cost Oct. 8arrow_forward[The following information applies to the questions displayed below.] A company reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Quantity Unit Cost Unit NRV Furniture 170 $ 82 $ 97 Electronics 47 370 285 Record the adjustment for inventory. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Cost of Goods Sold Inventoryarrow_forwardHeer Don't upload any image pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education