FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Cost Behavior

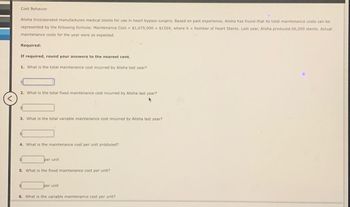

Alisha Incorporated manufactures medical stents for use in heart bypass surgery. Based on past experience, Alisha has found that its total maintenance costs can be

represented by the following formula: Maintenance Cost = $1,675,000+ $150X, where X = Number of Heart Stents. Last year, Alisha produced 66,000 stents. Actual

maintenance costs for the year were as expected.

Required:

If required, round your answers to the nearest cent.

1. What is the total maintenance cost incurred by Alisha last year?

2. What is the total fixed maintenance cost incurred by Alisha last year?

3. What is the total variable maintenance cost incurred by Alisha last year?

4. What is the maintenance cost per unit produced?

per unit

5. What is the fixed maintenance cost per unit?

per unit

6. What is the variable maintenance cost per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Skip Consulting helped Schmidt Roofers put various cost saving techniques into place. Thecontract specifies that Skip will receive a flat fee of $70,000 and an additional $19,000 if Schmidtattains a target amount of cost savings. Skip estimates a 20% chance that Schmidt will reach thetarget for cost savings. Assuming that Skip uses the expected-value approach, what is thetransaction price for this product?a. $19,000b. $70,000c. $73,800d. $89,000arrow_forwardCan you help me with CVP Drill #14?arrow_forwardFeather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 59,000 units and $2,360,000, respectively. If the fixed expenses do not change, how much will net operating income increase? $ 1,000,000 500,000 500,000 200,000 $ 300,000 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 19%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the…arrow_forward

- Assume Hairy-Cairy Salon, a hair styling salon in Matthews, NC, provides cuts, perms, and hairstyling services. Annual fixed costs are $225,000, and variable costs are 40 percent of sales revenue. Sales revenue totaled $450,000. Determine the margin of safety in sales dollars.arrow_forwardHow do you work this problarrow_forwardParker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the same equipment and labor; hence, there are no traceable fixed costs. Common fixed cost equals $40,000. Parker's accountant has begun to assess the profitability of the two lines and has gathered the following data for last year: VasesFigurinesPrice$40$70Variable cost3042Contribution margin$10$28Number of units1,000500 Required: If required, round your final answers to nearest whole value. 1. Compute the number of vases and the number of figurines that must be sold for the company to break even. Break-even vasesfill in the blank 1 unitsBreak-even figurinesfill in the blank 2 units 2. Parker Pottery is considering upgrading its factory to improve the quality of its products. The upgrade will add $5,260 per year to total fixed cost. If the upgrade is successful, the projected sales of vases will be 1,500, and figurine sales will increase to 1,000 units. What is the new break-even point in…arrow_forward

- Willis Company is trying to decide which of two bicycle wheels to manufacture next quarter. Cost data pertaining to the two choices follow. Multiple Choice Cost of materials per unit Cost of direct labor per unit Advertising cost per year 4,000 Depreciation on equipment 6,000 Which costs are relevant to the decision of which wheel to produce? Cost of materials and direct labor Wheel A $25 30 Cost of direct labor, advertising, and depreciation Cost of materials, direct labor and advertising Cost of advertising and depreciation Wheel XZ $45 35 7,000 9,000arrow_forwardplease answer all three requirements thankuarrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.55 feet of leather and predicts leather will cost $2.60 per foot. Suppose Perfect Pet made 50 collars during February. For these 50 collars, the company actually averaged 1.85 feet of leather per collar and paid $2.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Calculate the standard direct materials cost per unit. Note: Round your answer to 2 decimal places. Standard Direct Materials per Collararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education