FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

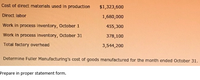

Transcribed Image Text:Cost of direct materials used in production

$1,323,600

Direct labor

1,680,000

Work in process inventory, October 1

455,300

Work in process inventory, October 31

378,100

Total factory overhead

3,544,200

Determine Fuller Manufacturing's cost of goods manufactured for the month ended October 31.

Prepare in proper statement form.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cost per Equivalent Unit: Average Cost Method The following information concerns production in the Forging Department for April. The Forging Department uses the average cost method. ACCOUNT Work in Process—Forging Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit April 1 Bal., 2,300 units, 40% completed 11,704 30 Direct materials, 53,100 units 435,420 447,124 30 Direct labor 181,700 628,824 30 Factory overhead 99,600 728,424 30 Goods transferred, 52,800 units ? ? 30 Bal., 2,600 units, 60% completed ? a. Determine the cost per equivalent unit. Round your answer to the nearest cent.$ per equivalent unit b. Determine the cost of the units transferred to Finished Goods.$ c. Determine the cost of units in ending Work in Process.$arrow_forwardCosts per Equivalent Unit The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Balance Date Item Debit Credit Debit Credit August 1 Bal., 4,200 units, 3/5 completed 9,870 31 Direct materials, 75,600 units 143,640 153,510 31 Direct labor 31 Factory overhead 38,550 21,690 192,060 213,750 31 Goods finished, 76,500 units 206,424 31 Bal., ? units, 2/5 completed 7,326 7,326 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit $ X 2. Conversion cost per equivalent unit $ 3. Cost of the beginning work in process completed during August $ 4. Cost of units started and completed during August $ 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for July and August, did the…arrow_forwardCost of Goods Sold In September, Lauren Ashley Company purchased materials costing $190,000 and incurred direct labor cost of $100,000. Overhead totaled $300,000 for the month. Information on inventories was as follows: September 1 September 30 Materials Work in process Finished goods Required: $120,000 80,000 70,000 $130,000 90,000 65,000 What was the cost of goods sold for September? Xarrow_forward

- Direct Materials Used, Cost of Goods Manufactured In September, Lauren Ashley Company purchased materials costing $210,000 and incurred direct labor cost of $140,000. Overhead totaled $320,000 for the month. Information on inventories was as follows: Materials Work in process Finished goods Required: X September 1 September 30 X $130,000 1. What was the cost of direct materials used in September ? $70,000 $75,000 X $140,000 $70,000 $70,000 2. What was the total manufacturing cost in September ? 3. What was the cost of goods manufactured for September?arrow_forwardGROUPER COMPANY Molding Department Production Cost Report For the Month Ended May 31, 2022 Equivalent Units of Production Physical QUANTITIES Units Materials Units to be accounted for Work in process, May 1 7,360 Started into production 29,440 Total units to be accounted for 36,800 Units accounted for Completed and transferred out 32,200 Work in process, May 31 4,600 Total units accounted for 36,800 COSTS Unit costs Costs in May Materials $128,800 Conversion Costs Conversion Costs $148,580 Total $277,380arrow_forwardCosts per Equivalent Unit The following information concerns production in the Baking Department for December. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department Date Item Debit Credit 161,460 47,970 26,982 ACCOUNT NO. 239,193 Balance Debit Dec. 1 Bal., 6,900 units, 3/5 completed 31 Direct materials, 124,200 units 31 Direct labor 31 Factory overhead 31 Goods finished, 126,000 units 31 Bal., ? units, 3/5 completed a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Credit 11,247 172,707 220,677 247,659 8,466 8,466 00000 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during December 4. Cost of units started and completed during December 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for November and December, did the…arrow_forward

- Cost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $66,000 Direct labor 73,000 Factory overhead 37,000 Work in process inventory, May 1 59,000 Work in process inventory, May 31 58,750 Finished goods inventory, May 1 25,000 Finished goods inventory, May 31 19,000 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $- Select - $- Select - - Select - - Select - Total manufacturing costs incurred during May fill in the blank 47477f001f8204f_9 Total manufacturing costs $fill in the blank 47477f001f8204f_10 - Select - Cost of goods manufactured $fill in the blank 47477f001f8204f_13 Question Content Area b. For May, using the data given, prepare a statement of Cost of Goods…arrow_forward3,800 units, 60% completed Direct materials, 32,000 units Direct labor Factory overhead Total cost to be accounted for $ 60,400 378,000 274,000 168.000 $880.400 During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units which were 85% completed. Inventories are costed by the first-in, first-out method and all materials are added at the beginning of the process. Determine the following (round unit cost data to four decimal places to minimize rounding differences): Equivalent units of production for conversion cost (a) (b) Conversion cost per equivalent unit Total and unit cost of finished goods started in prior period and completed in the current period Total and unit cost of finished goods started and completed in the current period (c) (d) (e) Total cost of work in process inventory, June 30arrow_forwardDirect materials Direct labor Variable manufacturing overhead (based on direct labor-hours) Direct materials (8,100 yards) Direct labor Variable manufacturing overhead Total $36,360 $ 7,070 $ 3,030 During August, the factory worked only 1,080 direct labor-hours and produced 2,700 sets of covers. The following actual costs were recorded during the month: Per Set of Covers $18.00 3.50 Total $ 46,980 $ 9,990 $ 4,590 1. Materials price variance 1. Materials quantity variance 2. Labor rate variance 1.50 $23.00 2. Labor efficiency variance 3. Variable overhead rate variance 3. Variable overhead efficiency variance At standard, each set of covers should require 2.0 yards of material. All of the materials purchased during the month were used in production. Per Set of Covers $ 17.40 3.70 1.70 $22.80 Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency…arrow_forward

- Equivalent Units of Production The following information concerns production in the Finishing Department for July. The Finishing Department uses the weighted average cost (WAC) method. Work in Process-Finishing Department Date July 1 Bal., 20,000 units, 40% completed 31 Direct materials, 144,000 units started 31 Direct labor Item 24,600 345,000 163,200 31 Factory overhead 86,700 31 Goods transferred, 142,500 units -578,550 40,950 31 Bal., ? units, 60% completed a. Determine the number of units in work-in-process inventory at the end of the month. 68,250 X b. Determine the number of units to be accounted for and to be assigned costs and the equivalent units of production for July. Units to be accounted for Units to be assigned costs Equivalent units of production Feedback Previous Nextarrow_forwardCosts per Equivalent Unit The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 8,700 units, 3/5 completed 14,181 31 Direct materials, 156,600 units 203,580 217,761 31 Direct labor 59,950 277,711 31 Factory overhead 33,722 311,433 31 Goods finished, 158,700 units 301,269 10,164 31 Bal., ? units, 2/5 completed 10,164 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost…arrow_forwardCosts per Equivalent Unit The following information concerns production in the Baking Department for December. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process—Baking Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit Dec. 1 Bal., 8,700 units, 3/5 completed 17,313 31 Direct materials, 156,600 units 250,560 267,873 31 Direct labor 70,530 338,403 31 Factory overhead 39,678 378,081 31 Goods finished, 158,700 units 364,749 13,332 31 Bal., ? units, 3/5 completed 13,332 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 1.6 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during December $fill in the blank 3 4. Cost of units started and completed during…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education